LBOs to take out Elo Touch, Latham Pool debt held by BDVC, FSIC, GARS

Arrangers pressed forward with some of the final new-issue loans of 2018 last week, but it’s an open question as to how much enthusiasm remains among buysiders that have been buffeted by volatility in recent weeks. The recent downdraft has repriced the primary market, and issuers are seeking to address the issue with yield—and not just on dicier transactions.Meanwhile, high-yield’s heartbeat barely registered with a single $350 million print and a murky outlook on further deal flow as the loan market continued to dominate the waning supply in the final weeks of 2018.

Read More

Topics:

Middle Market,

Analytics,

BDC,

market analytics,

business development company,

Fixed Income,

LevFin Insights,

News

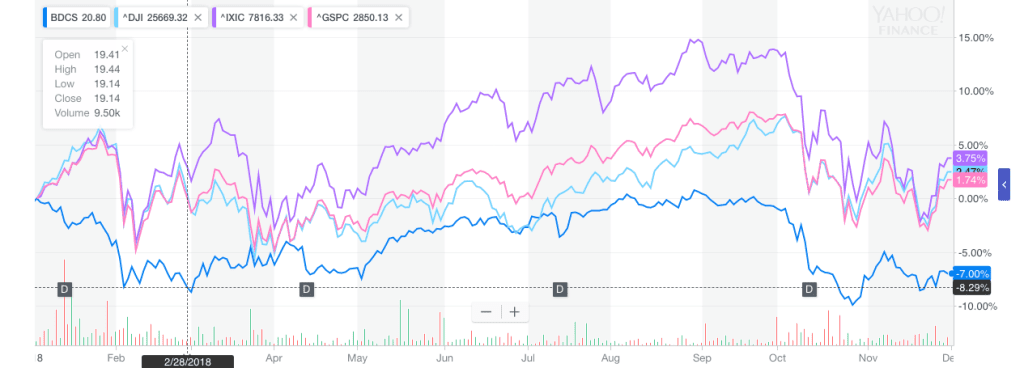

Back In Sync: As we expected, in the week ended November 30, 2018 the BDC common stock and the broader indices adjusted to get more in sync. The major markets raced ahead, while the BDC sector – which had performed better the week before – followed behind, up 0.62% in price terms. As this 2018 year-to-date chart comparing BDCS to the Dow Jones, NASDAQ and the S&P 500 shows all four have followed a similar shape even if there are short term divergences. If you adjust for the fact that the BDC sector pays out much higher distributions, even the total return is highly similar.

Read More

Topics:

Middle Market,

Analytics,

BDC,

market analytics,

business development company,

Fixed Income,

News,

bdc reporter

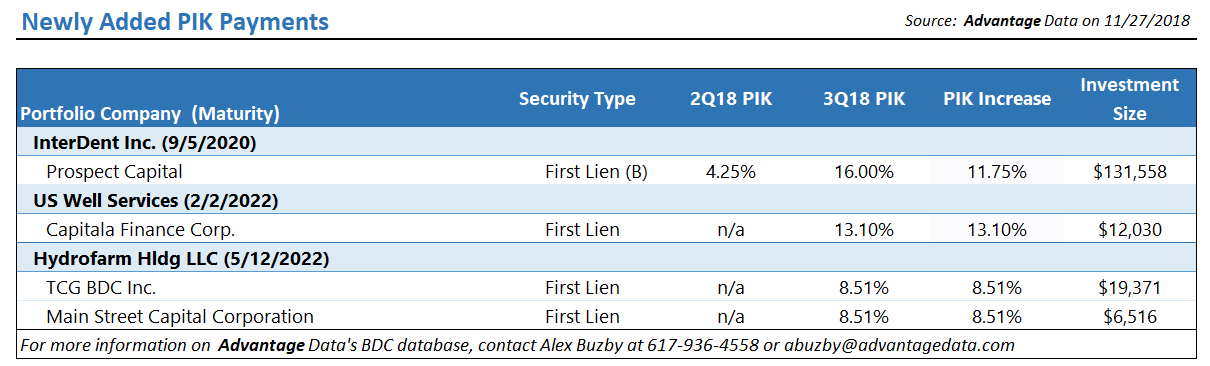

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

Read More

Topics:

Middle Market,

BDC,

Spreads,

First Lien,

Distressed Investments,

debt,

business development company,

Distress,

Distressed Debt,

Finance,

Restructuring,

Fixed Income,

download

Market Mayhem: As we discussed at length already in our premium BDC Common Stocks Market Recap, last week was surprising as the BDC sector – and many individual BDCs – fared much better than the main indices and all the main categories from investment grade to “junk”. However, we’d be very surprised if the BDC sector can continue to remain uncorrelated with the broader markets for very much longer. As this chart below shows – comparing the price progress of the Exchange Traded Fund SPY, which is based on the S&P 500, and the exchange traded note with the ticker BDCS,which reflect the BDC sector – the two have moved pretty much in tandem since the decline began in the markets on September 20.

Read More

Topics:

Middle Market,

Analytics,

BDC,

market analytics,

business development company,

Finance,

Fixed Income,

News,

bdc reporter

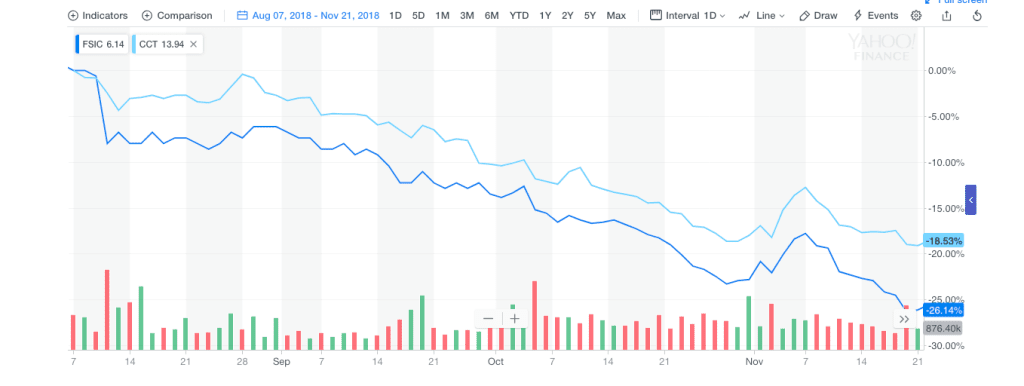

It’s hard to imagine a huge turnaround coming this week, what with the broad markets all in various stages of disarray. In addition, the general leveraged loan market – a kissing cousin of the BDC sector – is just coming off its lowest price point in two years, and knocking their total return to below 4%. (The Wells Fargo Index measured comparable return for BDCs is a very close 2.8%). Then there’s the Thanksgiving break coming up with many investors more focused on turkey and family. We expect a non-eventful to lower shade on BDC prices.

Read More

Topics:

Loans,

Middle Market,

BDC,

market analytics,

business development company,

Fixed Income,

News,

bdc reporter

.png)