Back in 2015, Marty Fridson, Chief Investment Officer at Lehmann, Livian, Fridson Advisors LLC, spoke with Barron's on the topic of high yield industries most sensitive to rising interest rates.

Industry Sectors in High Yield: A Yield Comparison

Topics: High Yield, junk bonds, bond market, market analytics, YTW, Fixed Income, News, interest rate

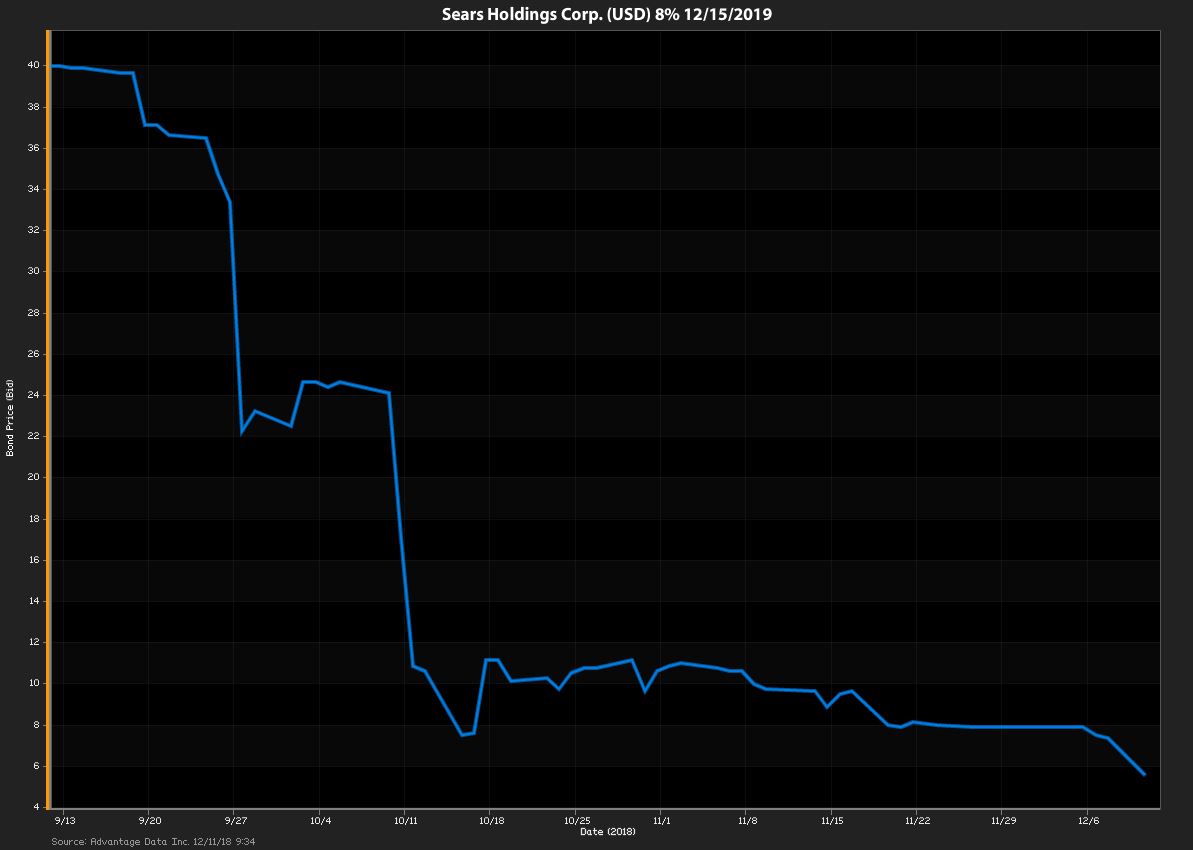

Sears CEO Places Hail Mary Bid to Save Company, And His Wallet

Sears CEO, Edward Lampert stands to lose a fortune if SEARS Holdings Corp. goes under. Analysts increasingly predict that will indeed be the case.

Topics: High Yield, bonds, Losers, Restructuring, sears, Fixed Income, News, bankruptcy

Topics: High Yield, Investment Grade, bonds, junk bonds, bond market, corporate bonds

Topics: High Yield, Investment Grade, bonds, bond market, corporate bonds

U.S. High Yield Default Rate Remains Below 2%; Seadrill Propels Yankee Rate

Fitch U.S. High Yield Default Insight (U.S. High Yield Default Rate Remains Below 2%; Seadrill Propels Yankee Rate)

Several U.S. high yield companies have interest payments scheduled for Sept. 15 which, according to Fitch Ratings, if not made would move the default rate above the current 1.8% mark, and includes two large retailers.

Topics: High Yield

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)