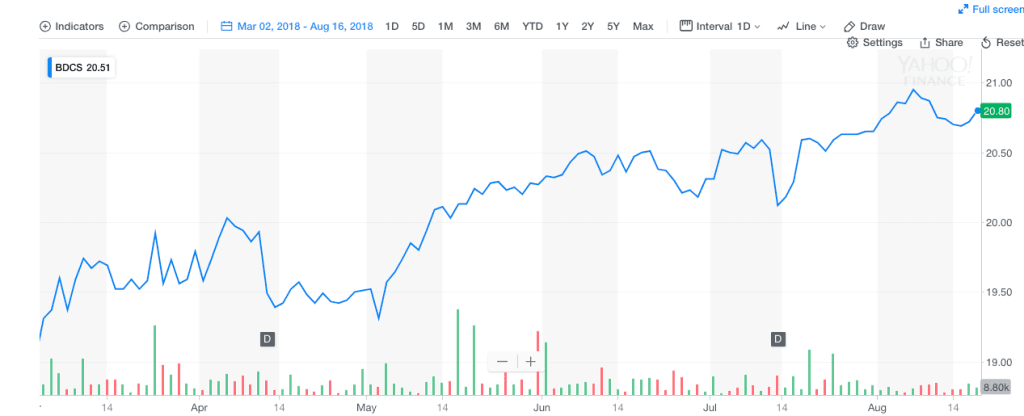

Going Nowhere

Often, after the completion of a BDC earnings season, we are witness to sharp price adjustments. After taking the health of nearly four dozen different funds in a very short period, analysts and investors often reach for the Buy or Sell button.This frequently results in a re-pricing of the entire sector, sometimes favorably and sometimes not. This week was a little different. Looking at the multiple data points that we do every week, we conclude that market participants did not do much in the way of re-thinking.

BDC Common Stocks Market Recap: Week Ended August 17, 2018

Topics: Middle Market, BDC, market analytics, Fixed Income, portfolio, News

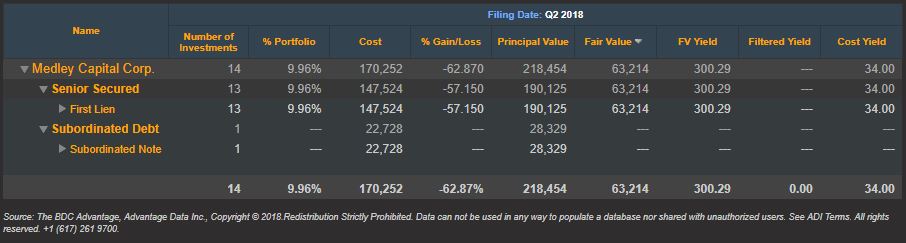

Q2 2018 BDC Non-Accruals: Medley Capital Corp No Longer Worst Performer

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Topics: BDC, First Lien, Non-accruals, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, BDC Filings, Default Rate, Fixed Income, fair value, portfolio, download, News

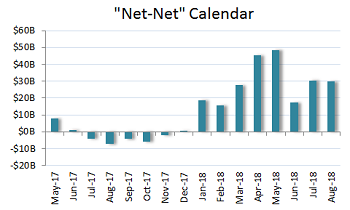

Repricings return, aiming for lower margins at BJ's (ACSF, Hancock Park, CCT), Compass Power (FS Energy) and Travel Leaders (Bain, Triton Pacific)

The first week of the new month was dominated by reactive trading and repositioning in the wake of quarterly reports, even as the new-issue market kept rolling out loans and bonds. In bonds, highlights included $1.25 billion short-term-fix from Intelsat just as the identically sized BMC Software buyout bonds got going on international roadshows for next week’s business following June’s completed loan financing.

After a somewhat sleepy start last week, loan arrangers piled it on. M&A deals peeled off the calendar late in the week included the long-awaited deal for Penn National Gaming, Cetera, Travel Leaders and Del Frisco Restaurant Group as gross launched volume jumped to $15.6 billion in the busiest week since June 15. M&A volume was a healthy $7.9 billion.

Topics: BDC, portfolio, LevFin Insights, News

Leveraging BDC data has never been easier. Using BDC Advantage by AdvantageData, you can filter aggregated business development company portfolio data by industry, investment type, filing notes and more.

Generate refined custom data elements that can be downloaded in an easy-to-use excel spreadsheet. We filtered our list by filing notes (selecting the "non-accrual: yes" option) to find out which portfolios were in the most trouble.

Topics: business development company, BDC Filings, Fixed Income, portfolio, download

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)