A trio of issuers launch refinancing efforts for BDC-held credits; ‘net net’ calendar turns negative

High-yield business was brisk last week with primarily off-the-run credits swapping higher coupons for extended maturities, and investors were happy to oblige the trade. The lone M&A-related bond trade, IAA Spinco, cleared with fanfare despite shaky market conditions as the well-rated credit was embraced by both bond and loan accounts alike.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Add-ons abound amid renewed wave of M&A; Autodata deal to take out debt held by PSEC

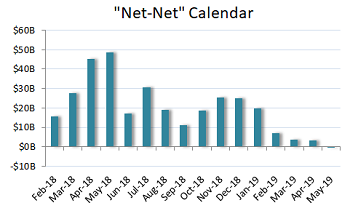

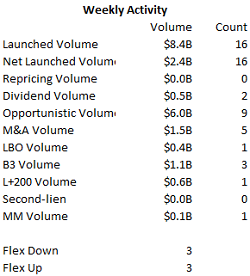

Momentum slowed in the new-issue loan market last week, with the uncertainty surrounding U.S.-China trade negotiations leaving market participants in wait-and-see mode heading into the weekend. While time-sensitive business continues apace, arrangers readying opportunistic deals appeared to be taking a more deliberate approach as events play out on the international stage. Yet high-yield issuance came at a breakneck pace—the $12 billion output was the highest-volume week in almost two years—as U.S. Treasury yields fell. Moreover, the broad secondary markets took the week’s events in stride, with earnings continuing to drive situational movers.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

LBOs at API Technologies, GlobalTranz to take out debt held by BCSF, PFLT, Audax, BBDC, PSEC

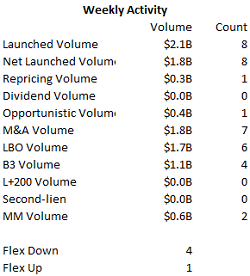

Loan market conditions continued to strengthen last week amid a paucity of new-issue activity ahead of the week’s early close. Both the bond and loan markets were seasonably slow, with a total of $2.6 billion from five bond deals and $2.1 billion of loans launched via seven issuers. Time-sensitive M&A situations accounted for nearly all of the week’s new deal flow in loans.

Read More

Topics:

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

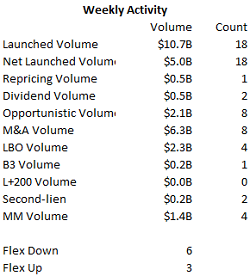

LBO to take out Wrench Group debt held by Crescent; BDVC's holdings include Hexion’s prepetition notes

Investor demand for large transactions such as Ultimate Software and Staples underscored a palpable shift in loan market tone last week as accounts scrambled to commit to the relatively few deals in syndication. A few stragglers aside, numerous deals have accelerated, upsized or flexed lower in recent days, for a lopsided downward-to-upward flex ratio of 7:3. Bonds, meanwhile, plowed forward with oversubscribed new issuance, steady retail cash inflows, and an upside grind in more active trading.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

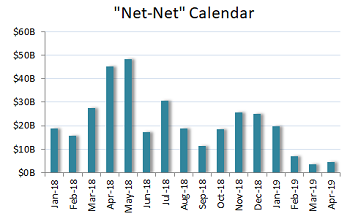

Refinancings seen in several portfolios; Barings BDC’s holdings unaffected by Calpine refi |

| Download: LFI BDC Portfolio News 3-25-19 With the jumbo Power Solutions LBO financing out the door early last week after an over-the-weekend delay, the primary loan market assumed a more subdued tone as arrangers cobbled together a smattering of opportunistic business in the face of a dwindling pipeline. Arrangers continue to flock to the high-yield market for attractive rates—a trend that is likely to continue with the Fed’s dovish stance last week—with Allison Transmission the latest issuer to step forward with a bond-for-loan takeout exercise. |

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

.png)