M&A drives new debt for names in several portfolios, including recently combined FS KKR Capital

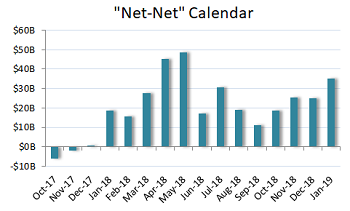

The loan market remained fixated on the primary calendar as $9.4 billion of new loans, all of it M&A- and LBO-related, entered syndication last week. Following the secondary market’s early January rebound, the primary also was off to a solid start last week with a series of oversubscribed transactions, accelerated timing and the return of reverse-flex activity as some new issues started to cement pricing levels well south of the December’s rate spike.

Read More

Topics:

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

Aimbridge LBO to take out unitranche debt held by Bain Capital Specialty Finance, Golub

Download: LFI BDC Portfolio News 1-14-19

Read More

Topics:

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News

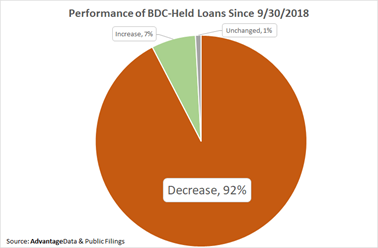

Loan market participants enter 2019 looking back at a miserable December. Senior secured loans traded off the most since early 2016. BB-rated loans were trading below $96.00 for the first time in the three-year span and nearly all loans fell below par.

Read More

Topics:

Loans,

Middle Market,

Analytics,

BDC,

market analytics,

business development company,

BDC Filings,

Fixed Income

Primary market yields on first lien middle market loans rose to their highest levels since Q1 2017 with increases in each quarter of 2018. This movement was driven heavily by the steady increase in LIBOR of over 100 bps throughout the year along with modest increases in coupon spread, most notably in the fourth quarter. First and second lien coupon spreads widened 35 and 33 bps respectively in the quarter, marking the largest quarterly spread widening in 2 years.

Read More

Topics:

Loans,

Middle Market,

Analytics,

market analytics,

Fixed Income,

download,

research

.png)