Datto moves forward on refi; existing debtholders include TCPC, GSBD, OCSL, SUNS, CGBD, GBDC

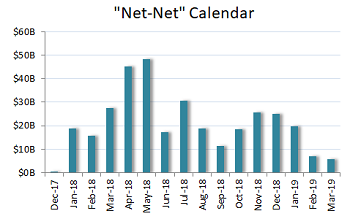

Power Solutions’ cross-border loan-and-bond deal was the focal point of last week’s activity, with loan demand magnified by the lack of available product elsewhere and both the secured and unsecured bonds playing well amid a bull-market run. Indeed, several other issuers pushed ahead with secured bonds as last week’s high-yield volume raced north of $10 billion, further depressing loan activity.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

Fixed Income,

LevFin Insights,

News

SORENSON PLANS FULL REFI OF DEBT HELD BY FSK, MAIN, HMS, AINV

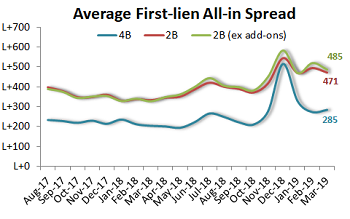

As the loan pipeline continues to ebb, opportunistic issuers are beginning to wade back in, spurred by bifurcated conditions that are allowing well-regarded repeat issuers to price tight to the broader market. Though the secondary rally stalled out last week, the appreciable improvement in the secondary market following the February rally eases the difficulty of layering in fungible new money at previous years’ more advantageous pricing levels.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

Oaktree vehicles hold Windstream’s prepetition debt

Although a pair of competing industry conferences took many buysiders out of pocket in the first part of last week, high-yield activity roared back to life late in the week via a procession of drive-bys, while loan arrangers launched a trio of large LBO deals off the pipeline as the secondary market continued to move higher. Several secondary situations also kept market participants on their toes, what with Windstream Services filing for bankruptcy, Neiman Marcus disclosing the framework of an extension/exchange plan and issuers releasing a flurry of earnings reports.

Read More

Topics:

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

Amynta add-on deal would boost margin on debt held by Ares Capital Corp.

Last week’s holiday-abbreviated calendar offered little action in the primary markets—loan arrangers launched a mere six deals for a paltry $3.2 billion of volume, while high-yield offered a string of well-received, refinancing-related drive-by deals. However, the week offered real drama as market participants digested the fallout from the bombshell news that Windstream Services lost a default ruling to Aurelius Capital Management. That ruling cast a long shadow over the nearly $10.5 billion of debt issued by Windstream and spinoff Uniti Group.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

Janus, Neustar adding more first-lien debt; PSEC, Triton Pacific hold respective companies’ second-lien credits

The secondary market commanded investors’ attention last week, what with earnings and other headline news sparking some big swings in widely held credits against the backdrop of a muted new-issue loan market and a high-yield secondary firm at three-month highs since the rebound rally in January.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

Fixed Income,

portfolio,

LevFin Insights,

News

.png)