LBO to take out Wrench Group debt held by Crescent; BDVC's holdings include Hexion’s prepetition notes

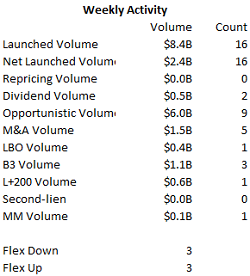

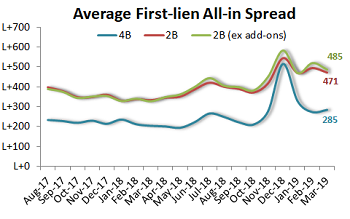

Investor demand for large transactions such as Ultimate Software and Staples underscored a palpable shift in loan market tone last week as accounts scrambled to commit to the relatively few deals in syndication. A few stragglers aside, numerous deals have accelerated, upsized or flexed lower in recent days, for a lopsided downward-to-upward flex ratio of 7:3. Bonds, meanwhile, plowed forward with oversubscribed new issuance, steady retail cash inflows, and an upside grind in more active trading.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Medley Redux Redux: Now that the vote on the three way Merger has been postponed for the umpteenth time, we’ll be looking this week for the reasons why the delay has occurred. That may or may not come from Medley Capital (MCC) or Medley Management (MDLY) by way of press release or SEC filing. Or, we might hear from one of the activists as to the why of the situations, or read a court transcript to learn what shareholders – who are mostly playing the role of spectator in this situation – have a right to know.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter

Refinancings seen in several portfolios; Barings BDC’s holdings unaffected by Calpine refi |

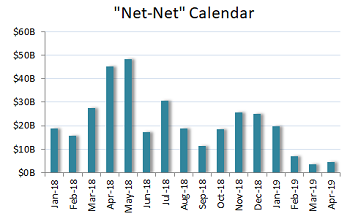

| Download: LFI BDC Portfolio News 3-25-19 With the jumbo Power Solutions LBO financing out the door early last week after an over-the-weekend delay, the primary loan market assumed a more subdued tone as arrangers cobbled together a smattering of opportunistic business in the face of a dwindling pipeline. Arrangers continue to flock to the high-yield market for attractive rates—a trend that is likely to continue with the Fed’s dovish stance last week—with Allison Transmission the latest issuer to step forward with a bond-for-loan takeout exercise. |

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

Medley Mania: This week brings the triple merger vote – postponed multiple times – by the Medley companies on March 29. However, chances are there will be much happening even before the digital ballot boxes are opened. Last week we had the sudden – and shocking – resignation of two of Medley Capital’s (MCC) “independent” directors. That’s caused problems for the BDC which needs a quota of disinterested directors to be publicly listed and to meet SEC regulations. We just don’t know by when MCC has to name replacements, and who they might be. Moreover, what role do “independent” directors play now that the votes are almost cast ? And – throwing one more question into the pot – what about the two remaining “independent” directors at MCC ? Are they happy to stay around or will further resignations be coming ?

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter

Datto moves forward on refi; existing debtholders include TCPC, GSBD, OCSL, SUNS, CGBD, GBDC

Power Solutions’ cross-border loan-and-bond deal was the focal point of last week’s activity, with loan demand magnified by the lack of available product elsewhere and both the secured and unsecured bonds playing well amid a bull-market run. Indeed, several other issuers pushed ahead with secured bonds as last week’s high-yield volume raced north of $10 billion, further depressing loan activity.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

Fixed Income,

LevFin Insights,

News

.png)