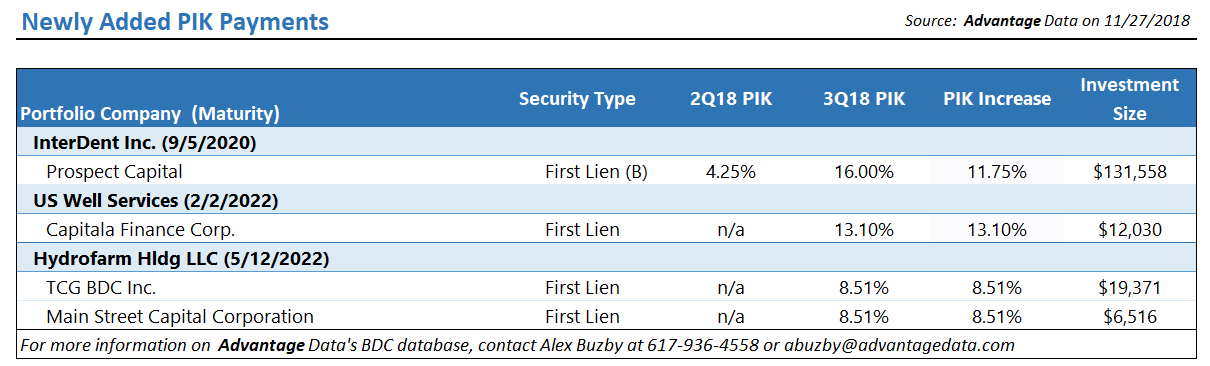

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

One Step Ahead: Identifying Distress In The Middle Market

Topics: Middle Market, BDC, Spreads, First Lien, Distressed Investments, debt, business development company, Distress, Distressed Debt, Finance, Restructuring, Fixed Income, download

BDC Preview: Week Of November 26 – November 30, 2018

Market Mayhem: As we discussed at length already in our premium BDC Common Stocks Market Recap, last week was surprising as the BDC sector – and many individual BDCs – fared much better than the main indices and all the main categories from investment grade to “junk”. However, we’d be very surprised if the BDC sector can continue to remain uncorrelated with the broader markets for very much longer. As this chart below shows – comparing the price progress of the Exchange Traded Fund SPY, which is based on the S&P 500, and the exchange traded note with the ticker BDCS,which reflect the BDC sector – the two have moved pretty much in tandem since the decline began in the markets on September 20.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

BDC Preview: Week Of November 19 – November 23, 2018

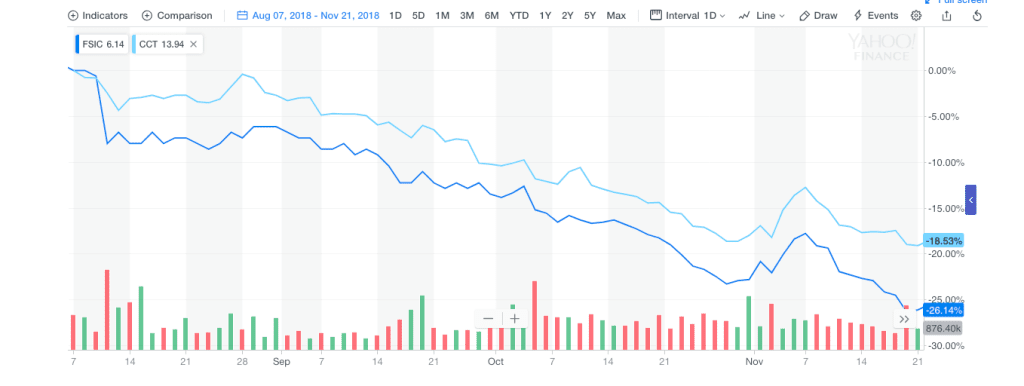

Whence The BDC Rally ? : Last week, the two week long BDC rally ground to a halt. Based on the Wells Fargo BDC Index for the period, the sector pulled back (2.2%). Only 9 individual BDC companies were up in price or flat, while 37 were down. Using the UBS Exchange Traded Note which invests in most every common stock in the sector – ticker BDCS – we dropped to (6.6%) down in price terms on a year-to date basis.

It’s hard to imagine a huge turnaround coming this week, what with the broad markets all in various stages of disarray. In addition, the general leveraged loan market – a kissing cousin of the BDC sector – is just coming off its lowest price point in two years, and knocking their total return to below 4%. (The Wells Fargo Index measured comparable return for BDCs is a very close 2.8%). Then there’s the Thanksgiving break coming up with many investors more focused on turkey and family. We expect a non-eventful to lower shade on BDC prices.

Topics: Loans, Middle Market, BDC, market analytics, business development company, Fixed Income, News, bdc reporter

BDC Common Stocks Market Recap: Week Ended November 16, 2018

BDC Common Stocks

Two Weeks Forward. One Week Back

The BDC common stock winter “rally” took some time off this week, after two weeks of upward momentum.

Topics: Loans, Middle Market, BDC, market analytics, business development company, Fixed Income, News, bdc reporter

Repricings at Avantor and MRO to reduce yield on credits held by CCT, BDVC, OCSI, BBDC, CION and Flat Rock

Editor’s note: Due to the Thanksgiving holiday, LFI BDC Portfolio News will not publish on Monday, Nov. 26. The report will resume publication on Monday, Dec. 3.

Download: LFI BDC Portfolio News 11-19-18

The tone in the broader leveraged loan market deteriorated as last week progressed, complicated by a handful of high-profile earnings misses that came in as the traditional 45-day reporting period trailed off and the jumbo LifePoint Health deal that quickly faded in the secondary loan and bond markets despite a host of investor-friendly revisions. In many cases, price talk and structure are deeply in flux, and investors are increasingly skittish amid poor secondary performance as the list of recently issued loans bid below their OIDs grows.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Fixed Income, LevFin Insights, News

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)