Below is the full list of public Business Development Companies found in AdvantageData's BDC Advantage. This post was originally published on October 18th, 2016. The contents on this post, and the business development companies herein, have been updated with the latest information available as of July 8, 2019. View an updated list as of November 2019 here.

Full List of Public Business Development Companies (BDC)

Topics: Loans, Middle Market, BDC, business development company, BDC Filings, Fixed Income

BDC Common Stocks Market Recap: Week Ended June 14, 2019

BDC COMMON STOCKS

Out Of The Ordinary

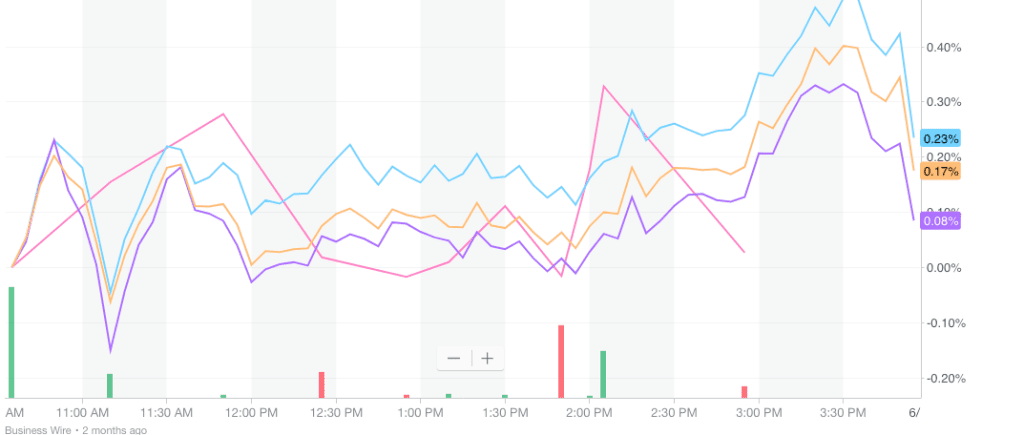

Unusually, the BDC sector outstripped the major indices in the week ended June 14, 2019. As the chart below illustrates, BDCS – the UBS Exchange Traded Note which includes most of the 45 public public funds we track – was up 1.4%, to $19.92. BDCS is in blue.

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

BDC Common Stocks Market Recap: Week Ended June 7, 2019

BDC COMMON STOCKS

Come Back

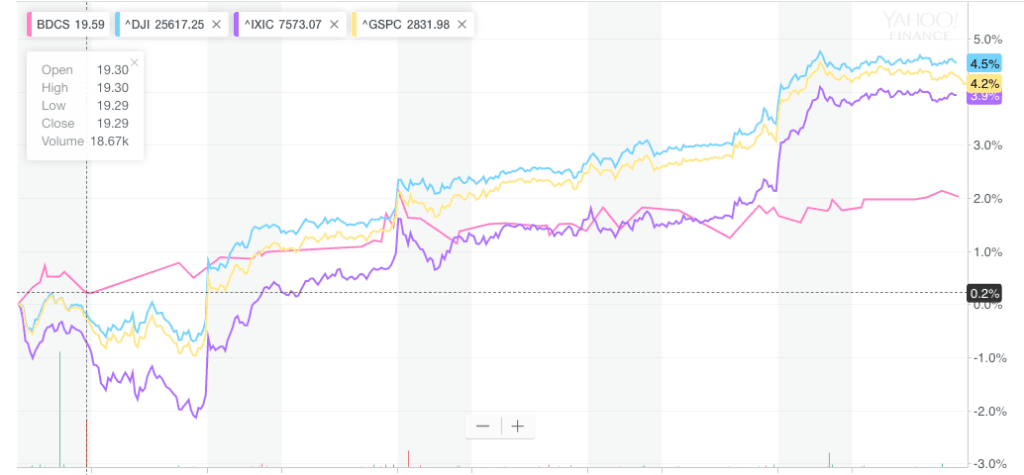

In a week where the major indices came roaring back, following a worrying slump, the BDC sector joined the party.

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

BDC Common Stocks Market Recap: Week Ended May 31, 2019

BDC COMMON STOCKS

All Done

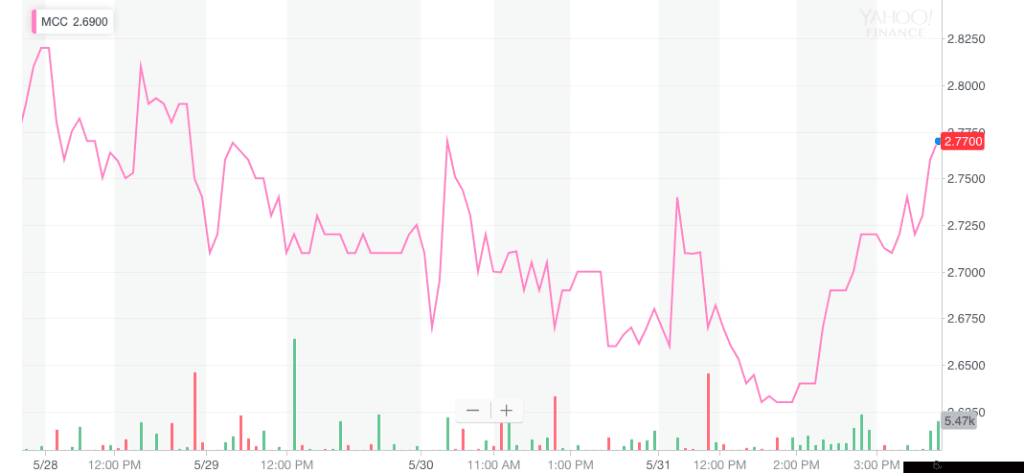

With the big drop in the broader markets – and in the BDC sector – the BDC rally is done. BDCS dropped (2.9%) this week to $19.18. That level of BDCS is (5.2%) off the February 22, 2019 high.

By our self imposed rules any drop over (5%) from a high point ends a rally, so there you are. That means this latest rally – in the volatile up and down world of BDC common stocks – lasted from December 24, 2018 to May 31, 2019. That’s 5 months and 1 week. From lowest to highest (using intra-day numbers) BDCS moved up 18.12%.

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

BDC Common Stocks Market Recap: Week Ended May 24, 2019

BDC COMMON STOCKS

Go Your Own Way

In the past month – as every financial news outlet will tell you – the major market indices have been pulling back, almost in unison.

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)