BDC Filing season is almost over. This report will analyze BDCs that have filed in the last 3 weeks. Last week’s analysis is available here.

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 104 Billion USD. BDCs have reported 36 Billion USD AUM in this week.

Read More

Topics:

BDC Index,

BDC,

First Lien,

business development company,

Non-accruals,

New Issues,

Second Lien,

BDC Filings,

fair value

BDC Filing season is in full swing. This report will analyze BDCs that have filed in the last 2 weeks. Last week’s analysis is available here.

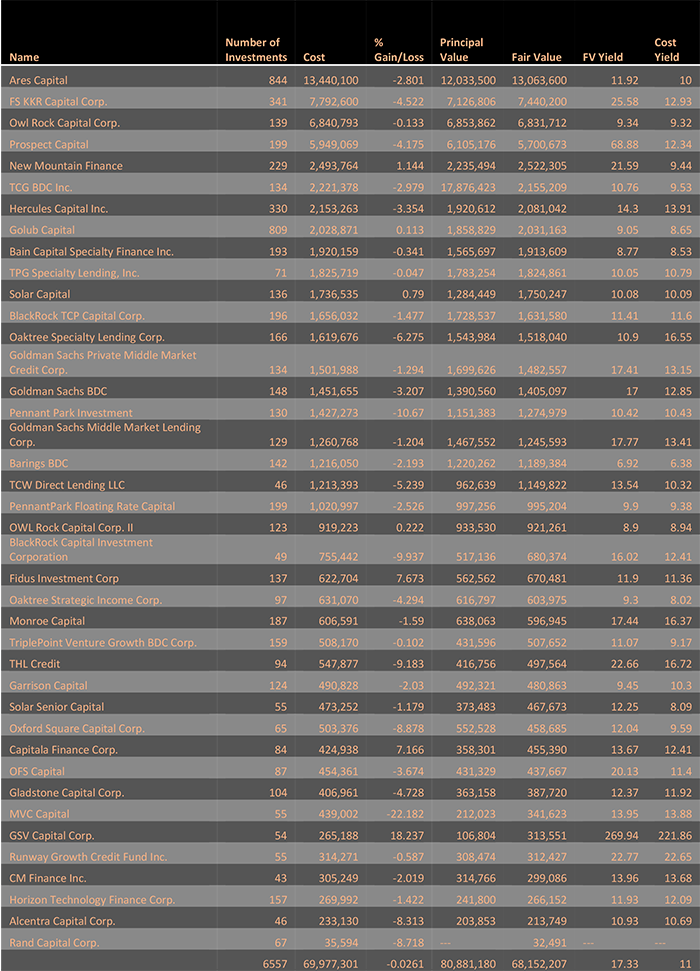

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 68.1 Billion USD which is approximately 70% of aggregate AUM of all BDCs. BDCs have reported 48.8 Billion USD AUM in this week alone.

Read More

Topics:

Analytics,

BDC,

AUM,

market analytics,

business development company,

Non-accruals,

BDC Filings,

fair value,

market update,

top 5,

adds & exits

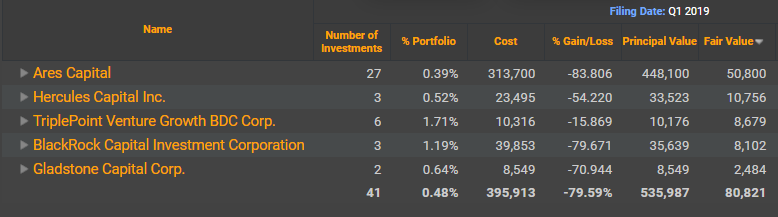

BDC Filing season is in full swing. This report will analyze nine BDCs that have filed this week. Aggregate Fair Value reported by these BDCs is 19.3 Billion USD which is approximately 20% of aggregate AUM of all BDCs.

Read More

Topics:

Analytics,

BDC,

AUM,

market analytics,

business development company,

Non-accruals,

BDC Filings,

fair value,

market update,

top 5,

adds & exits

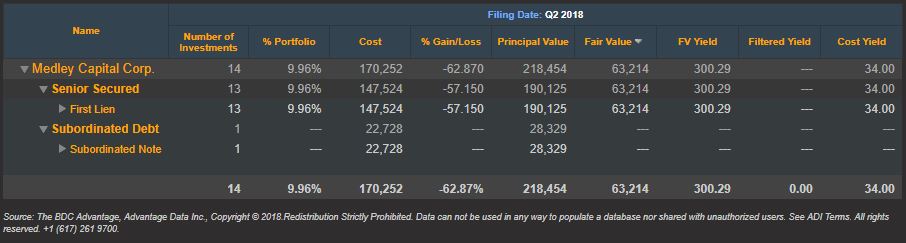

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Read More

Topics:

