A very busy week ahead for BDC investors including fast moving prices; eleven new earnings releases and the vote on whether Medley Capital will merge into Sierra Income. We pledge to keep readers updated as a critical week unfolds.

Markets: Given that last week the BDC sector – as measured by the Wells Fargo BDC Index and the price of the UBS Exchange Traded Note with the ticker BDCS – dropped every day, the direction of the market will be a critical factor. Last week’s pullback occurred while the broader markets continued to rise and other forms of non investment grade credit remained strong, begging the question as to whether this was just a short term pause in a continuing rally or a turning point, and prices will be down from here. As we’ll discuss in greater detail below, BDC earnings season is still in process, and individual fund results may influence sector performance. By mid-month, though, all the latest quarterly updates will be in and investors will have positioned themselves. We’ll be keeping track not only of BDCS and the Wells Fargo BDC Index but of the trends amidst the 45 different public BDCs we track. Last week, 42 dropped in price and 20 are now trading at a price below that of 4 weeks ago in the very midst of the rally. If that proportion of underwater stocks rises, or we see an uptick in BDCs trading within 5% or even 10% of their 52 week lows (the current numbers are zero and one respectively) we’ll be worried that the rally that began December 24, 2018 has run its course. On the other hand, if BDCS breaks through the August 30, 2018 high of $21.03, we’ll know that this rally lives and has broken through a critical threshold. For reference, as of Friday, BDCS was at $19.73.

Read More

Topics:

Analytics,

market analytics,

business development company,

Finance,

Fixed Income,

News,

bdc reporter

Earnings: This is going to be a busy week for BDC earnings as the season rolls on. We’re already blanching at the prospect, with 11 separate releases coming. Far and away the most important will be the report by FS KKR Capital (FSK). This will be the first time since the merger with Corporate Capital Trust (ex-CCT), and after a name and ticker change. More importantly, we’re going to hear more about the ever huger BDC’s credit status. Reviewing the filing and listening to the Conference Call should tell investors whether the ambitious folk at this unusual arrangement between a firm best known for raising capital and another for investing capital will be successful at lending capital. To be honest, our impression from reviewing the portfolios at both entities (CCT and FSK) for some time now is that management is going to be in turnaround mode for some time to come. Much of that – if we’re right – can be laid at the underwriting taken by FS Investment’s prior partner in leveraged lending GSO Blackstone, which was not shy about taking some very large positions on behalf of the shareholders of multiple FS Investment funds in what now appear to have been some dicey propositions. KKR – now in charge of day to day investment management – re-underwrote those assets when taking over and adding their initials to the door and will have to be responsible for the consequences, if not the original credit decisions. However, KKR will benefit from being in control of many of the debt tranches through the multiple funds now under their co-tutelage with FS Investment, which will aid any work out efforts (but also prolong the time it will take to determine the final outcome). Also worth mentioning – as Oaktree Specialty Lending did last week (OCSL) when discussing their own escape from under two troubled portfolio companies – is that the LBO market remains flooded with private equity buyers with huge untapped resources; hungry lenders of all stripes and an economy which is humming along (despite all the “next recession is around the corner” talk). As OCSL’s management noted, with a little luck and those favorable conditions, FSK may be able to dig itself out of the hole dug by another party, but which they enthusiastically adopted.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

Finance,

Fixed Income,

News,

bdc reporter

Here is our preview of the most important developments likely to occur in the BDC sector in the coming week. After a January that was notable mostly for what was happening to BDC prices rather than anything else, the week ahead promises to be jam packed with “hard news”; the ongoing Medley drama and the continuing question mark about how the rally will fare entering into Week 7. The BDC Reporter does not expect to get much sleep.

