Earnings: This is going to be a busy week for BDC earnings as the season rolls on. We’re already blanching at the prospect, with 11 separate releases coming. Far and away the most important will be the report by FS KKR Capital (FSK). This will be the first time since the merger with Corporate Capital Trust (ex-CCT), and after a name and ticker change. More importantly, we’re going to hear more about the ever huger BDC’s credit status. Reviewing the filing and listening to the Conference Call should tell investors whether the ambitious folk at this unusual arrangement between a firm best known for raising capital and another for investing capital will be successful at lending capital. To be honest, our impression from reviewing the portfolios at both entities (CCT and FSK) for some time now is that management is going to be in turnaround mode for some time to come. Much of that – if we’re right – can be laid at the underwriting taken by FS Investment’s prior partner in leveraged lending GSO Blackstone, which was not shy about taking some very large positions on behalf of the shareholders of multiple FS Investment funds in what now appear to have been some dicey propositions. KKR – now in charge of day to day investment management – re-underwrote those assets when taking over and adding their initials to the door and will have to be responsible for the consequences, if not the original credit decisions. However, KKR will benefit from being in control of many of the debt tranches through the multiple funds now under their co-tutelage with FS Investment, which will aid any work out efforts (but also prolong the time it will take to determine the final outcome). Also worth mentioning – as Oaktree Specialty Lending did last week (OCSL) when discussing their own escape from under two troubled portfolio companies – is that the LBO market remains flooded with private equity buyers with huge untapped resources; hungry lenders of all stripes and an economy which is humming along (despite all the “next recession is around the corner” talk). As OCSL’s management noted, with a little luck and those favorable conditions, FSK may be able to dig itself out of the hole dug by another party, but which they enthusiastically adopted.

BDC Preview: Week Of February 25 – March 1, 2019

Topics: Loans, Analytics, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

Amynta add-on deal would boost margin on debt held by Ares Capital Corp.

Last week’s holiday-abbreviated calendar offered little action in the primary markets—loan arrangers launched a mere six deals for a paltry $3.2 billion of volume, while high-yield offered a string of well-received, refinancing-related drive-by deals. However, the week offered real drama as market participants digested the fallout from the bombshell news that Windstream Services lost a default ruling to Aurelius Capital Management. That ruling cast a long shadow over the nearly $10.5 billion of debt issued by Windstream and spinoff Uniti Group.

Topics: Loans, Analytics, BDC, market analytics, business development company, LevFin Insights, News

BDC Preview: Week Of February 19 – February 22, 2019

Who’s Next ?: Clearly, the capital markets for both debt and equity are open for business where public Business Development Companies are concerned. Admittedly, there’s not been a flood of new capital raised but New Mountain Finance(NMFC) once again undertook a secondary stock offering at a premium to book value (even if that required some subsidizing by the External Manager) and Gladstone Capital (GLAD) entered into an equity distribution arrangement with Jefferies. On the fixed income side of the street, mid-sized BDC Fidus Investment (FDUS) launched a second Baby Bond not long after Saratoga Investment (SAR) piled on additional issuance to its own second Baby Bond offering, while Prospect Capital (PSEC) indefatigably continued to issue InterNotes, albeit in relatively small sizes. That’s all happened just in the month of February. Also worth mentioning – but less subject to the enthusiasms of the capital markets – multiple BDCs have been not only extending but expanding their secured debt financings, including TPG Specialty (TSLX) and Hercules Capital (HTGC).

Topics: Loans, Analytics, BDC, market analytics, business development company, Fixed Income, News, bdc reporter

Janus, Neustar adding more first-lien debt; PSEC, Triton Pacific hold respective companies’ second-lien credits

The secondary market commanded investors’ attention last week, what with earnings and other headline news sparking some big swings in widely held credits against the backdrop of a muted new-issue loan market and a high-yield secondary firm at three-month highs since the rebound rally in January.

Topics: Loans, Analytics, BDC, market analytics, business development company, Fixed Income, portfolio, LevFin Insights, News

BDC Preview: Week Of February 11 – February 15, 2019

Here is our preview of the most important developments likely to occur in the BDC sector in the coming week. Pretty much everything highlighted in last week’s report came to pass. This week may be a little less frantic, as we explain below. However – as always – the BDC common stock market remains in a volatile state as investors – who just a few weeks ago – were bailing out have bailed back in, but now face what to do next. BDC Fixed Income investors have a more propitious environment than at any time since November 2018.

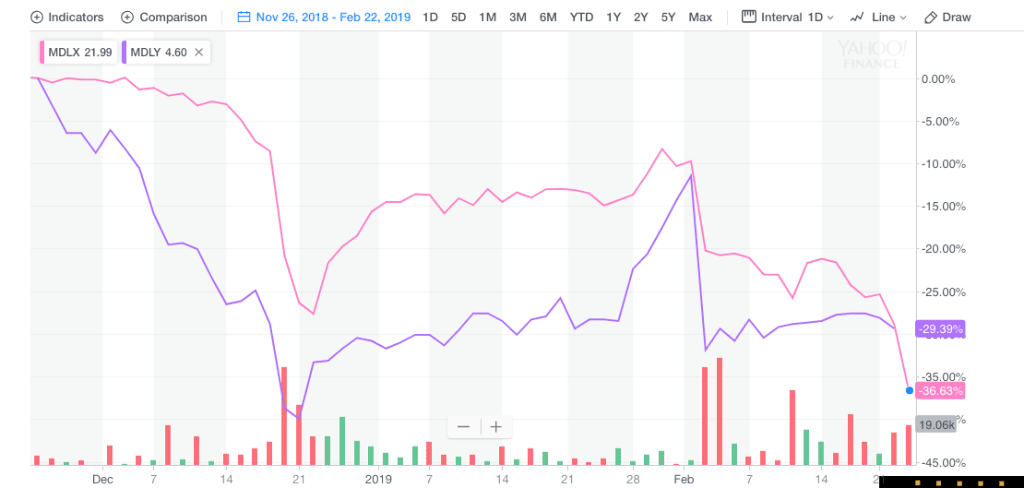

Medley Merger: As we anticipated in last week’s Preview, the dogfight about the future of Medley Capital (MCC), as well as Medley Management(MDLY) and Sierra Income, dominated the BDC news headlines. The BDC Reporter wrote three (!) more full length articles on the subject during the week for our Premium subscribers, the most recent over the week-end. We won’t repeat all the twists and turns of the week past. However, this is where we are right now: MCC and Sierra have rebuffed the NexPoint offer to serve as the Investment Advisor of the two merged BDCs. Also, MCC, Sierra and MDLY have set a new date for a shareholder vote for each entity: March 8, 2019. Plus, MCC’s Board has changed some of its by-laws to maintain control over when and by whom shareholder meetings are called. NexPoint has offered some very harsh criticism of the management and Boards of the Medley empire. Oh, and we’ve learnt about several lawsuits underway which MCC and MDLY have to contend with by disgruntled parties, including FrontFour.

Topics: Analytics, BDC, market analytics, business development company, News, bdc reporter

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)