Repricings return, aiming for lower margins at BJ's (ACSF, Hancock Park, CCT), Compass Power (FS Energy) and Travel Leaders (Bain, Triton Pacific)

The first week of the new month was dominated by reactive trading and repositioning in the wake of quarterly reports, even as the new-issue market kept rolling out loans and bonds. In bonds, highlights included $1.25 billion short-term-fix from Intelsat just as the identically sized BMC Software buyout bonds got going on international roadshows for next week’s business following June’s completed loan financing.

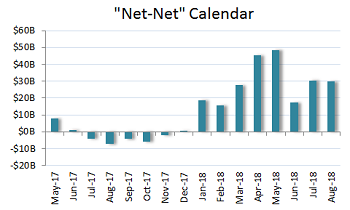

After a somewhat sleepy start last week, loan arrangers piled it on. M&A deals peeled off the calendar late in the week included the long-awaited deal for Penn National Gaming, Cetera, Travel Leaders and Del Frisco Restaurant Group as gross launched volume jumped to $15.6 billion in the busiest week since June 15. M&A volume was a healthy $7.9 billion.

.png)