On Monday, President Trump criticized the Fed for even considering raising rates, yet on Wednesday the Federal Open Market Committee announced its decision to raise the Fed Funds rate ¼ of a percent from 2.25% to 2.5% -- the fourth such increase in 2018.

Fed announces fourth rate hike of 2018, markets react

Topics: High Yield, Analytics, bonds, junk bonds, market analytics, New Issues, Finance, Equity, Fixed Income, News

BDC Preview: Week Of December 17 – December 21, 2018

Focus: This week – as in all recent weeks – the focus of most market participants will be on the gyrations of the markets. The week ended December 14, 2018 was not a pretty one for either BDC common stocks or Fixed Income, with both hitting new lows as we expounded on at length in our stock and debt Market Recaps for the BDC Reporter’s now shell-shocked Premium subscribers. BDC common stocks are now in the red in 2018 on a total return basis and at multiple new record lows. The median BDC debt price is now under par – albeit by only $0.05 – for the first time.

Looking ahead for the week ended December 21 – and downward – the next major number to look out for is the price of the UBS Exchange Traded Note with the ticker BDCS – which we use as a quick sector proxy – and which closed Friday December 14 at $18.67. The all-time low for BDCS is $17.31, set in February 2016 following a similar market meltdown. The very fact that the BDCS price would have to drop as much as 7.3% to match that nadir speaks to how relatively well the sector has held up in the current environment – the 10%+ drop from the August 30 2018 BDCS high notwithstanding. However, that sort of implosion would not be uncharacteristic for this highly volatile sector.

Topics: BDC, business development company, Finance, Fixed Income, News, bdc reporter

Industry Sectors in High Yield: A Yield Comparison

Back in 2015, Marty Fridson, Chief Investment Officer at Lehmann, Livian, Fridson Advisors LLC, spoke with Barron's on the topic of high yield industries most sensitive to rising interest rates.

Topics: High Yield, junk bonds, bond market, market analytics, YTW, Fixed Income, News, interest rate

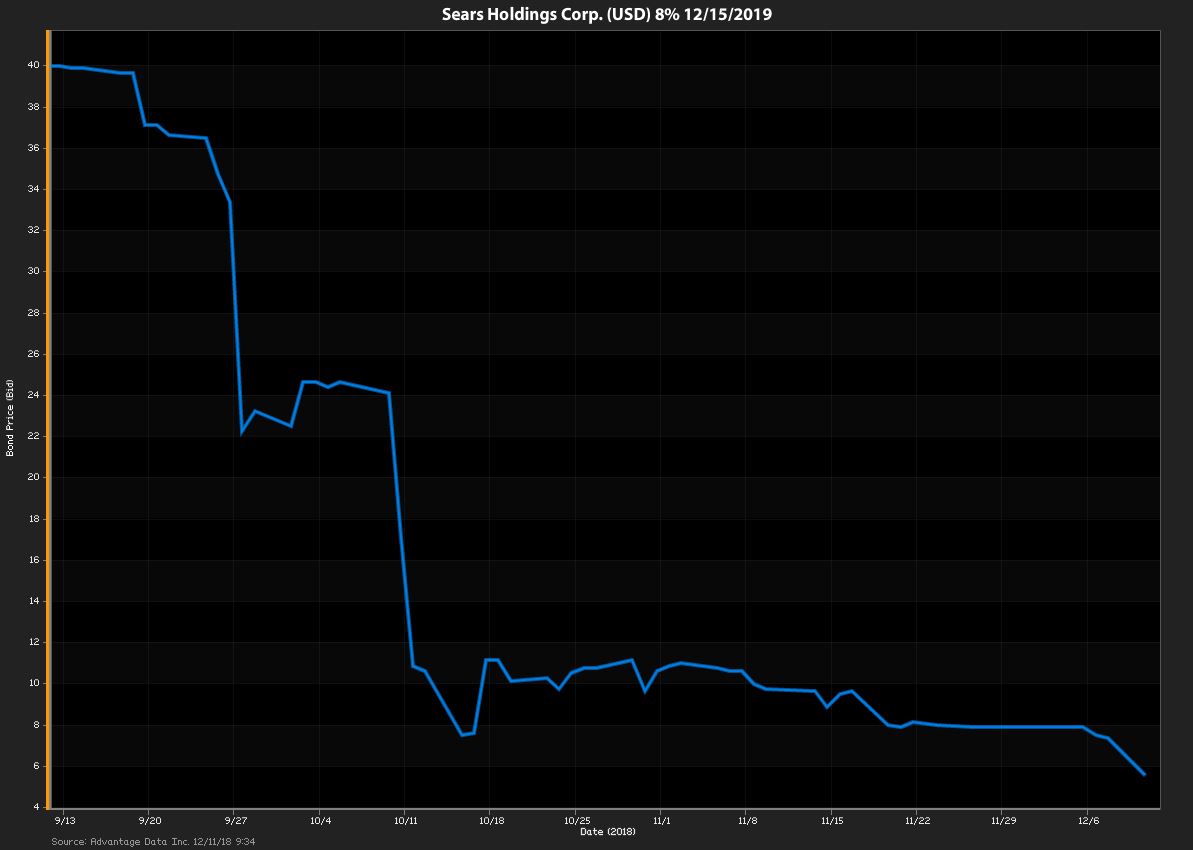

Sears CEO Places Hail Mary Bid to Save Company, And His Wallet

Sears CEO, Edward Lampert stands to lose a fortune if SEARS Holdings Corp. goes under. Analysts increasingly predict that will indeed be the case.

Topics: High Yield, bonds, Losers, Restructuring, sears, Fixed Income, News, bankruptcy

BDC Preview: Week Of December 10 – December 14, 2018

Inescapable: We’re going to assume the ups and downs of the major indices – and the corresponding movement in BDC common stock prices – will continue until it doesn’t. Since late August, the turmoil across all asset classes has caused the playbook of BDC fundamentals to be thrown out the window as new low after new low is reached, with a few head fakes along the way. As we write this the Dow Jones index is trading 200 points down in the Monday pre-market, which only means that more of the same is on the cards. Admittedly, this past week, the BDC sector fared less poorly than the 3 major indices (Dow Jones, NASDAQ and S&P 500), but that could reverse itself this week, whether the broader markets go up or down. All we are sure of is that the BDC sector cannot disentangle itself from whatever direction the markets are headed. Here is the chart showing the price of the UBS Exchange Traded Note with the ticker BDCS – which includes most every BDC player – since August 30, 2018, roughly when the market dramas began, compared to the main indices.

Topics: Middle Market, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)