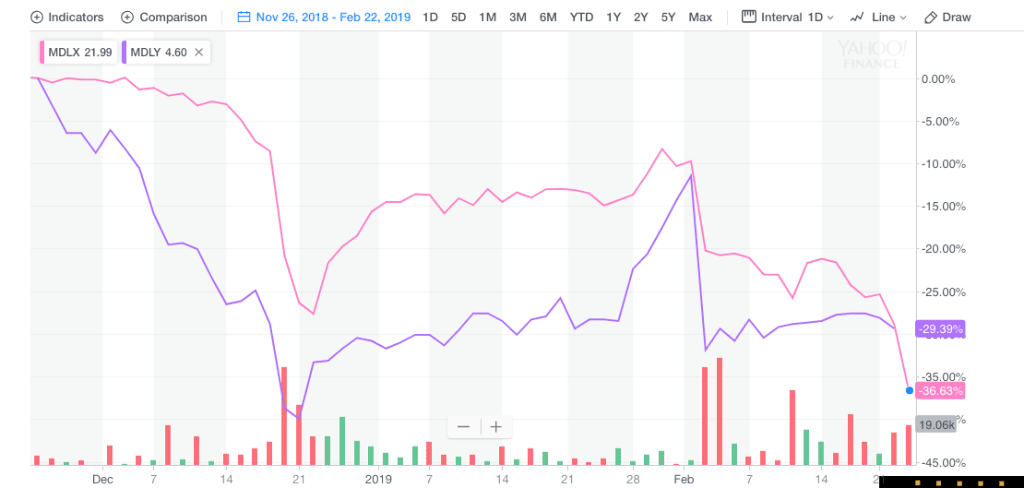

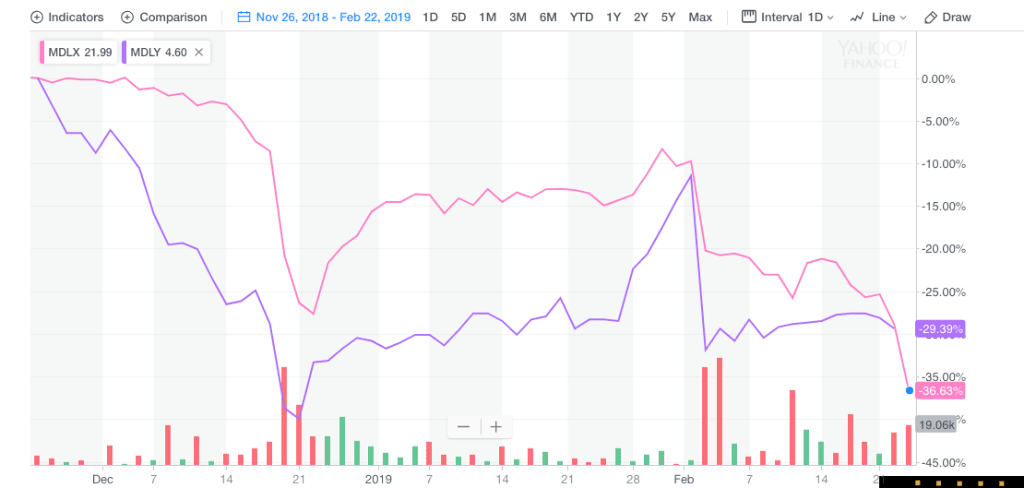

Medley Mergers: For the first time in weeks, our arbitrary prioritization of what is likely to matter most in the BDC sector will not be led by “the markets”. Not that watching the tape will not be important as the BDC rally grows ever longer in the tooth. However, that other long simmering subject: the attempted merger of Medley Capital (MCC) and Medley Management (MDLY) into non-traded Sierra Income which is to be followed by the internalization of the management arrangement and a public issuance, has reached a boiling point. The BDC Reporter has written two articles over the week-end alone – and more than half a dozen in total – about the twists and turns in this poorly received merger proposal. First, there was opposition from several major MCC shareholders, most notably FrontFour Capital (FrontFour). Then a major proxy advisory firm chimed in with what now seems – as we’ve heard both from the proponents of the merger and its opponents – contradictory views about the merits of the transaction. Over the week-end, the plot thickened when a would-be new manager (NextPoint) offered itself as investment advisor to the shareholders of MCC and Sierra, but not MDLY. In fact, NexPoint’s principal strategy is to dump MDLY out of any arrangement, which leaves a bigger pie for the shareholders of the other two entities to share. That’s how we left matters when we went to bed Sunday night and after much hypothesizing to our readers about the possible impact on the stock price of MCC and MDLY and on the value of Sierra.

Read More

Topics:

Analytics,

BDC,

market analytics,

business development company,

Finance,

News,

bdc reporter

On Monday, President Trump criticized the Fed for even considering raising rates, yet on Wednesday the Federal Open Market Committee announced its decision to raise the Fed Funds rate ¼ of a percent from 2.25% to 2.5% -- the fourth such increase in 2018.

Read More

Topics:

High Yield,

Analytics,

bonds,

junk bonds,

market analytics,

New Issues,

Finance,

Equity,

Fixed Income,

News

U.S. TREASURY YIELDS SLID ON MONDAY APPROACHING three-month lows as investors fled to safe-haven assets.

The 10-year benchmark settled near 2.857% losing 3.6 basis points while the inverted 2-year and 5-year Treasury yield gap

narrowed to .3 basis points.

Read More

Topics:

High Yield,

bond market,

market analytics,

Finance,

News,

research

.png)