BDC COMMON STOCKS

On A Run

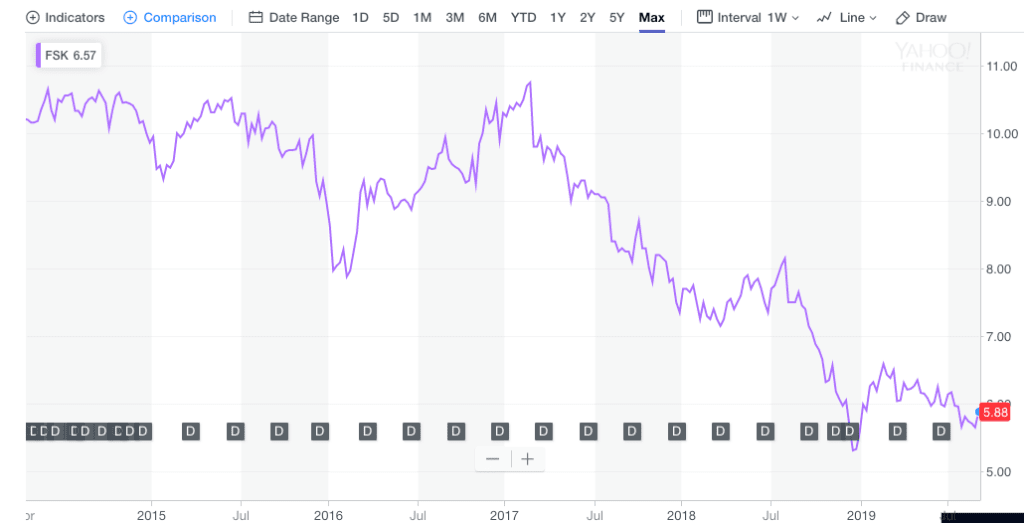

For the fifth week in a row, the BDC sector ended up in price on the week. The upward push appeared to have taken on a life of its own.

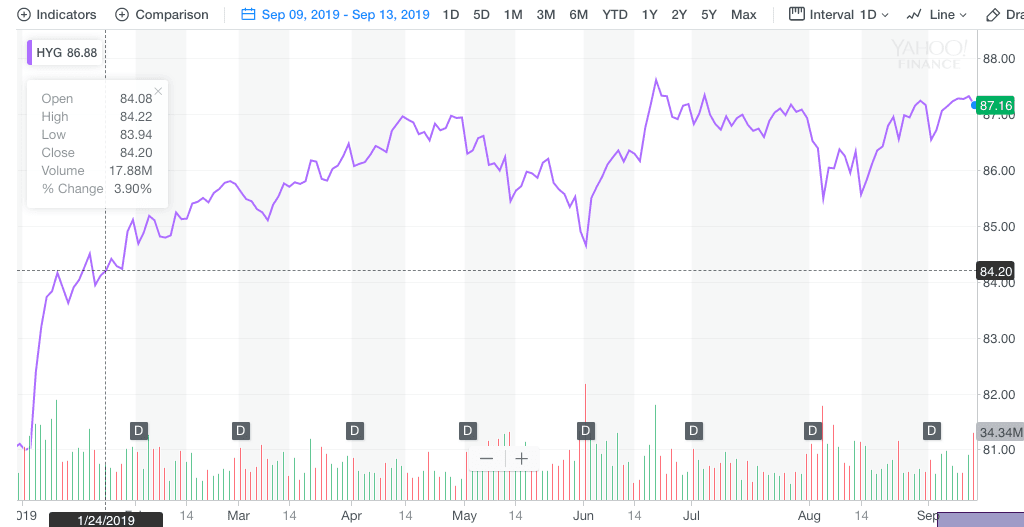

In prior weeks, the hike in BDC prices seemed to be tied to the upward direction of the broader markets. This week, however, BDCS – the UBS Exchange Traded Note which includes most BDC stocks and which we use as our gauge of price change – was up 0.9% while the S&P 500 was down (o.5%).

Since Friday August 16, the last time the BDC sector was down for the week till this last Friday, BDCS is up 2.6% and the S&P 500 2.3%. We don’t know what’s more intriguing: that the two indices are so close or that BDCS is (slightly) ahead of the S&P. (That’s not traditionally the case: YTD the gap is 5% in favor of the latter and over 5 years 69%! Of course, distributions are much higher for BDCs than the S&P 500).

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

Increase in market activity brings wave of add-ons to BDC-held credits

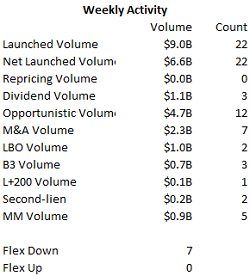

New-issue activity ramped up last week in both loans and bonds as increasingly robust conditions paved the way for well-rated and/or well-regarded issuers to speed through the market quickly despite the crowded calendar. For bonds, it was the busiest week this year with $15.5 billion of issuance, while loan arrangers rolled out another $8.1 billion in a mix of M&A and opportunistic business, much the same as the previous week.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

BDC COMMON STOCKS

Surprising

Notwithstanding the absence of any BDC sector news, prices continued to rise for a fourth week in a row.

As of September 13, 2019 the UBS Exchange Traded Note with contains most of the 46 public BDCs we track – and which has the ticker BDCS – closed at $20.08.

That was 1.75% higher than the week before.

Likewise, that other barometer of BDC price performance – the Wells Fargo BDC Index – reached 2,793.76.

BDCS is not at a record level, but the Wells Fargo measurement – which provides a “total return” – was again at a new year-to-date high for a second week in a row.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

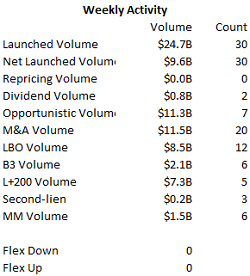

With leveraged loan market back online, LBOs for CoAdvantage, Del Frisco’s, Waystar, OEConnection to take out BDC-held debt

Both the leveraged loan and high-yield bond markets wasted no time getting back to business despite August’s tenuous market conditions, with issuers stepping forward last week with a mix of opportunistic and M&A-related transactions. Foreshadowing what is expected to be a busy September, the high-yield market saw its first drive-by execution on the Tuesday after Labor Day in seven years as issuers rushed to capitalize on the plunge in U.S. Treasury yields with heightened trade tension last month, even as it reversed course last week with one of the biggest one-day yield gains in three years.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

There was very little to move the BDC common stock market sector in the week ended September 6, 2019.

No BDC reported earnings and the news flow was pretty weak.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

.png)