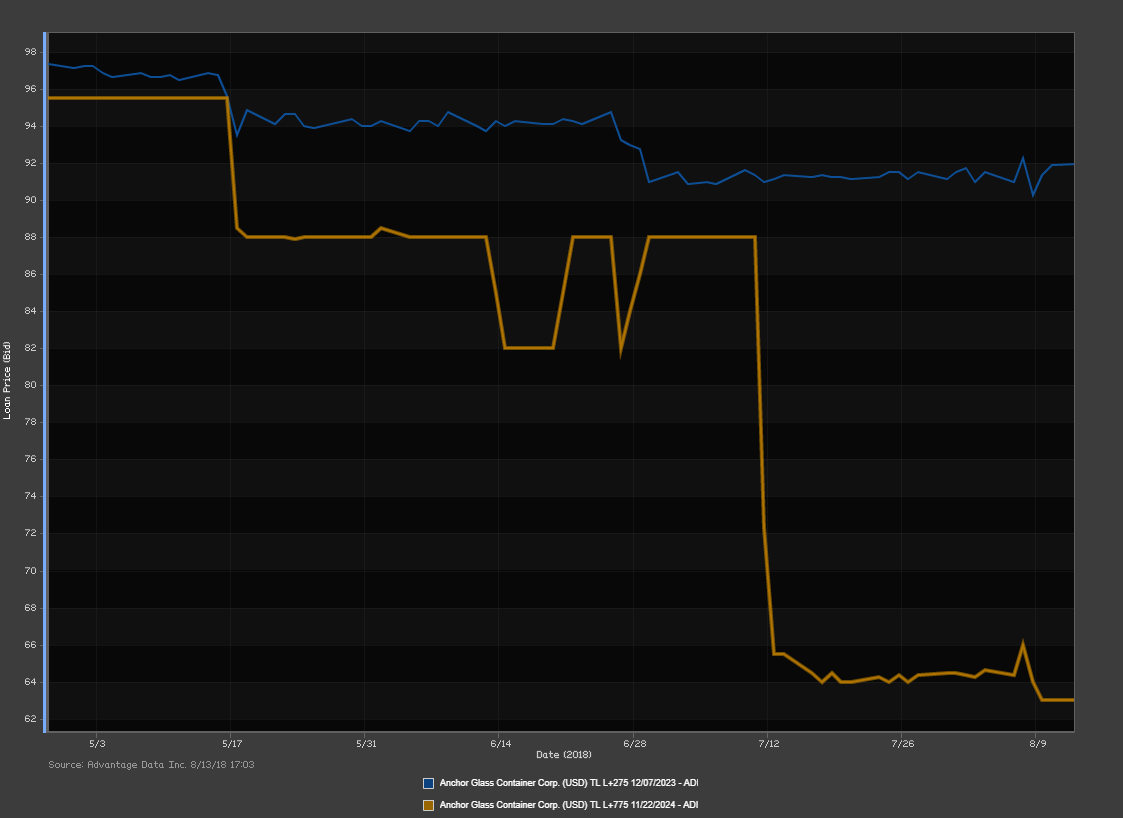

A quarter over quarter coupon spread increase can be an early warning sign for investors and restructuring advisors that the issuer may be facing financial troubles.

What do we mean by “coupon spread increase”? First, the coupon is simply the annual interest payment paid by the issuer relative to the loan or bond's face or par value. Coupon spreads compare the interest rate differential between two loans or bonds. Say the coupon rate is 5% in the first quarter of the year, and then changes to 7% the next quarter. This would cause a coupon spread increase between it and the coupon of a comparable loan or bond. [source]

An increased coupon spread from one quarter to another is an indicator that something happened – it does not mean there is imminent risk of default. If a company does not meet its obligation to its lenders, it may be required to take some sort of action to make good on its promises of repayment or otherwise remain in good faith. One such action could be an increase of the coupon payment.

.png)