Back in 2015, Marty Fridson, Chief Investment Officer at Lehmann, Livian, Fridson Advisors LLC, spoke with Barron's on the topic of high yield industries most sensitive to rising interest rates.

Industry Sectors in High Yield: A Yield Comparison

Topics: High Yield, junk bonds, bond market, market analytics, YTW, Fixed Income, News, interest rate

The 2018 bobsguide Software Rankings: Advantage Data Made the List!

AdvantageData made the list!

Bobsguide, a website and directory that connects consumers with FinTech solutions, announced their 2018 Software Rankings. AdvantageData was ranked in the Data Provider category along with Bloomberg and Thomson Reuters!

Topics: News

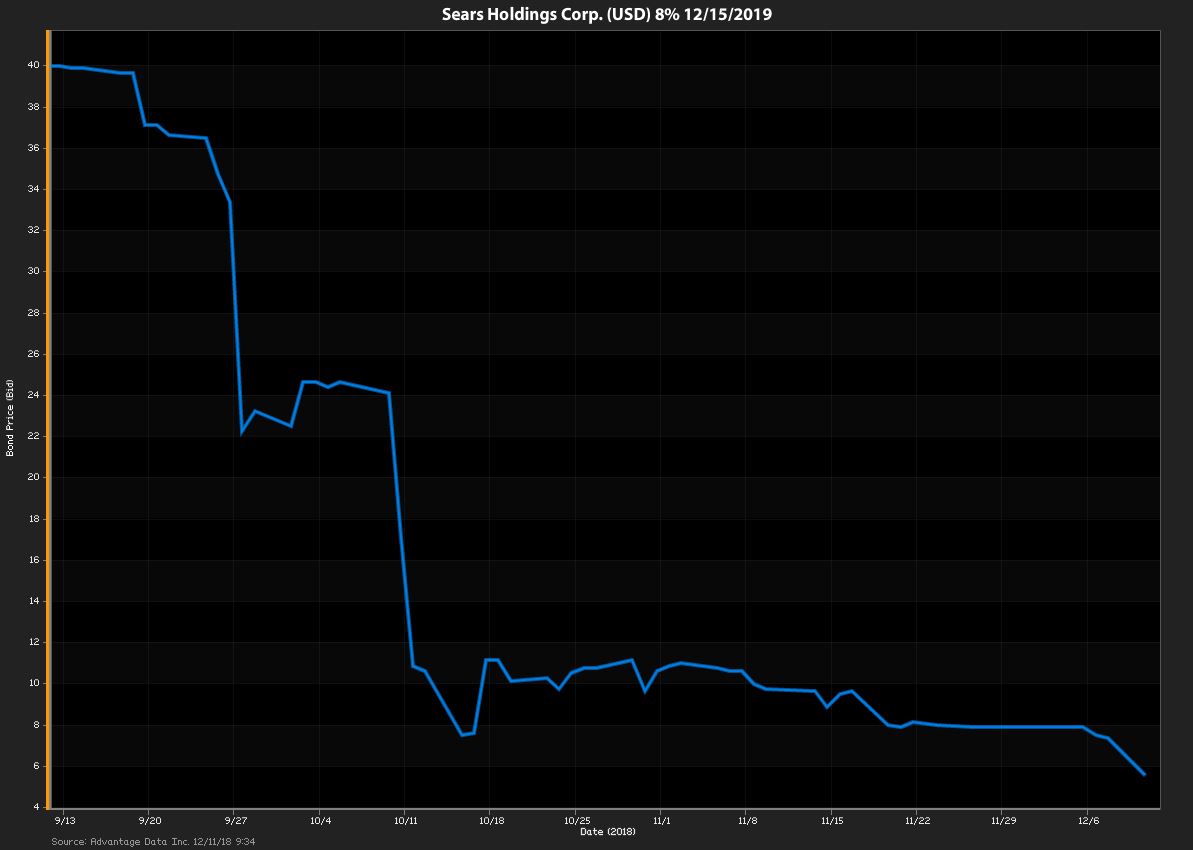

Sears CEO Places Hail Mary Bid to Save Company, And His Wallet

Sears CEO, Edward Lampert stands to lose a fortune if SEARS Holdings Corp. goes under. Analysts increasingly predict that will indeed be the case.

Topics: High Yield, bonds, Losers, Restructuring, sears, Fixed Income, News, bankruptcy

BDC Preview: Week Of December 10 – December 14, 2018

Inescapable: We’re going to assume the ups and downs of the major indices – and the corresponding movement in BDC common stock prices – will continue until it doesn’t. Since late August, the turmoil across all asset classes has caused the playbook of BDC fundamentals to be thrown out the window as new low after new low is reached, with a few head fakes along the way. As we write this the Dow Jones index is trading 200 points down in the Monday pre-market, which only means that more of the same is on the cards. Admittedly, this past week, the BDC sector fared less poorly than the 3 major indices (Dow Jones, NASDAQ and S&P 500), but that could reverse itself this week, whether the broader markets go up or down. All we are sure of is that the BDC sector cannot disentangle itself from whatever direction the markets are headed. Here is the chart showing the price of the UBS Exchange Traded Note with the ticker BDCS – which includes most every BDC player – since August 30, 2018, roughly when the market dramas began, compared to the main indices.

Topics: Middle Market, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

LBOs to take out Elo Touch, Latham Pool debt held by BDVC, FSIC, GARS

Arrangers pressed forward with some of the final new-issue loans of 2018 last week, but it’s an open question as to how much enthusiasm remains among buysiders that have been buffeted by volatility in recent weeks. The recent downdraft has repriced the primary market, and issuers are seeking to address the issue with yield—and not just on dicier transactions.Meanwhile, high-yield’s heartbeat barely registered with a single $350 million print and a murky outlook on further deal flow as the loan market continued to dominate the waning supply in the final weeks of 2018.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Fixed Income, LevFin Insights, News

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)