The new year has brought new growth to the High Yield space as average yield for North American High Yield new issues has steadily increased month over month.

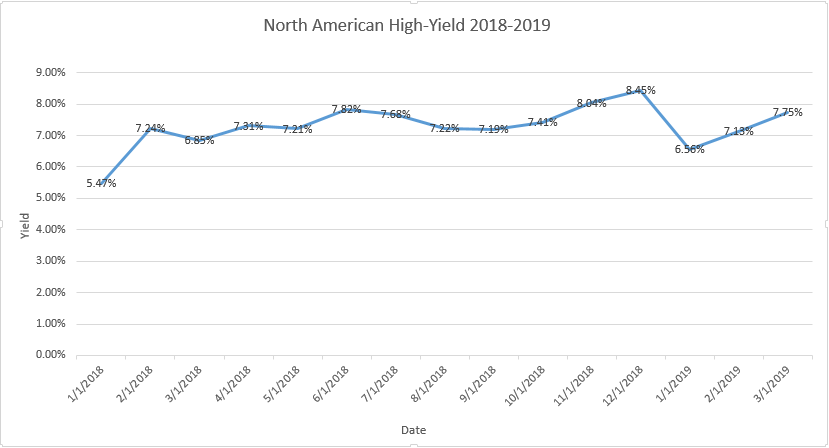

Yields on the Rise for North American High Yield

The new year has brought new growth to the High Yield space as average yield for North American High Yield new issues has steadily increased month over month.

Topics: High Yield, bonds, junk bonds, bond market

Fed announces fourth rate hike of 2018, markets react

On Monday, President Trump criticized the Fed for even considering raising rates, yet on Wednesday the Federal Open Market Committee announced its decision to raise the Fed Funds rate ¼ of a percent from 2.25% to 2.5% -- the fourth such increase in 2018.

Topics: High Yield, Analytics, bonds, junk bonds, market analytics, New Issues, Finance, Equity, Fixed Income, News

Industry Sectors in High Yield: A Yield Comparison

Back in 2015, Marty Fridson, Chief Investment Officer at Lehmann, Livian, Fridson Advisors LLC, spoke with Barron's on the topic of high yield industries most sensitive to rising interest rates.

Topics: High Yield, junk bonds, bond market, market analytics, YTW, Fixed Income, News, interest rate

Topics: junk bonds, bond market

Topics: High Yield, Investment Grade, bonds, junk bonds, bond market, corporate bonds

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)