Macro economic factors — tariffs on Chinese goods, political unrest in Hong Kong and Brexit among them — have returned volatility to capital markets, however direct lending has plowed onward with few upsets.

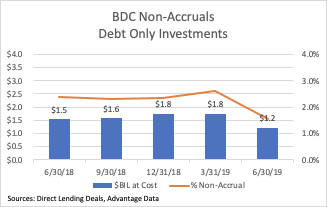

BDC portfolios show little pain in non-accruals for 2Q19, steady ahead

Topics: BDC, debt, business development company, Non-accruals, portfolio, Direct Lending, underperformers, Direct Lending Deals

Top 5 Portfolio Companies by Fair Value Across All BDCs

Top 5 Portfolio companies by Fair Value held by BDC’s account for 25 percent of aggregate BDC’s assets under management. Please click below to download List of Top 5 Portfolio Companies by Fair Value held by all BDCs.

Topics: BDC, business development company, fair value, portfolio

Janus, Neustar adding more first-lien debt; PSEC, Triton Pacific hold respective companies’ second-lien credits

The secondary market commanded investors’ attention last week, what with earnings and other headline news sparking some big swings in widely held credits against the backdrop of a muted new-issue loan market and a high-yield secondary firm at three-month highs since the rebound rally in January.

Topics: Loans, Analytics, BDC, market analytics, business development company, Fixed Income, portfolio, LevFin Insights, News

Portfolio mainstays Confie Seguros, McAfee pursue lower margins through respective refinancing, repricing

The brief turn two weeks ago toward caution in the leveraged-loan market amid volatility in high-yield and equities has proved to be but a blip amid a sea of endless liquidity, and that sentiment was affirmed last week as loans ignored another selloff in shares. Indeed for loans, it was business as usual with a pronounced emphasis on opportunistic activity. Bonds, too, got back to business, spurred by Uber’s successful $2 billion private offering, with other issuers jumping into the market in the wake of that upsized transaction.

Topics: Middle Market, Analytics, BDC, business development company, Fixed Income, portfolio, LevFin Insights, News

BDC Common Stocks Market Recap: Week Ended October 12, 2018

BDC Common Stocks

Singing The Blues

As the lesser know Sonny Curtis song goes “We fought the tape, and the tape won”. Last week (ended October 5) , the BDC Reporter injected a note of optimism after a bad week for the BDC sector in which the Wells Fargo BDC Index dropped (1.4%). However, we’re not yet convinced that this current malaise will last all that much longer, bringing down BDC prices to correction or bear market levels. We can’t speak to general market sentiment which – as they say – is “going to do what it’s going to do”.

We’ve not yet been proven absolutely wrong because BDCS – which has now dropped to $19.40 after disgorging a $0.41 distribution – is down (7.8%) from its high. If we adjust for the dividend the drop is “only” (5.8%) and the “Total Return” Wells Fargo BDC Index is off just (4.5%). We are some way off a a classic 10% correction or a 20% haircut bear market.

Topics: Middle Market, Analytics, market analytics, business development company, Fixed Income, portfolio, News, bdc reporter

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)