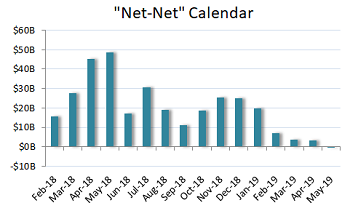

A trio of issuers launch refinancing efforts for BDC-held credits; ‘net net’ calendar turns negative

High-yield business was brisk last week with primarily off-the-run credits swapping higher coupons for extended maturities, and investors were happy to oblige the trade. The lone M&A-related bond trade, IAA Spinco, cleared with fanfare despite shaky market conditions as the well-rated credit was embraced by both bond and loan accounts alike.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Add-ons abound amid renewed wave of M&A; Autodata deal to take out debt held by PSEC

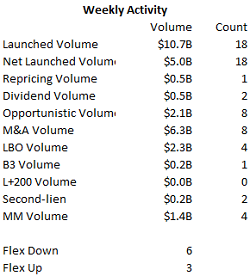

Momentum slowed in the new-issue loan market last week, with the uncertainty surrounding U.S.-China trade negotiations leaving market participants in wait-and-see mode heading into the weekend. While time-sensitive business continues apace, arrangers readying opportunistic deals appeared to be taking a more deliberate approach as events play out on the international stage. Yet high-yield issuance came at a breakneck pace—the $12 billion output was the highest-volume week in almost two years—as U.S. Treasury yields fell. Moreover, the broad secondary markets took the week’s events in stride, with earnings continuing to drive situational movers.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

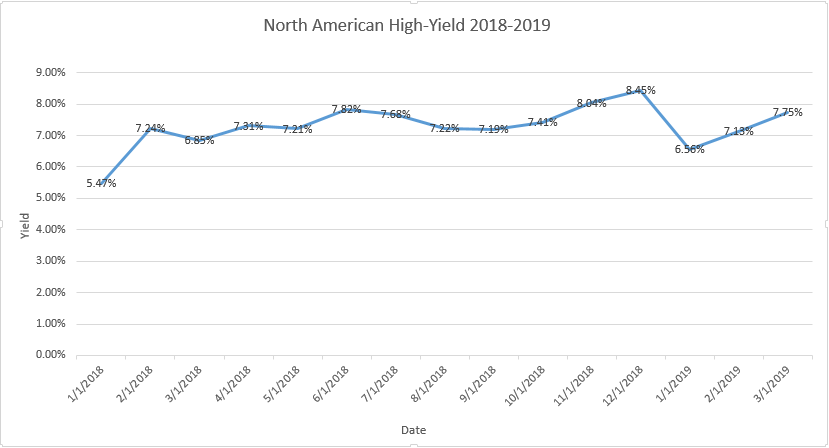

North American High Yield new issue average yields have been on the incline. Throughout 2018, a steady positive trend can be observed from January to November, when average yield peaked at 8.45%.

Volatility in December effected virtually all markets, as depicted in the North American High Yield average yield chart below. A sharp decline represents a drop in new issues average yield by almost two percent.

The new year has brought new growth to the High Yield space as average yield for North American High Yield new issues has steadily increased month over month.

Read More

Topics:

High Yield,

bonds,

junk bonds,

bond market

On Monday, President Trump criticized the Fed for even considering raising rates, yet on Wednesday the Federal Open Market Committee announced its decision to raise the Fed Funds rate ¼ of a percent from 2.25% to 2.5% -- the fourth such increase in 2018.

Read More

Topics:

High Yield,

Analytics,

bonds,

junk bonds,

market analytics,

New Issues,

Finance,

Equity,

Fixed Income,

News

U.S. TREASURY YIELDS SLID ON MONDAY APPROACHING three-month lows as investors fled to safe-haven assets.

The 10-year benchmark settled near 2.857% losing 3.6 basis points while the inverted 2-year and 5-year Treasury yield gap

narrowed to .3 basis points.

Read More

Topics:

High Yield,

bond market,

market analytics,

Finance,

News,

research

.png)