Even in markets where established data infrastructure is limited, such as syndicated loans, reliable sources of data that are indicative of a liquid security’s value are available through market data vendors and broker quotes. When evaluating illiquid securities like middle market or directly originated loans, the effort of data aggregation becomes much more difficult and is often assumed to be an exercise in futility. We would disagree.

The Hunt For Data: Middle Market and Illiquid Loan Valuation

Topics: Loans, Middle Market, BDC, business development company, Valuation, Fixed Income, illiquid, download, Direct Lending, syndicated

BDC Common Stocks Market Recap: Week Ended September 14, 2018

Concession Speech

We are prepared to concede that the once semi-robust BDC common stock rally is in stall mode.

Topics: BDC, bond market, market analytics, business development company, Fixed Income, News

The Middle Market Loans Advantage: The Tools and Data to Source Your Next Deal

An effective deal sourcing process is crucial to successful investing. Deal sourcing involves generating leads and managing relationships with intermediaries. Strategies for deal sourcing vary among firms. Some firms prefer to employ specialist teams while others prefer using in-house resources.

Regardless of a firm’s strategy, access to the proper tools and the right data are essential for effective deal sourcing. In March, Mergers & Acquisitions published an article that illustrated this concept with Michael Lewis’ book, Moneyball: The Art of Winning an Unfair Game. The book details how the Oakland Athletics baseball team successfully used statistics and analytics to their advantage. The same can be done in the world of deal sourcing.

Topics: Middle Market, Analytics, market analytics, Distressed Debt, Finance, Restructuring, Fixed Income

BDC Common Stocks Market Recap: Week Ended September 7, 2018

Summary

A pull-back in the BDC sector in this holiday shortened week, and a couple of unexpected developments.

To the BDC Reporter, though, the outlook remains the same.

Back To Business

In the semi-official, Labor Day shortened, first week back after the summer holidays, the BDC sector dropped back a little.

The UBS Exchange Traded Note with the ticker BDCS – which we use to measure the whole group – was off 1.0% to end at $20.79.

Likewise, the Wells Fargo BDC Index was down 1.05%.

The number of BDC stocks up in price, or at least unchanged, numbered just 14, versus 27 last week.

No BDC common stock increased more than 3.0% in price on the week, but three dropped by 3.0% or greater.

Topics: Middle Market, Analytics, BDC, business development company, Fixed Income, News

Download: LFI BDC Portfolio News 9-10-18

As promised, loan arrangers rolled out a big September calendar of M&A deals brimming with new money seeking to take advantage of the late-August lull and a favorable funds flow picture following the busiest month for CLO issuance since March 2015. High-yield, too, kicked back into high gear, driven in part by coordinated cross-border deals for some of the same issuers currently being reviewed by loan accounts, while restructurings drove some of last week’s lively secondary action.

Loan investors are kicking the tires on a trio of large M&A deals that will set the tone for the market in the coming weeks not only for the other transactions already launched but also for those to come later this month. Traders, too, are awaiting clearing levels on these jumbo deals—which are being talked wide of where single-B executions printed earlier in the year—as well as to see how the market absorbs the supply once these deals allocate.

Topics: Middle Market, BDC, bonds, market analytics, Fixed Income, portfolio, LevFin Insights, News

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

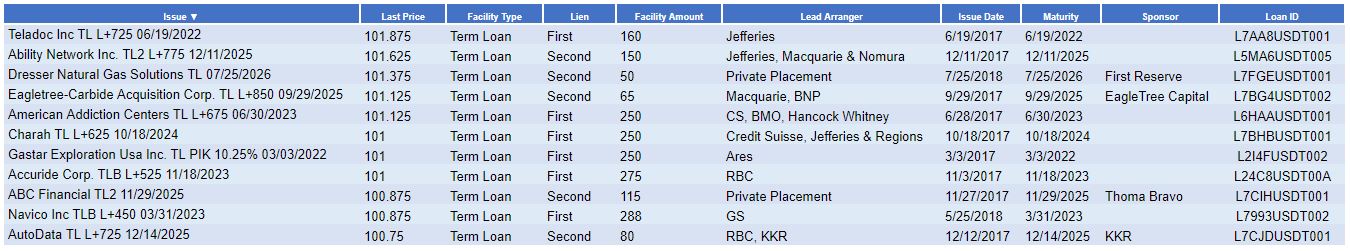

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)