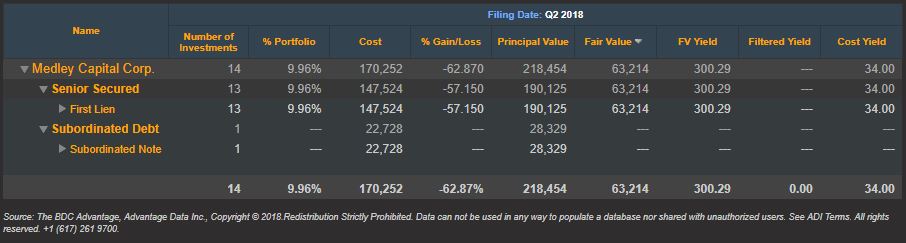

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Q2 2018 BDC Non-Accruals: Medley Capital Corp No Longer Worst Performer

Topics: BDC, First Lien, Non-accruals, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, BDC Filings, Default Rate, Fixed Income, fair value, portfolio, download, News

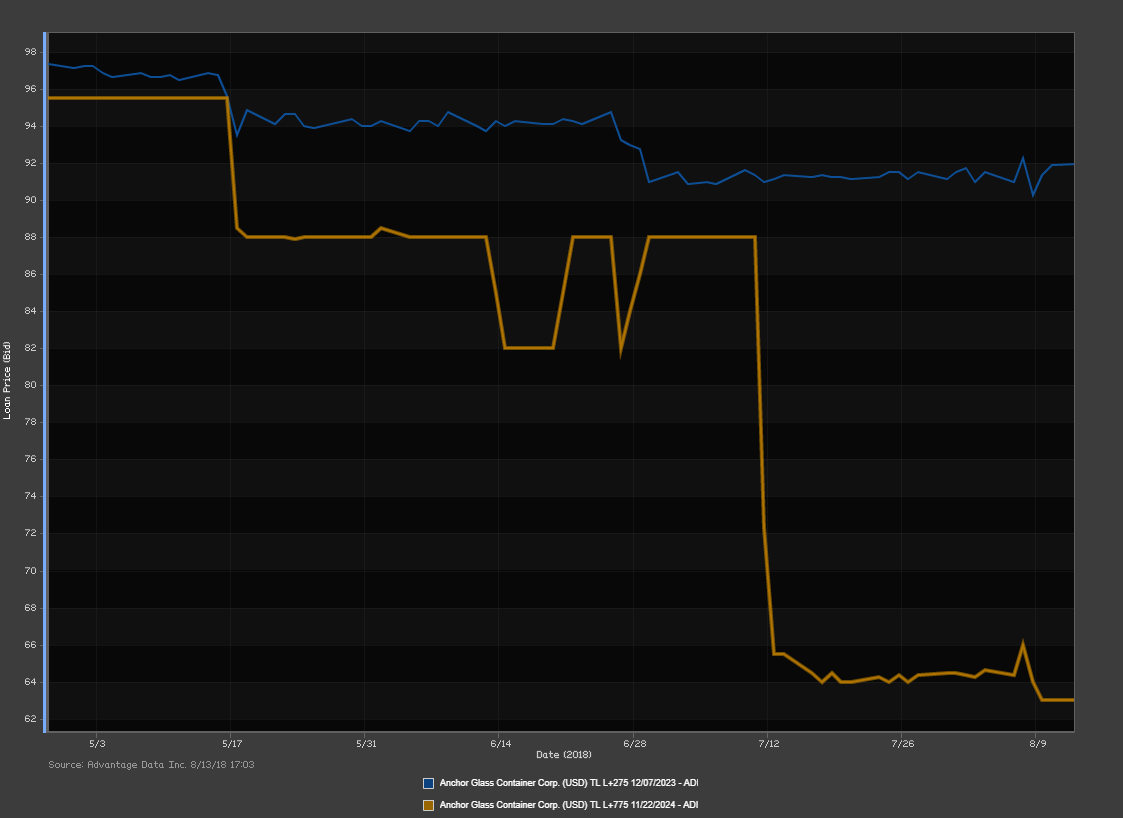

Newly Distressed Loans: Anchor Glass Container Corporation

We all know that companies in distress tend to have a harder time meeting their financial obligations, which translates to a higher probability that they will default. A company in this position has pretty straightforward options: either raise enough cash through asset sales, operating improvements, and new financing, or reduce or postpone interest and principal payments on the debt by negotiating with creditors.

For restructuring or turnaround experts, identifying distressed companies is the first hurdle to deal sourcing and business development. Using the AdvantageData workstation, we’ve compiled a list of distressed loans that you might want to be aware of.

Topics: Loans, First Lien, market analytics, Distress, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, Default Rate, Fixed Income, download

