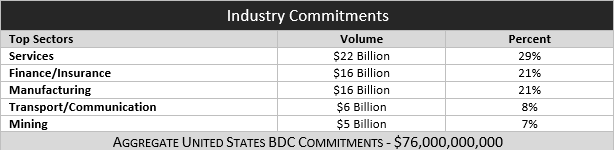

As of November 14, AdvantageData has recorded 55 BDC filings for Q3 2016 making up nearly $70 of the $83 billion in the space. Using this aggregate data to track dealflow in the middle market we can provide unique insight into trends in lending.

Topics: Middle Market, BDC, First Lien, Dealflow

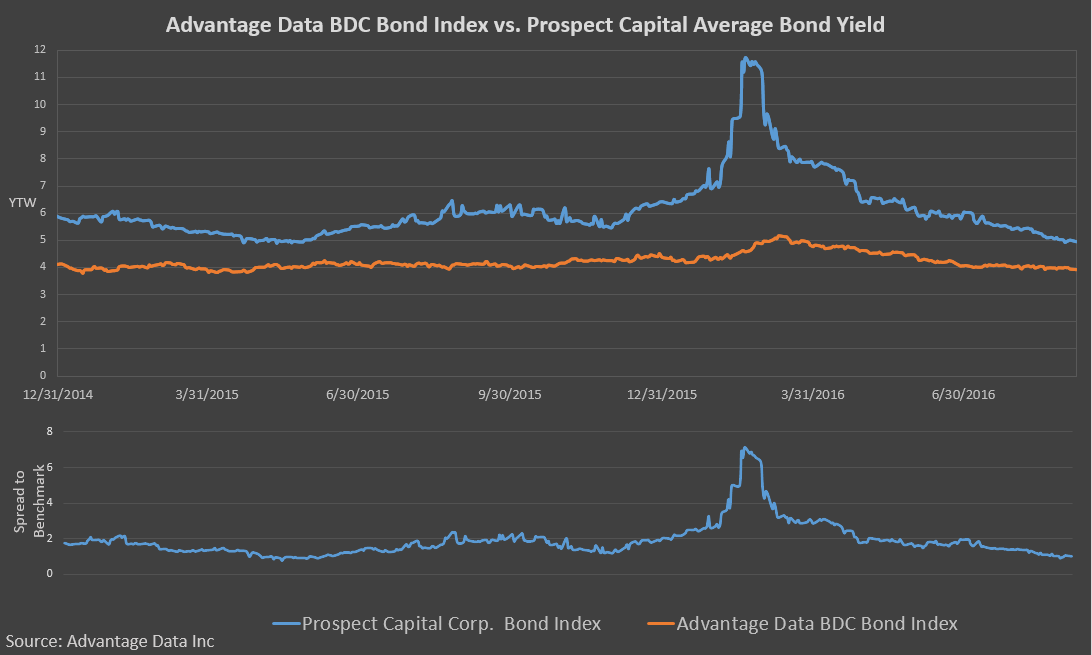

Topics: High Yield, Middle Market, Prospect Capital, BDC Index, BDC

Report: Business Development Company (BDC) Commitment to the U.S. Middle Market

Earlier this year, Advantage Data Inc. had collaborated with SBIA to analyze Business Development Companies commitment to the United States Middle Market.

Topics: Middle Market, BDC

Analysis: Q2 2016 vs. Q1 2016 Distressed BDC Investments

Looking at $80 billion of FV AUM for 76 BDCs at Q2 2016, with the exception of internally managed BDCs, we see reductions in distressed assets (90% of par or less) across the board, whether looking at size of BDC, externally managed BDCs or senior secured and non senior investments. Internally managed BDCs saw an increase in distressed assets as a percentage of portfolio of 0.2% vs. a decrease of 2.7% for all BDC's and a 3.1% decrease for externally managed BDC's.

Topics: BDC, Distressed Investments

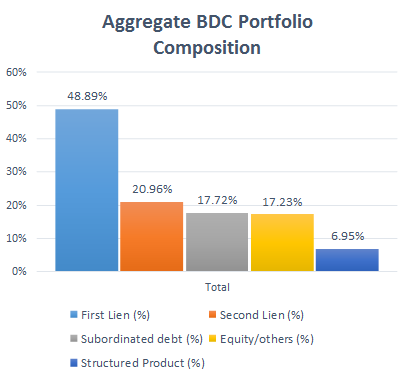

Aggregate BDC Portfolio Composition as of Q2 2016

BDC’s AUM for Q2 2016 at Fair Value was $80 Billion USD. Senior Secured investments comprised of First Lien, Second Lien and Unitranche makes up almost 70% of BDC Investments.

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)