Janus, Neustar adding more first-lien debt; PSEC, Triton Pacific hold respective companies’ second-lien credits

The secondary market commanded investors’ attention last week, what with earnings and other headline news sparking some big swings in widely held credits against the backdrop of a muted new-issue loan market and a high-yield secondary firm at three-month highs since the rebound rally in January.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

Fixed Income,

portfolio,

LevFin Insights,

News

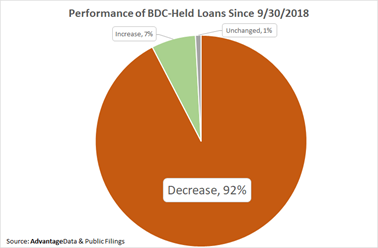

Loan market participants enter 2019 looking back at a miserable December. Senior secured loans traded off the most since early 2016. BB-rated loans were trading below $96.00 for the first time in the three-year span and nearly all loans fell below par.

Read More

Topics:

Loans,

Middle Market,

Analytics,

BDC,

market analytics,

business development company,

BDC Filings,

Fixed Income

Primary market yields on first lien middle market loans rose to their highest levels since Q1 2017 with increases in each quarter of 2018. This movement was driven heavily by the steady increase in LIBOR of over 100 bps throughout the year along with modest increases in coupon spread, most notably in the fourth quarter. First and second lien coupon spreads widened 35 and 33 bps respectively in the quarter, marking the largest quarterly spread widening in 2 years.

Read More

Topics:

Loans,

Middle Market,

Analytics,

market analytics,

Fixed Income,

download,

research

It’s hard to imagine a huge turnaround coming this week, what with the broad markets all in various stages of disarray. In addition, the general leveraged loan market – a kissing cousin of the BDC sector – is just coming off its lowest price point in two years, and knocking their total return to below 4%. (The Wells Fargo Index measured comparable return for BDCs is a very close 2.8%). Then there’s the Thanksgiving break coming up with many investors more focused on turkey and family. We expect a non-eventful to lower shade on BDC prices.

Read More

Topics:

Loans,

Middle Market,

BDC,

market analytics,

business development company,

Fixed Income,

News,

bdc reporter

BDC Common Stocks

Two Weeks Forward. One Week Back

The BDC common stock winter “rally” took some time off this week, after two weeks of upward momentum.

Read More

Topics:

Loans,

Middle Market,

BDC,

market analytics,

business development company,

Fixed Income,

News,

bdc reporter

.png)