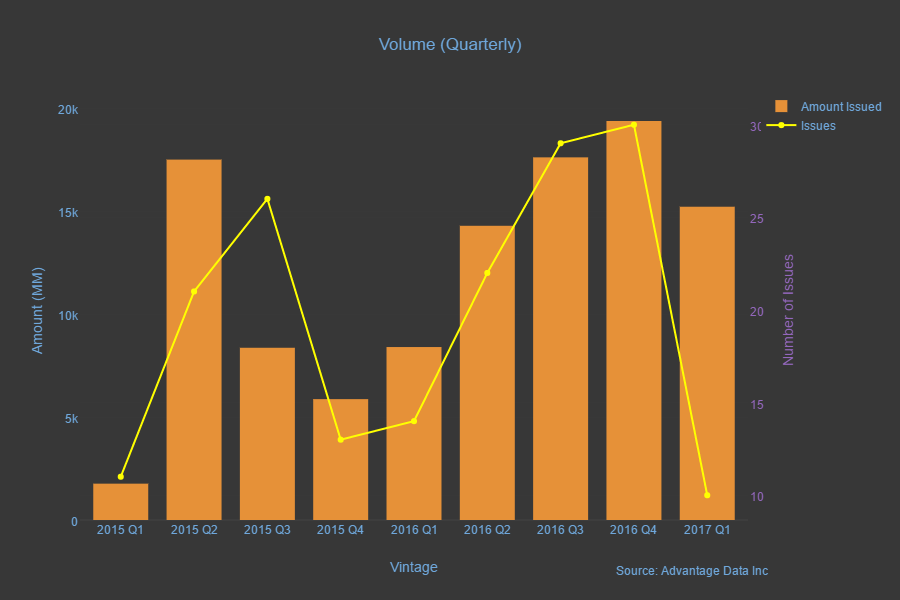

Level 3 Financing announces $4.61 billion Senior Secured Credit Agreement

Level 3 Financing, Inc. , a wholly owned subsidiary of Level 3 Communications, Inc. (NYSE: LVLT), announced last week that it successfully refinanced its outstanding Term Loans through the issuance of a new TLB L+225/2024. The company anticipates approximately $35 million of cash interest expense savings on an annualized basis through this $4.61 billion senior secured agreement. At the day of issuance, ADI loan pricing services quoted an end of day bid for the loan at 99 3/4. Since then, the loan has traded up to a bid of 100 5/8 in the week and half since its first quote.

Topics: Loans, First Lien, New Issues

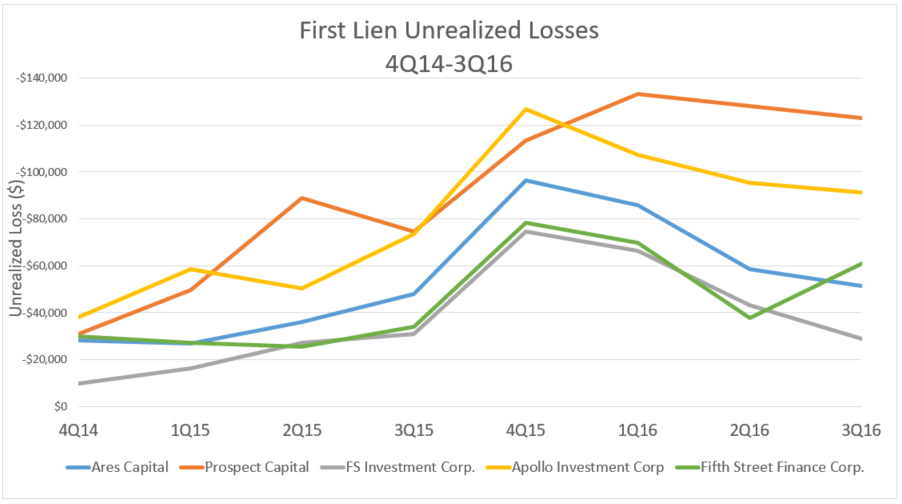

BDC Unrealized Losses and Percentage Loss - First Liens

Topics: Middle Market, BDC, First Lien

BDC First Lien Marks Rise While Non-Accruals Stay Relatively Flat

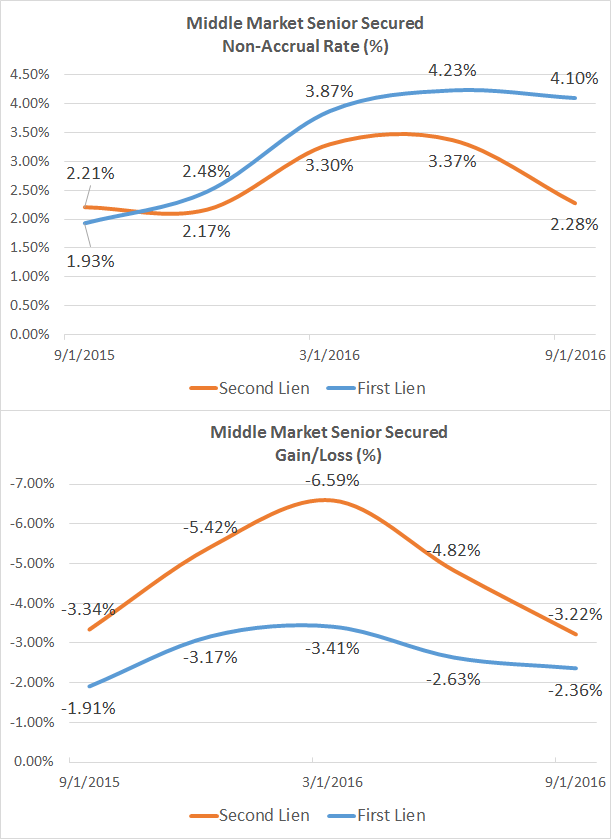

Interesting divergence between the first and second middle market liens on non-accrual vs. percentage loss over the 12 months from Q4 2015 through Q3 2016. In BDC portfolios, first lien non-accruals as a percentage of cost exceed second liens, while on a percentage loss basis second liens exceed first liens.

Topics: Middle Market, First Lien, Non-accruals

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)