Market: Both BDC common stocks and publicly traded unsecured debt have been in rally mode for three weeks now. For this preview of the week ahead, we will be looking out for any faltering in the blistering pace of the rebound in leveraged debt values. From the lowest point on Christmas Eve to the close on Friday BDC common stocks have moved up 11%. Less spectacularly, BDC Fixed Income has crossed back over par – using the median of the 41 issues we track – from a low of $24.30 in December, when nearly every issue out there had dropped below the $25.00 level. We’ll be focused on whether BDC common stock prices can make their way back – at least – to the late November level before the markets got into full dramatic mode as investors sold everything that was not nailed down, and some that was. Investors climbing that wall of worry have more than the usual number of challenges ahead including the well worn list of the government shutdown; the uncertainty over tariffs; concerns about a slowing economic environment – or worse; and the endless debate about what the Fed will or won’t do. Moreover, having climbed so high and so quickly investors have – metaphorically speaking – that much further to fall. The week ahead will be a useful test of the breadth and thrust of this rally. We take nothing for granted, and assume the next direction could just as easily be down or up. The best BDC investors might hope for in the short run is a modest pause two weeks ahead of earnings season.

BDC Preview: Week of January 14 – January 18, 2019

Topics: Analytics, BDC, market analytics, business development company, News, bdc reporter

Aimbridge LBO to take out unitranche debt held by Bain Capital Specialty Finance, Golub

Download: LFI BDC Portfolio News 1-14-19

Topics: Analytics, BDC, market analytics, business development company, LevFin Insights, News

BDC Preview: Week of January 7 – January 11, 2019

We’re back to writing a preview of the week ahead in the BDC sector after a two week holiday break when not much was happening except wild swings in BDC common stock and bond prices, neither of which do we pretend to have any definitive insights as to their short term behavior. With the new year, though, we’re eager to get back to penciling out what we might expect to be reading about in the days ahead, and what the BDC Reporter might need to tackle in greater depth. In our most recent BDC Common Stocks Market Recap we boldly stated to our Premium subscribers that 2019 promises to be “the most important for the BDC sector in the last 10 years”. Let’s see how that goes, starting right away.

Topics: BDC, business development company, Fixed Income, News, bdc reporter

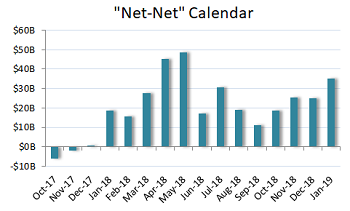

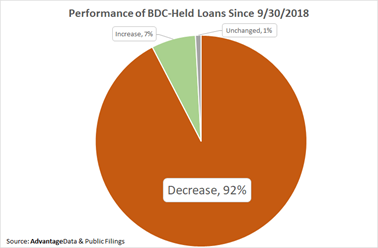

Loan market participants enter 2019 looking back at a miserable December. Senior secured loans traded off the most since early 2016. BB-rated loans were trading below $96.00 for the first time in the three-year span and nearly all loans fell below par.

Topics: Loans, Middle Market, Analytics, BDC, market analytics, business development company, BDC Filings, Fixed Income

BDC Preview: Week Of December 17 – December 21, 2018

Focus: This week – as in all recent weeks – the focus of most market participants will be on the gyrations of the markets. The week ended December 14, 2018 was not a pretty one for either BDC common stocks or Fixed Income, with both hitting new lows as we expounded on at length in our stock and debt Market Recaps for the BDC Reporter’s now shell-shocked Premium subscribers. BDC common stocks are now in the red in 2018 on a total return basis and at multiple new record lows. The median BDC debt price is now under par – albeit by only $0.05 – for the first time.

Looking ahead for the week ended December 21 – and downward – the next major number to look out for is the price of the UBS Exchange Traded Note with the ticker BDCS – which we use as a quick sector proxy – and which closed Friday December 14 at $18.67. The all-time low for BDCS is $17.31, set in February 2016 following a similar market meltdown. The very fact that the BDCS price would have to drop as much as 7.3% to match that nadir speaks to how relatively well the sector has held up in the current environment – the 10%+ drop from the August 30 2018 BDCS high notwithstanding. However, that sort of implosion would not be uncharacteristic for this highly volatile sector.

Topics: BDC, business development company, Finance, Fixed Income, News, bdc reporter

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)