BDC COMMON STOCKS

All Together Now

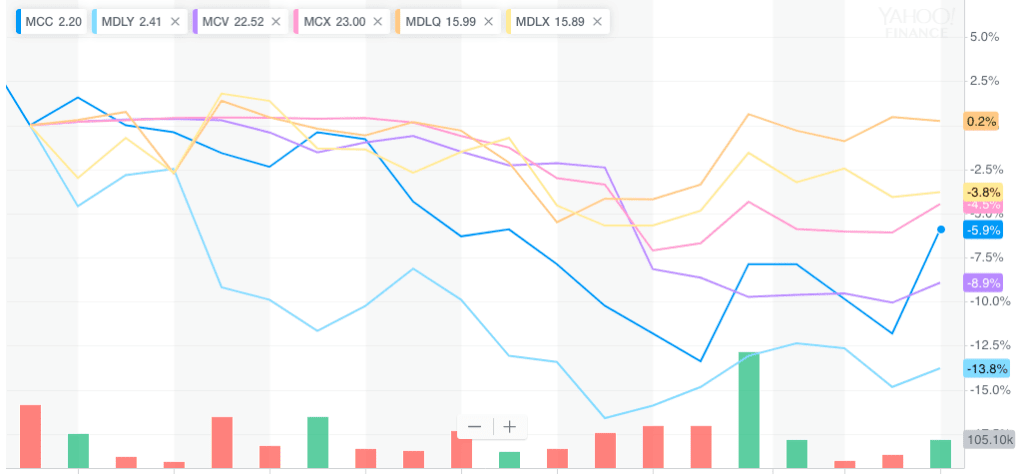

The week was not a good one for the major indices, all of which were down in the period. The BDC sector was not spared, with both indicators we use for price and total return in the red.

The UBS Exchange Traded Note, which includes most every public BDC – with the ticker BDCS – was off (0.25%). Likewise, the all-inclusive Wells Fargo BDC Index was down by (0.74%).

Thirty one individual BDC issues dropped in price, and just fourteen were unchanged or increased. The week before 28 issues had increased in price and 37 the week before that.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

LBOs to take out existing debt at Insurity, Loparex, Pregis and Press Ganey; holders include TSLX, BDVC, Audax, ORCC, FSK and Sierra

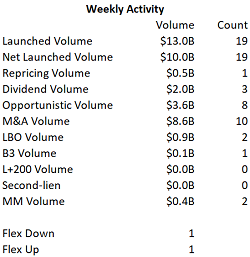

It was back to business last week for loans and bonds alike, with loan arrangers holding 22 lender meetings or calls to support $15.82 billion of deal flow. High-yield was similarly busy with nine credits for $3.88 billion marking the busiest post-July 4 week in several years, a testament to strong market conditions amid still-low underlying rates despite a small spike on Thursday afternoon and ongoing inflows to the asset class. An overwhelming majority was refinancing related, but new-money opportunities through M&A deals are already on tap for high-yield this week.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Summary

- On one hand, BDC index prices moved up again. On the other hand, other data we use to measure investor enthusiasm for the BDC sector was unmoved.

- We seek to reconcile this contradictory picture, while looking forward.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC COMMON STOCKS

Total Return Milestone

This may have been a holiday shortened week, but there was notable news where BDC sector pricing was concerned.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

LFI BDC Portfolio News 6-24-19: Talen Energy Supply to repay term debt held by FS Energy & Power Fund

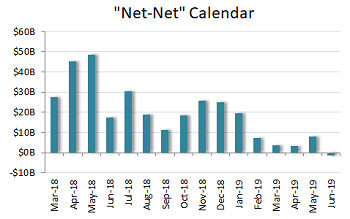

High-yield extended its June rebound with increasing vigor over the past week amid retail cash inflows and declining interest rates, and the new-issue machine kept churning out maturity-extension focused refinancings, peppered by a few M&A situations. The loan secondary, by contrast, was little changed, with new issues at an ebb pre-holiday and the specter of falling rates dampening enthusiasm among end investors.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

.png)