LBOs to take out existing debt at Insurity, Loparex, Pregis and Press Ganey; holders include TSLX, BDVC, Audax, ORCC, FSK and Sierra

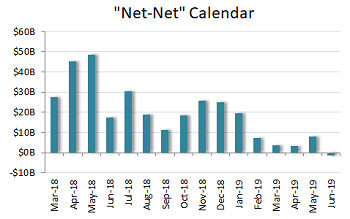

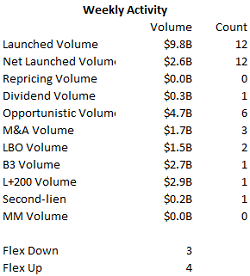

It was back to business last week for loans and bonds alike, with loan arrangers holding 22 lender meetings or calls to support $15.82 billion of deal flow. High-yield was similarly busy with nine credits for $3.88 billion marking the busiest post-July 4 week in several years, a testament to strong market conditions amid still-low underlying rates despite a small spike on Thursday afternoon and ongoing inflows to the asset class. An overwhelming majority was refinancing related, but new-money opportunities through M&A deals are already on tap for high-yield this week.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Summary

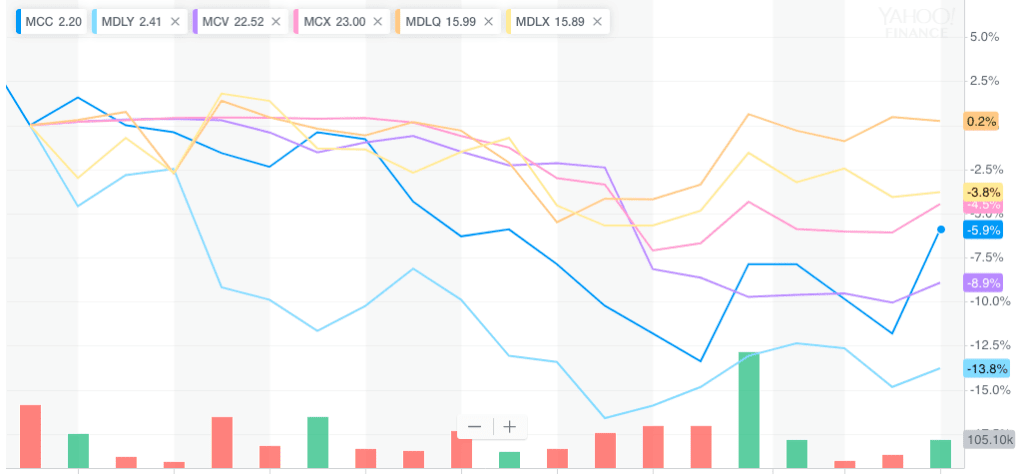

- On one hand, BDC index prices moved up again. On the other hand, other data we use to measure investor enthusiasm for the BDC sector was unmoved.

- We seek to reconcile this contradictory picture, while looking forward.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC COMMON STOCKS

Total Return Milestone

This may have been a holiday shortened week, but there was notable news where BDC sector pricing was concerned.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

LFI BDC Portfolio News 6-24-19: Talen Energy Supply to repay term debt held by FS Energy & Power Fund

High-yield extended its June rebound with increasing vigor over the past week amid retail cash inflows and declining interest rates, and the new-issue machine kept churning out maturity-extension focused refinancings, peppered by a few M&A situations. The loan secondary, by contrast, was little changed, with new issues at an ebb pre-holiday and the specter of falling rates dampening enthusiasm among end investors.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Allied Universal to widen margin on most 1L debt; existing holders include BDVC, OCSL

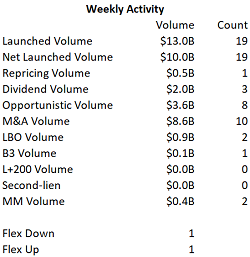

Bifurcated market conditions continued to reign in new-issue loans despite modest deal flow and a panoply of deal revisions that reflect the challenging nature of the current calendar; in the month to date B3 issuers comprise 44% of rated volume, the highest percentage since December. Bonds charged forward with a bunch of refi-related prints tight to talk, but the two buyout financings met some inevitable pushback on issuer-friendly terms.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

.png)