Loan market participants enter 2019 looking back at a miserable December. Senior secured loans traded off the most since early 2016. BB-rated loans were trading below $96.00 for the first time in the three-year span and nearly all loans fell below par.

Topics: Loans, Middle Market, Analytics, BDC, market analytics, business development company, BDC Filings, Fixed Income

Primary market yields on first lien middle market loans rose to their highest levels since Q1 2017 with increases in each quarter of 2018. This movement was driven heavily by the steady increase in LIBOR of over 100 bps throughout the year along with modest increases in coupon spread, most notably in the fourth quarter. First and second lien coupon spreads widened 35 and 33 bps respectively in the quarter, marking the largest quarterly spread widening in 2 years.

Topics: Loans, Middle Market, Analytics, market analytics, Fixed Income, download, research

BDC Preview: Week Of December 10 – December 14, 2018

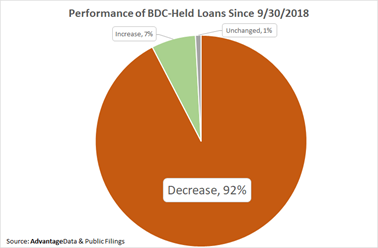

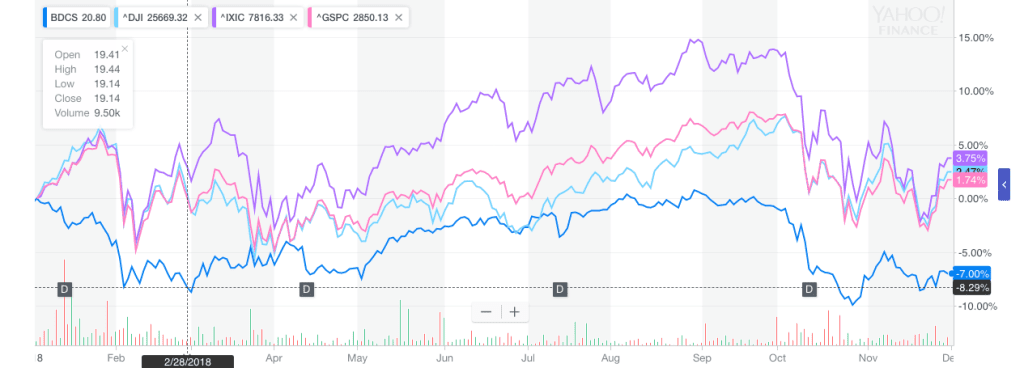

Inescapable: We’re going to assume the ups and downs of the major indices – and the corresponding movement in BDC common stock prices – will continue until it doesn’t. Since late August, the turmoil across all asset classes has caused the playbook of BDC fundamentals to be thrown out the window as new low after new low is reached, with a few head fakes along the way. As we write this the Dow Jones index is trading 200 points down in the Monday pre-market, which only means that more of the same is on the cards. Admittedly, this past week, the BDC sector fared less poorly than the 3 major indices (Dow Jones, NASDAQ and S&P 500), but that could reverse itself this week, whether the broader markets go up or down. All we are sure of is that the BDC sector cannot disentangle itself from whatever direction the markets are headed. Here is the chart showing the price of the UBS Exchange Traded Note with the ticker BDCS – which includes most every BDC player – since August 30, 2018, roughly when the market dramas began, compared to the main indices.

Topics: Middle Market, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

LBOs to take out Elo Touch, Latham Pool debt held by BDVC, FSIC, GARS

Arrangers pressed forward with some of the final new-issue loans of 2018 last week, but it’s an open question as to how much enthusiasm remains among buysiders that have been buffeted by volatility in recent weeks. The recent downdraft has repriced the primary market, and issuers are seeking to address the issue with yield—and not just on dicier transactions.Meanwhile, high-yield’s heartbeat barely registered with a single $350 million print and a murky outlook on further deal flow as the loan market continued to dominate the waning supply in the final weeks of 2018.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Fixed Income, LevFin Insights, News

BDC Preview: Week Of December 3 – December 7, 2018

Back In Sync: As we expected, in the week ended November 30, 2018 the BDC common stock and the broader indices adjusted to get more in sync. The major markets raced ahead, while the BDC sector – which had performed better the week before – followed behind, up 0.62% in price terms. As this 2018 year-to-date chart comparing BDCS to the Dow Jones, NASDAQ and the S&P 500 shows all four have followed a similar shape even if there are short term divergences. If you adjust for the fact that the BDC sector pays out much higher distributions, even the total return is highly similar.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Fixed Income, News, bdc reporter

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)