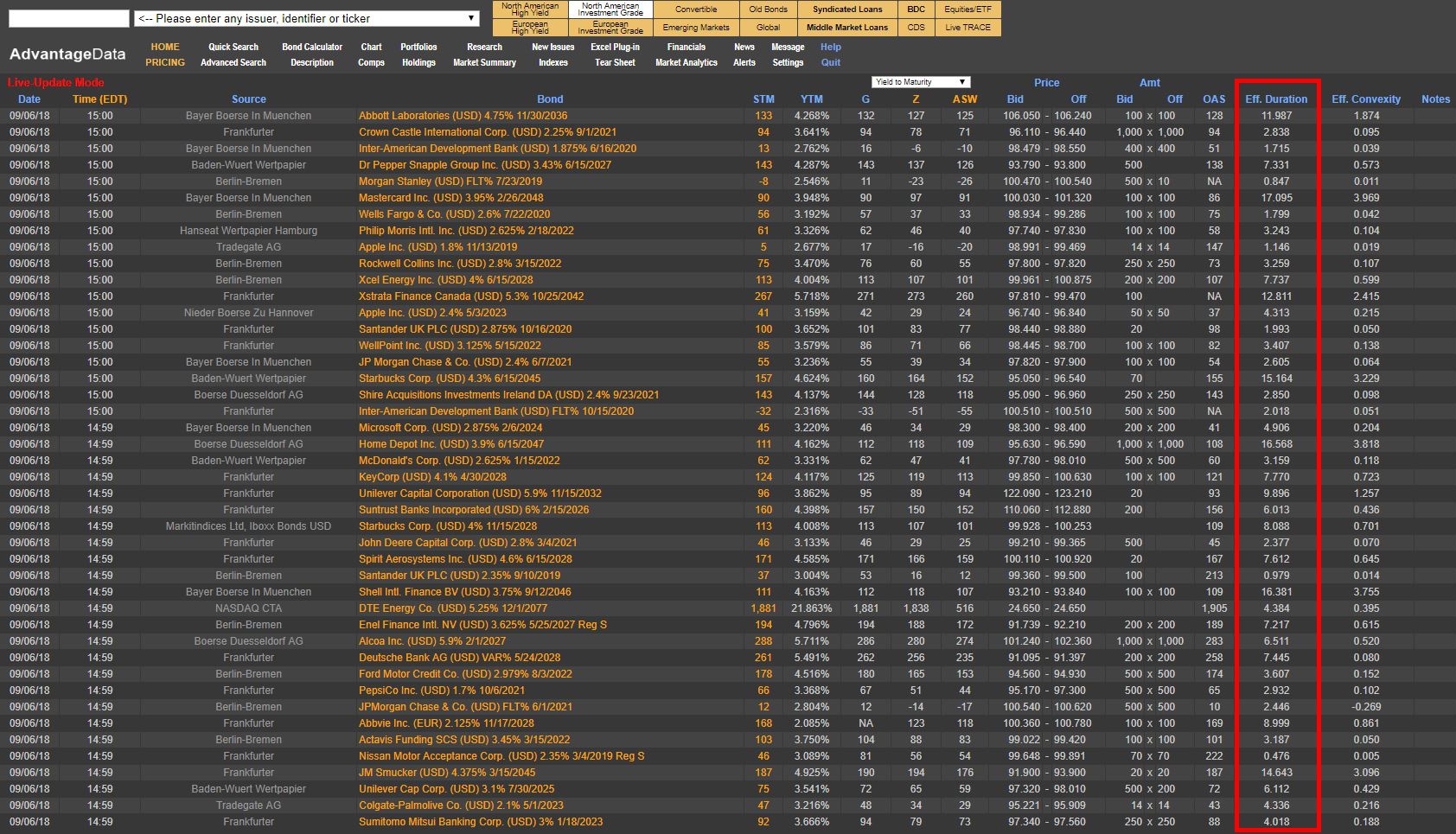

Duration risk has been a popular theme around buy-side firms as they look to incorporate low duration bonds into model portfolios to reduce interest rate sensitivity and increase liquidity. Typical bond indexes have an average duration of 5-7 years; this will create large outflow of assets in the upcoming quarters and increase popularity among individual securities.

