Nick Buenaventura

Recent Posts

Topics: Loans, Middle Market, BDC

Sears Holdings (NYSE: SHLD) announced its concerns on Tuesday about its ability to stay afloat after years of losses and declining sales. The U.S. retail giant has failed to turn an annual profit since 2011. At the end of its fiscal year in January, the company had said that it was hoping to reduce its costs by $1 billion and cut its debt and pension obligations by at least $1.5 billion. It currently has liabilities totalling around $13.19 billion. In efforts to boost its liquidity, Sears said that it has taken action to sell its Craftsman tool brand for $900 million to Stanley Black & Decker Inc (NYSE: SWK).

Topics: High Yield, Loans, retail

Hub Holdings, LLC Announces $375 Million Senior Secured Term Loan

Hub holdings, LLC announced that it will increase its senior secured term loan by $375 million to refinance current oustanding debt. The proceeds will be mainly used to make payments on $300 million of second-lien secured notes and around $60 million of revolving credit. Following the announcement, Moody's announced that it would affirm the B3 corporate family rating and change the outlook on the debt from negative to stable. This outlook is based on the company's EBITDA growth and the feeling that they will be able to continue to reduce their leverage in 2017.

Topics: Loans, New Issues, Second Lien

Level 3 Financing announces $4.61 billion Senior Secured Credit Agreement

Level 3 Financing, Inc. , a wholly owned subsidiary of Level 3 Communications, Inc. (NYSE: LVLT), announced last week that it successfully refinanced its outstanding Term Loans through the issuance of a new TLB L+225/2024. The company anticipates approximately $35 million of cash interest expense savings on an annualized basis through this $4.61 billion senior secured agreement. At the day of issuance, ADI loan pricing services quoted an end of day bid for the loan at 99 3/4. Since then, the loan has traded up to a bid of 100 5/8 in the week and half since its first quote.

Topics: Loans, First Lien, New Issues

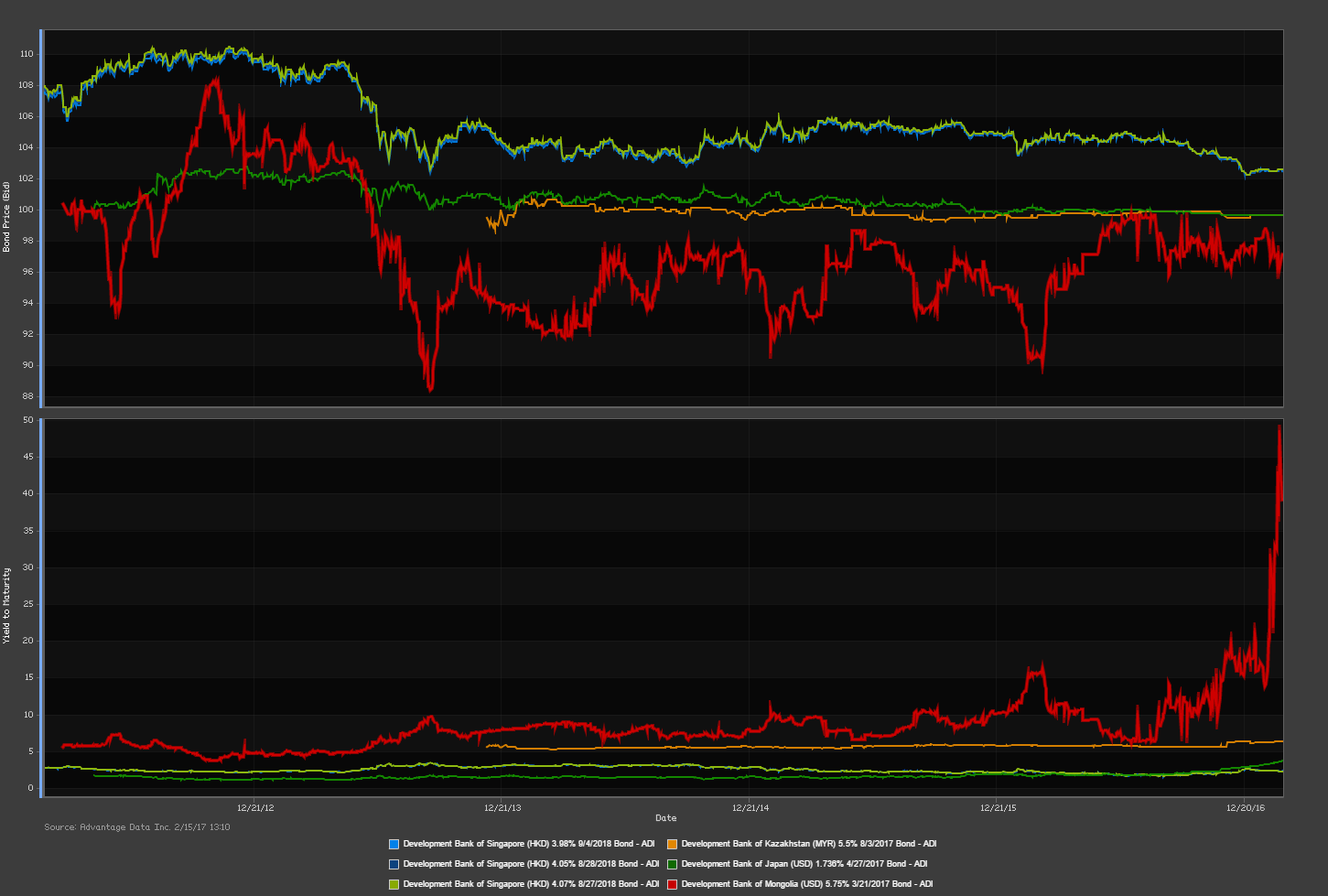

Development Bank of Mongolia Under Review for March 2017 Debt

Development Bank of Mongolia may have its 5.75% 3/21/2017 bond rating cut over concerns it may not be able to make its $580 million repayment by maturity. The mining and infrastructure financer currently does not have the liquidity to finance the repayment itself and is looking for outside help. Mongolian government has reportedly contacted China and the International Monetary Fund for assitance in the matter, but investors have their doubts that a bailout will be resolved within a month's time.

Topics: bonds, emerging markets, Development Bank

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)