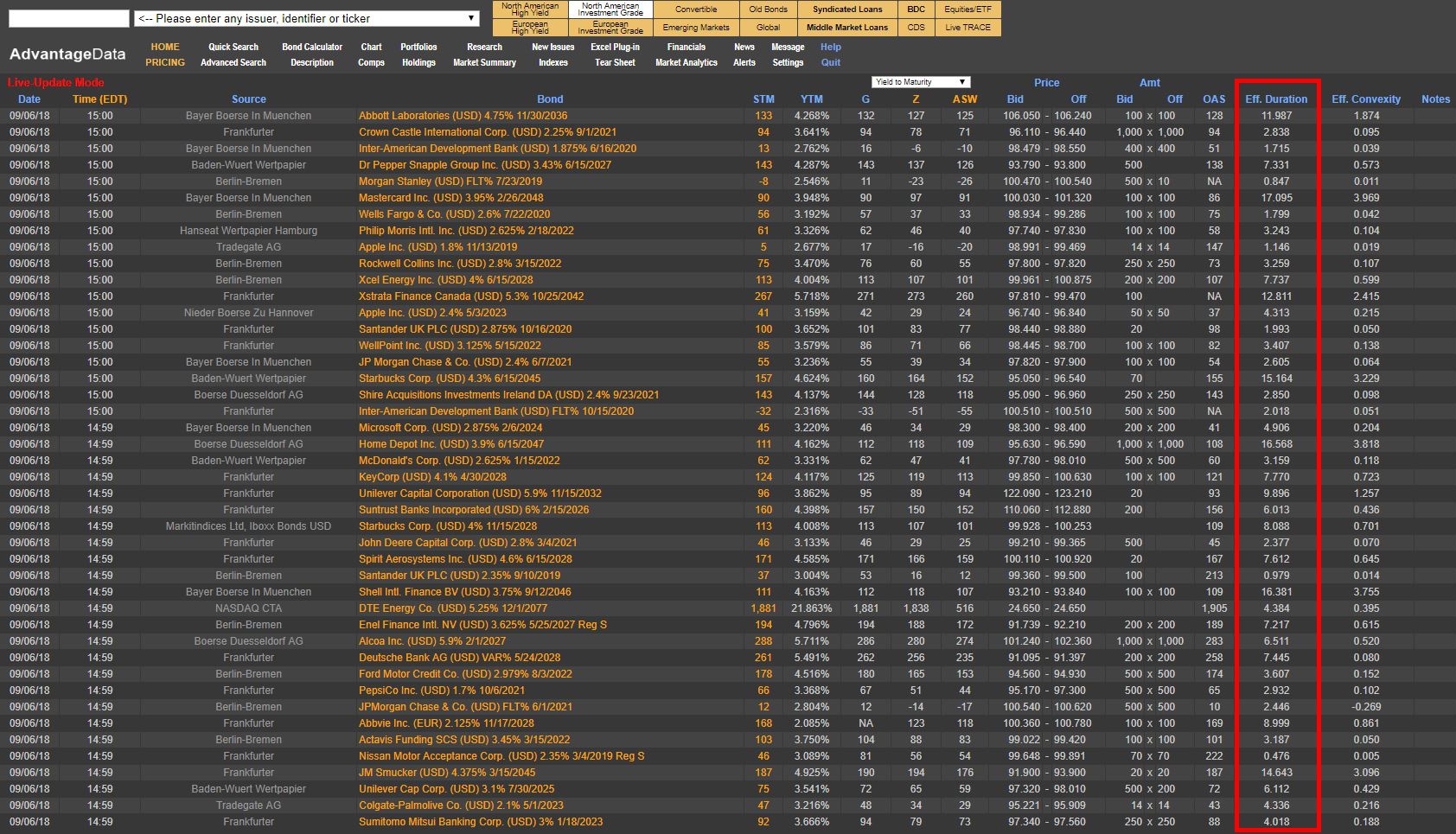

Duration risk has been a popular theme around buy-side firms as they look to incorporate low duration bonds into model portfolios to reduce interest rate sensitivity and increase liquidity. Typical bond indexes have an average duration of 5-7 years; this will create large outflow of assets in the upcoming quarters and increase popularity among individual securities.

Duration Risk: The Relationship Between Bond Prices and Interest Rates

Topics: Investment Grade, Analytics, bonds, Bonds Maturing, bond market, market analytics, Fixed Income, portfolio, interest rate, duration risk

BDC Common Stocks Market Recap: Week Ended August 31, 2018

BDC COMMON STOCKS

Ended Well

Like a good beach novel, the BDC sector ended the summer in a satisfying manner.

The UBS Exchange Traded Note with the ticker BDCS – which is based on the Wells Fargo BDC Index – and which we use as a sector proxy, closed at $21.00.