BDC,

First Lien,

Non-accruals,

Distressed Debt,

Restructuring,

Second Lien,

Loan Default Rate,

BDC Filings,

Default Rate,

Fixed Income,

fair value,

portfolio,

download,

News

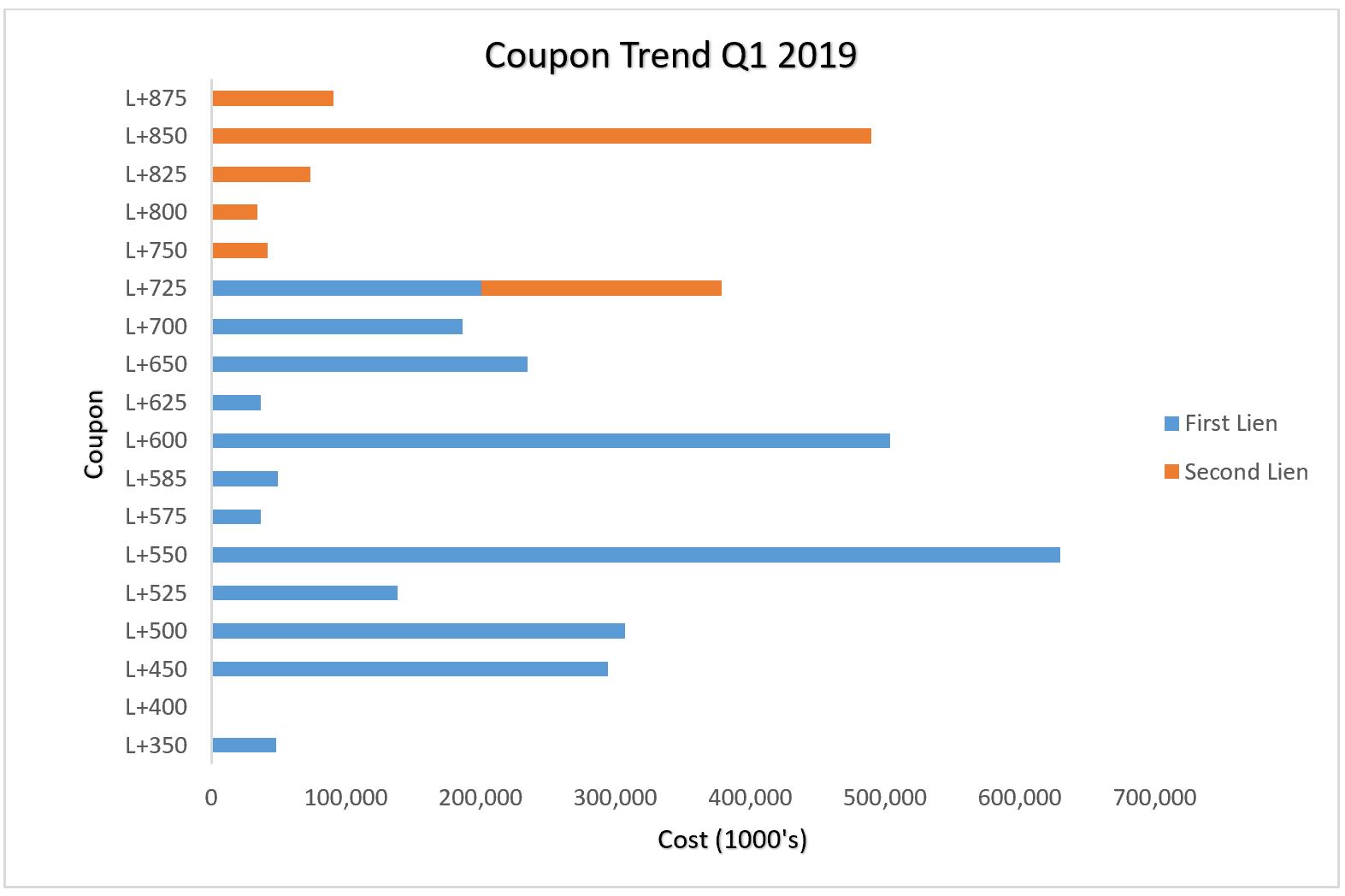

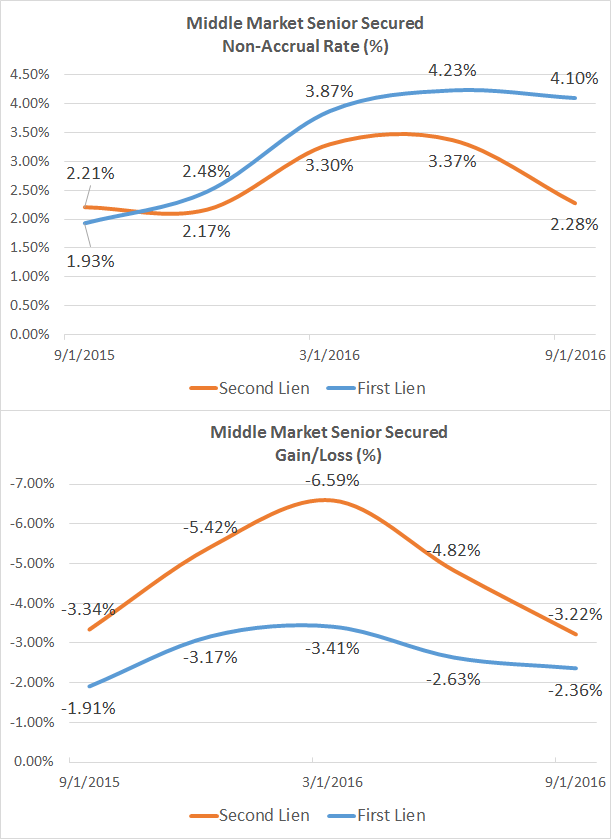

Interesting divergence between the first and second middle market liens on non-accrual vs. percentage loss over the 12 months from Q4 2015 through Q3 2016. In BDC portfolios, first lien non-accruals as a percentage of cost exceed second liens, while on a percentage loss basis second liens exceed first liens.

Read More

Topics:

Middle Market,

First Lien,

Non-accruals

.png)