A trio of issuers launch refinancing efforts for BDC-held credits; ‘net net’ calendar turns negative

High-yield business was brisk last week with primarily off-the-run credits swapping higher coupons for extended maturities, and investors were happy to oblige the trade. The lone M&A-related bond trade, IAA Spinco, cleared with fanfare despite shaky market conditions as the well-rated credit was embraced by both bond and loan accounts alike.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Go Your Own Way

In the past month – as every financial news outlet will tell you – the major market indices have been pulling back, almost in unison.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

More Of Same

Guess what? Another week where BDC common stock prices went nowhere. Again, the UBS Traded Note which covers 36 of the 45 stocks in our universe, ticker BDCS, was essentially flat.

BDCS closed at $19.88, from $19.85 the week before. Outside the major markets rage up and down in price depending on their latest view on tariffs, the economy, impending war in the Middle East etc.

Up to a point, BDC prices move in tandem, but by week’s end we end back where we started. 15 stocks were up in price, and 30 were unchanged or down.

Read More

Topics:

Loans,

BDC Index,

Analytics,

BDC,

market analytics,

business development company,

BDC Filings,

News,

bdc reporter,

research,

market update

Add-ons abound amid renewed wave of M&A; Autodata deal to take out debt held by PSEC

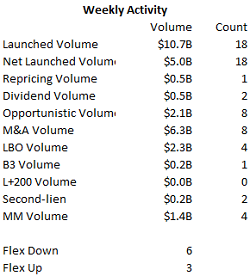

Momentum slowed in the new-issue loan market last week, with the uncertainty surrounding U.S.-China trade negotiations leaving market participants in wait-and-see mode heading into the weekend. While time-sensitive business continues apace, arrangers readying opportunistic deals appeared to be taking a more deliberate approach as events play out on the international stage. Yet high-yield issuance came at a breakneck pace—the $12 billion output was the highest-volume week in almost two years—as U.S. Treasury yields fell. Moreover, the broad secondary markets took the week’s events in stride, with earnings continuing to drive situational movers.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

BDC COMMON STOCKS

Unimpressed

In a week where there was an avalanche of BDC quarterly results, the market just shrugged indifferently.

Read More

Topics:

Loans,

BDC Index,

Analytics,

BDC,

market analytics,

business development company,

BDC Filings,

News,

bdc reporter,

research,

market update

.png)