Duration Risk: The Relationship Between Bond Prices and Interest Rates

Posted by

David Diggins on Sep 6, 2018 3:30:33 PM

0 Comments Click here to read/write comments

Topics: Investment Grade, Analytics, bonds, Bonds Maturing, bond market, market analytics, Fixed Income, portfolio, interest rate, duration risk

FAVOR FOR INVESTMENT-GRADE BONDS carried over from yesterday's session, even as stocks in Europe's bourses stepped higher amid

strength in the oil-and-energy sector.

Royal Dutch Shell PLC shares, up 4.2% as of

3:40

London time, lifted a range of related European oil firms' stock and junk debt as well, including those of

Tullow Oil PLC,

Total SA, and

BP PLC. A degree of optimism in the banking sector stemmed from data showing

encouraging stress tests for U.K. banks, although gains in this sector remained spotty amid pullbacks in

Barclays PLC shares, off 0.7%, and

Credit Suisse Group, off 0.52%, while

Societe Generale

added 0.75%. Meanwhile the mining and materials sectors remained under pressure as shares of

Rio Tinto PLC,

Glencore PLC, and

BHP Billiton PLC

shares all extended yesterday's pullbacks

.

0 Comments Click here to read/write comments

Topics: Investment Grade, bond market, corporate bonds

JUNK BONDS FLUCTUATED HIGHER

in overall price gains linked to trades, outpacing investment-grade debt on the European trading front. A

strong showing by Europe's carmakers

was a major element in today's market dynamic, as

Volkswagen AG

shares jumped 3.1%,

Fiat Chrysler NV

was up 1.6%, and

Renault SA added 1.3%, as of

3:30 PM, London time. Today's rebound in risk assets, on the heels of the worst run of sell-offs since October of '16, was fed also by upbeat data from heavyweight conglomerate

Bouygues SA,

3i Group PLC, and

British Land Co. PLC.

Nymex

oil prices stabilized around $55.30, supporting a

rebound in the oil-and-energy sector

as the view grew that U.S. shale producers will be more disciplined, going forward.

0 Comments Click here to read/write comments

Topics: High Yield, Investment Grade, bonds, junk bonds, bond market, corporate bonds

CAUTION AND PROFIT-TAKING kept Europe's

investment-grade bonds with a slight edge

over junk debt in today's trading. A

mix of European economic data

kept price swings channeled in fairly thin bands, as

inflation took a downturn,

GDP came in above forecast, and jobs data showed the

lowest unemployment since '09. The

oil-and-energy group fared well, giving important sector cues to corporate-bond traders, as

Nymex

oil prices hovered around $54 and

BP PLC shares initially rose 3.6%. However

BNP Paribas weighed on the financial group, off 2.9% on disappointing quarterly revenue, while

Weir Group PLC tanked 7.3%.

0 Comments Click here to read/write comments

Topics: Investment Grade, bonds, junk bonds, bond market, corporate bonds

JUNK BONDS REGAINED A SLIGHT EDGE over less-risky

investment-grade debt, as stocks in Europe's bourses took a turn to the upside. The pan-European

Stoxx 600

index reflected a string of gains among European equities, driven mainly by

dovish comments from Mario Draghi, chief of the

ECB (European Central Bank). In a more-or-less expected stance, Draghi pledged to move cautiously in scaling back stimulus measures, sending the

euro lower

and putting many investors in risk assets in a good mood. Corporate-bond traders took cues from

early gains in Spanish banks, with

Banco Sabadell SA

shares up 4.7% at one point,

BBVA

up 3%, while

Nokia Corp. was off over 17% as of

5 PM

London time.

0 Comments Click here to read/write comments

Topics: High Yield, Investment Grade, bonds, bond market, corporate bonds

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)