Even in markets where established data infrastructure is limited, such as syndicated loans, reliable sources of data that are indicative of a liquid security’s value are available through market data vendors and broker quotes. When evaluating illiquid securities like middle market or directly originated loans, the effort of data aggregation becomes much more difficult and is often assumed to be an exercise in futility. We would disagree.

The Hunt For Data: Middle Market and Illiquid Loan Valuation

Topics: Loans, Middle Market, BDC, business development company, Valuation, Fixed Income, illiquid, download, Direct Lending, syndicated

The Middle Market Loan Advantage: A Look Behind The Curtain

[Transcribed from video]

Introducing the Middle Market Loan Advantage. The newest edition to AdvantageData’s suite of credit data products. The Middle Market Loan Advantage complements our syndicated loan and BDC Advantage modules. With [~4500**] middle market loans, the Middle Market Loan Advantage shines a bright light on this opaque market.

How do we do it? AdvantageData aggregates information from news sources, trading desks, buy and sell-side filings, and more.

Topics: Loans, Middle Market, Analytics, BDC, business development company, Valuation, Restructuring, Direct Lending, Investment Banks, Syndicated Bonds

Sourcing and Utilizing Market Data for The Valuation of Middle Market and Illiquid Loans

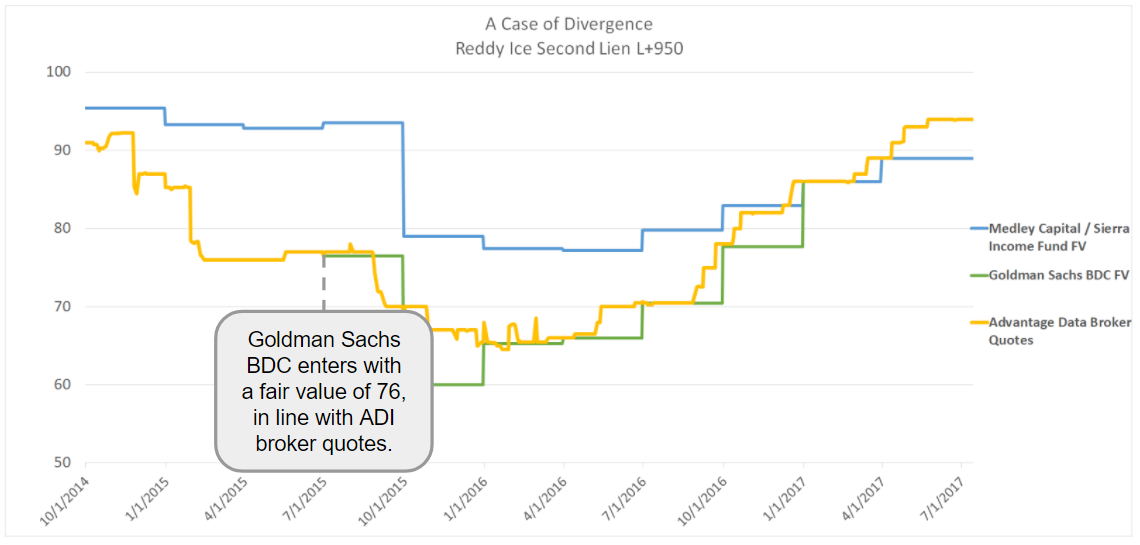

In this summary Advantage Data aims to highlight the challenges faced in sourcing and utilizing market data for valuation of illiquid and middle market loans. We will consider the overall methods of aggregating and applying data to loans in this space and how the issues surrounding the lack of readily available information can be overcome.

Topics: Middle Market, Valuation

Avaya Inc. Loan Performance Since Chapter 11 Filing on Friday

This past Friday, Avaya Inc., announced that it had filed for Chapter 11 bankruptcy protection in attempt to reduce its load of $6.3 billion in debt. The telecommunications company has been burdened by debt since an $8.2 billion buyout in 2007 by private equity companies, Silver Lake Partners and TPG Capital. Looking at intraday broker loan quotes on Avaya's L+525 2020, today's market opened at a 83 7/8 bid and 84 5/8 offer. Since then, the market has trended down to most recently a 83 1/2 bid and 84 offer. The L+750 DIP remains constant at 102 3/4 and 103 1/2.

Topics: Loans, Chapter 11, Valuation, Restructuring

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)