Datto moves forward on refi; existing debtholders include TCPC, GSBD, OCSL, SUNS, CGBD, GBDC

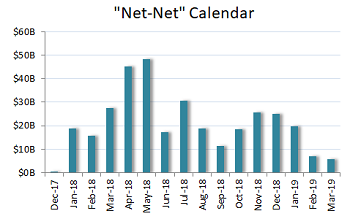

Power Solutions’ cross-border loan-and-bond deal was the focal point of last week’s activity, with loan demand magnified by the lack of available product elsewhere and both the secured and unsecured bonds playing well amid a bull-market run. Indeed, several other issuers pushed ahead with secured bonds as last week’s high-yield volume raced north of $10 billion, further depressing loan activity.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

Fixed Income,

LevFin Insights,

News

Better Late Than Never: The most interesting news of the week will occur on Friday when the shareholders of the three Medley Group related companies finally vote on whether to merge together or not. Of course, the vote has now been twice suspended, apparently due to governmental delays relating to the Federal shut-down. Last week, after the vote was delayed at the last minute, very little was said by the parties involved, except confirmation of the date and times of the votes. Even the BDC Reporter did not have anything new to say, nor do we now. We’ll have much more to say once the votes have occurred, the last of which is scheduled for 11:00 a.m. EST. Then there will be fireworks of one kind or another.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

bdc reporter

SORENSON PLANS FULL REFI OF DEBT HELD BY FSK, MAIN, HMS, AINV

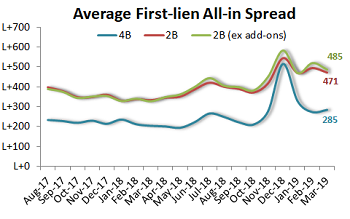

As the loan pipeline continues to ebb, opportunistic issuers are beginning to wade back in, spurred by bifurcated conditions that are allowing well-regarded repeat issuers to price tight to the broader market. Though the secondary rally stalled out last week, the appreciable improvement in the secondary market following the February rally eases the difficulty of layering in fungible new money at previous years’ more advantageous pricing levels.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

Oaktree vehicles hold Windstream’s prepetition debt

Although a pair of competing industry conferences took many buysiders out of pocket in the first part of last week, high-yield activity roared back to life late in the week via a procession of drive-bys, while loan arrangers launched a trio of large LBO deals off the pipeline as the secondary market continued to move higher. Several secondary situations also kept market participants on their toes, what with Windstream Services filing for bankruptcy, Neiman Marcus disclosing the framework of an extension/exchange plan and issuers releasing a flurry of earnings reports.

Read More

Topics:

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

A very busy week ahead for BDC investors including fast moving prices; eleven new earnings releases and the vote on whether Medley Capital will merge into Sierra Income. We pledge to keep readers updated as a critical week unfolds.

Markets: Given that last week the BDC sector – as measured by the Wells Fargo BDC Index and the price of the UBS Exchange Traded Note with the ticker BDCS – dropped every day, the direction of the market will be a critical factor. Last week’s pullback occurred while the broader markets continued to rise and other forms of non investment grade credit remained strong, begging the question as to whether this was just a short term pause in a continuing rally or a turning point, and prices will be down from here. As we’ll discuss in greater detail below, BDC earnings season is still in process, and individual fund results may influence sector performance. By mid-month, though, all the latest quarterly updates will be in and investors will have positioned themselves. We’ll be keeping track not only of BDCS and the Wells Fargo BDC Index but of the trends amidst the 45 different public BDCs we track. Last week, 42 dropped in price and 20 are now trading at a price below that of 4 weeks ago in the very midst of the rally. If that proportion of underwater stocks rises, or we see an uptick in BDCs trading within 5% or even 10% of their 52 week lows (the current numbers are zero and one respectively) we’ll be worried that the rally that began December 24, 2018 has run its course. On the other hand, if BDCS breaks through the August 30, 2018 high of $21.03, we’ll know that this rally lives and has broken through a critical threshold. For reference, as of Friday, BDCS was at $19.73.

Read More

Topics:

Analytics,

market analytics,

business development company,

Finance,

Fixed Income,

News,

bdc reporter

.png)