Add-ons abound amid renewed wave of M&A; Autodata deal to take out debt held by PSEC

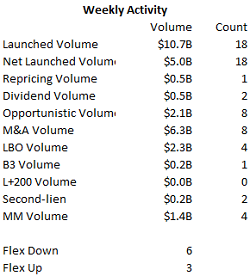

Momentum slowed in the new-issue loan market last week, with the uncertainty surrounding U.S.-China trade negotiations leaving market participants in wait-and-see mode heading into the weekend. While time-sensitive business continues apace, arrangers readying opportunistic deals appeared to be taking a more deliberate approach as events play out on the international stage. Yet high-yield issuance came at a breakneck pace—the $12 billion output was the highest-volume week in almost two years—as U.S. Treasury yields fell. Moreover, the broad secondary markets took the week’s events in stride, with earnings continuing to drive situational movers.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

BDC COMMON STOCKS

Unimpressed

In a week where there was an avalanche of BDC quarterly results, the market just shrugged indifferently.

Read More

Topics:

Loans,

BDC Index,

Analytics,

BDC,

market analytics,

business development company,

BDC Filings,

News,

bdc reporter,

research,

market update

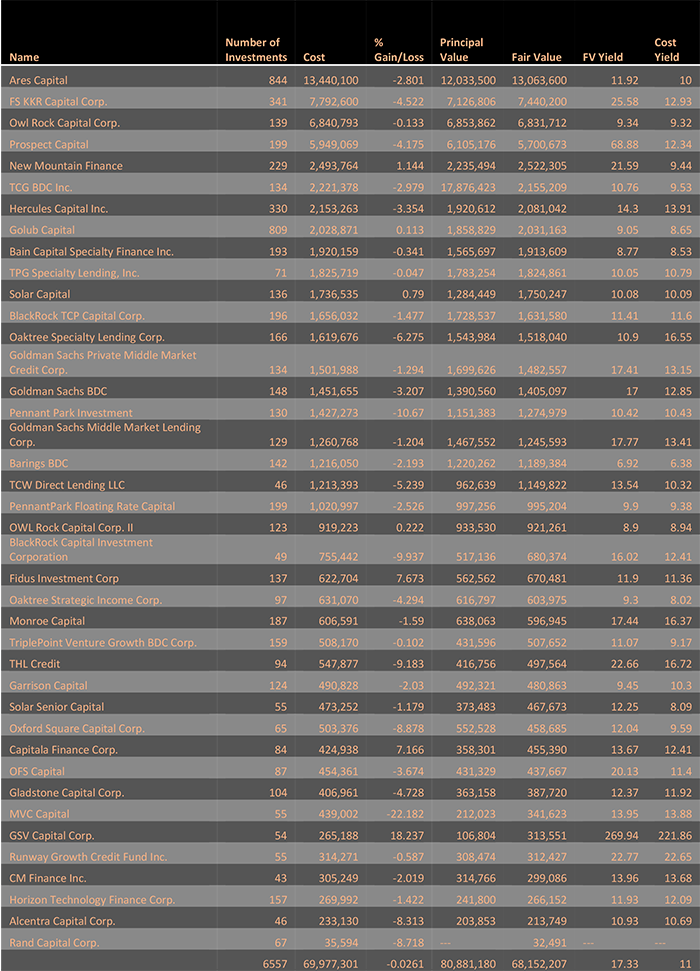

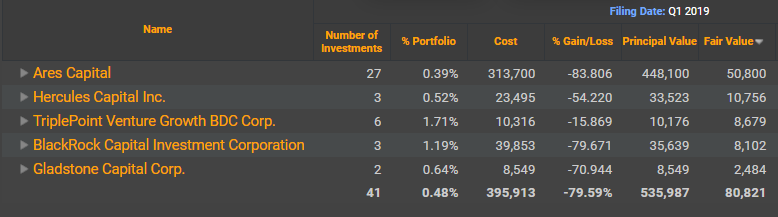

BDC Filing season is in full swing. This report will analyze BDCs that have filed in the last 2 weeks. Last week’s analysis is available here.

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 68.1 Billion USD which is approximately 70% of aggregate AUM of all BDCs. BDCs have reported 48.8 Billion USD AUM in this week alone.

Read More

Topics:

Analytics,

BDC,

AUM,

market analytics,

business development company,

Non-accruals,

BDC Filings,

fair value,

market update,

top 5,

adds & exits

Surprising BDC COMMON STOCKS

On May 1st, the BDC sector – as measured by BDCS – dropped to $19.54. That was sharply off the $19.87 at the end of the prior week on Friday April 26, 2019.

Read More

Topics:

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC Filing season is in full swing. This report will analyze nine BDCs that have filed this week. Aggregate Fair Value reported by these BDCs is 19.3 Billion USD which is approximately 20% of aggregate AUM of all BDCs.

Read More

Topics:

Analytics,

BDC,

AUM,

market analytics,

business development company,

Non-accruals,

BDC Filings,

fair value,

market update,

top 5,

adds & exits

.png)