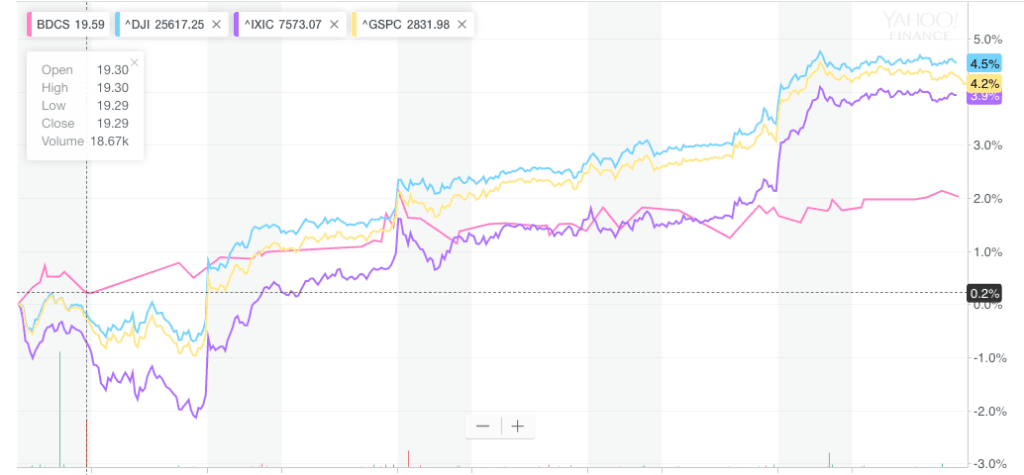

Allied Universal to widen margin on most 1L debt; existing holders include BDVC, OCSL

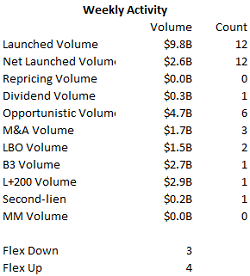

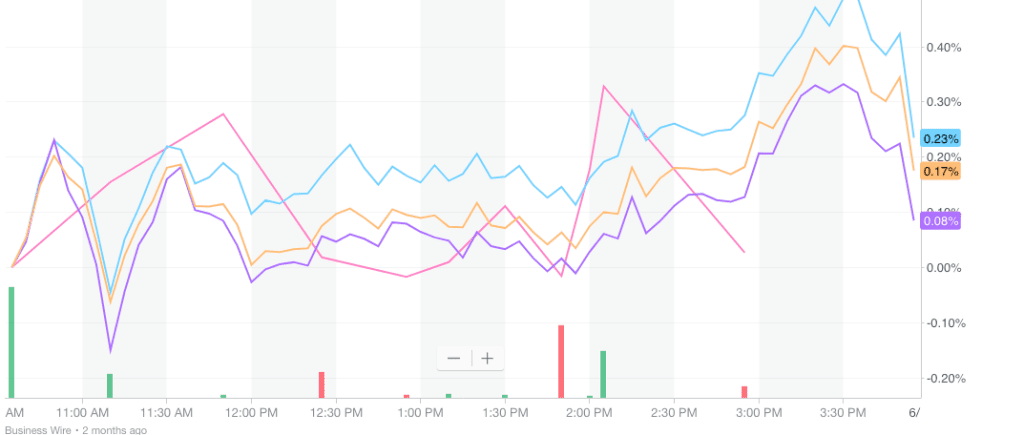

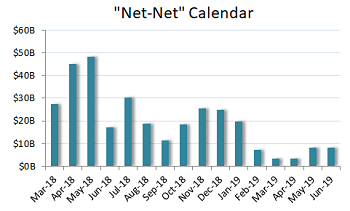

Bifurcated market conditions continued to reign in new-issue loans despite modest deal flow and a panoply of deal revisions that reflect the challenging nature of the current calendar; in the month to date B3 issuers comprise 44% of rated volume, the highest percentage since December. Bonds charged forward with a bunch of refi-related prints tight to talk, but the two buyout financings met some inevitable pushback on issuer-friendly terms.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Avantor repricing to narrow yield on debt held by BDVC, OCSI, OCSL, FSK

High-yield took center stage last week as investors shrugged off outflows and cozied up to a busy new-issue calendar bolstered by falling U.S. Treasury yields that helped support an attractive refinancing window, which drew big names such as HCA, Sirius XM Radio, Vistra Energy and even Intelsat. New-issue loans, on the other hand, were mixed as bifurcated market conditions that have existed for much of the year are coming into sharper focus.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

.png)