That was 1.50% above the prior week’s end.

Topics: Loans, BDC, debt, business development company, Fixed Income, News

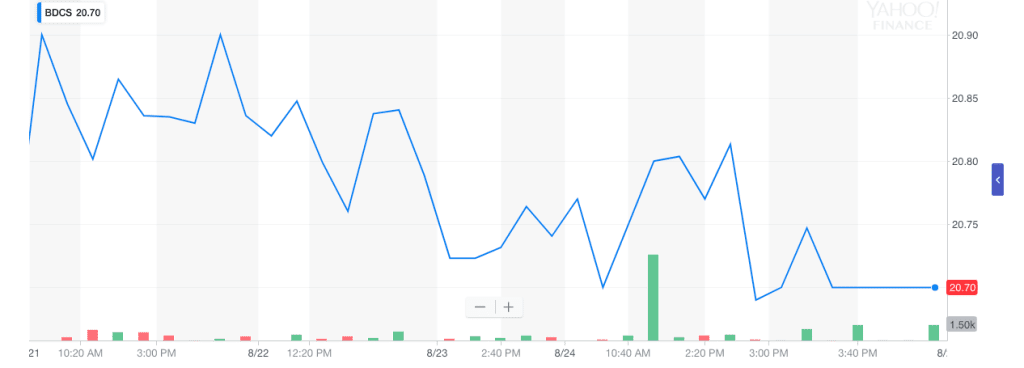

BDC Common Stocks Market Recap: Week Ended August 24, 2018

Treading Water

Another quiet week – as you might expect in August – for BDC common stocks.

The headline number – the price of the sector-wide UBS Exchange Traded Note with the ticker BDCS – was down. BDCS closed at $20.69, following a mostly downward sloping week.

Topics: Loans, Middle Market, BDC, market analytics, Fixed Income, portfolio, News

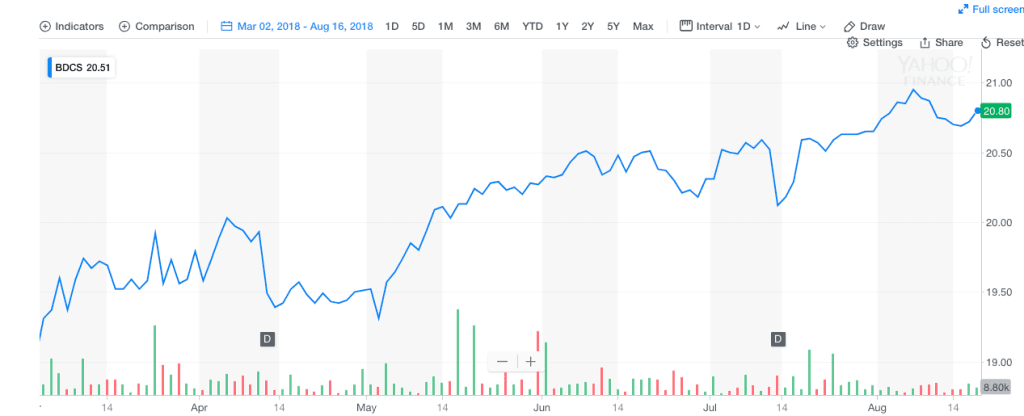

BDC Common Stocks Market Recap: Week Ended August 17, 2018

Going Nowhere

Often, after the completion of a BDC earnings season, we are witness to sharp price adjustments. After taking the health of nearly four dozen different funds in a very short period, analysts and investors often reach for the Buy or Sell button.This frequently results in a re-pricing of the entire sector, sometimes favorably and sometimes not. This week was a little different. Looking at the multiple data points that we do every week, we conclude that market participants did not do much in the way of re-thinking.

Topics: Middle Market, BDC, market analytics, Fixed Income, portfolio, News

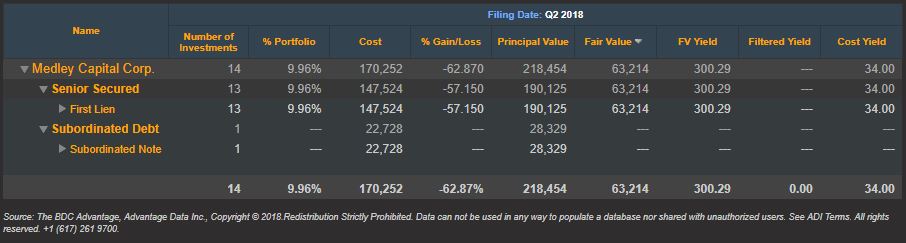

Q2 2018 BDC Non-Accruals: Medley Capital Corp No Longer Worst Performer

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Topics: BDC, First Lien, Non-accruals, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, BDC Filings, Default Rate, Fixed Income, fair value, portfolio, download, News

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)