Recent Posts

JUNK BONDS CAME UNDER MORE PRESSURE,

outpaced by investment-grade debt in net prices, for a second day.

Profit-taking,

political infighting

(in both Europe and the U.S.), and the occurrence of massive

pullbacks in shares of Hammerson PLC and Saga PLC, all factored into the mostly risk-averse European session.

More bumps along the road in Brexit

(British exit from EU) were also in the mix, as London traders faced the backdrop of an earlier sell-off in Asian markets, while the

oil-and-energy sector was roiled

by a pullback in global crude-oil prices.

0 Comments Click here to read/write comments

Topics: junk bonds, bond market

CAUTION AND PROFIT-TAKING kept Europe's

investment-grade bonds with a slight edge

over junk debt in today's trading. A

mix of European economic data

kept price swings channeled in fairly thin bands, as

inflation took a downturn,

GDP came in above forecast, and jobs data showed the

lowest unemployment since '09. The

oil-and-energy group fared well, giving important sector cues to corporate-bond traders, as

Nymex

oil prices hovered around $54 and

BP PLC shares initially rose 3.6%. However

BNP Paribas weighed on the financial group, off 2.9% on disappointing quarterly revenue, while

Weir Group PLC tanked 7.3%.

0 Comments Click here to read/write comments

Topics: Investment Grade, bonds, junk bonds, bond market, corporate bonds

Horizon is an externally managed Business Development Company (BDC) that makes secured loans to development-stage companies backed by venture capital and private equity firms within the technology, life science, healthcare information and services, and clean-tech industries.

0 Comments Click here to read/write comments

CAUTION BECAME MORE ACUTE, leading European investment-grade bonds to easily outpace junk debt in net price gains linked to actual trades. Bids for high-yield debt were damped in parallel with a

downside shift to the red in the pan-European Stoxx 600, as investors 'hunkered down' ahead of a key U.K. election vote

Thursday. In a 'tough-to-call' test of Prime Minister Theresa May's conservative majority, implications will emerge for her forward strength in

Brexit negotiations. Meanwhile a Middle-East

spat between Qatar and its neighbors weighed on high-yield debt prices, as

Nymex oil fluctuated in the $47 range.

0 Comments Click here to read/write comments

Topics: bonds

AdvantageData Wins 2017 Inside Market Data Award

Posted by

Marlena Mathews on May 25, 2017 9:52:12 AM

The 15th annual Inside Market Data Awards and Inside Reference Data Awards took place last night and AdvantageData was proud to be in attendance.

0 Comments Click here to read/write comments

Topics: Loans, Middle Market, BDC

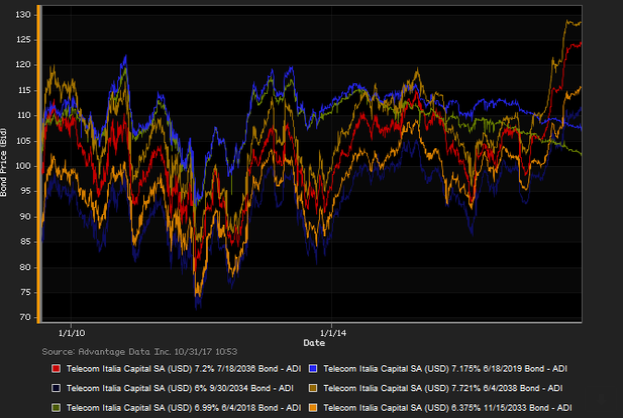

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)