Many reports are claiming the death of Sears, but is it really dead or just dead as we knew it?

Sears started life in 1892 as a mail-order catalog that sold watches and jewelry. In 1894 the Sears, Roebuck and Company catalog had grown to 322 pages and included sewing machines, bicycles, sporting goods, automobiles and other new items. In the following years the catalog would eclipse 500 pages and adding dolls, stoves and groceries.

Read More

Topics:

Loans,

bonds,

Distressed Debt,

Restructuring,

sears,

News,

default,

bankruptcy

[Transcribed from video]

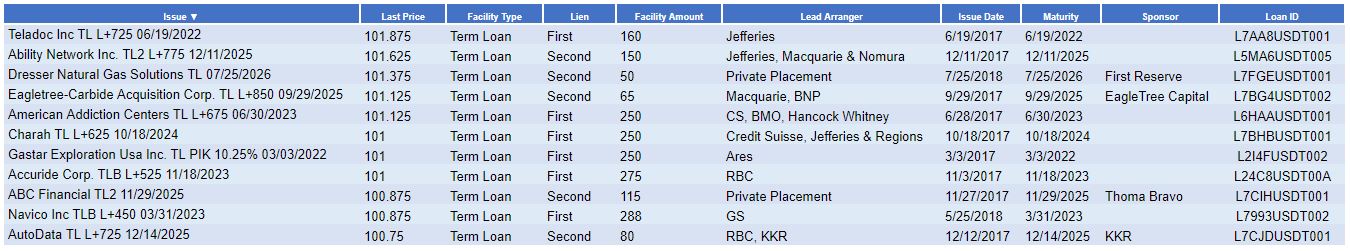

Introducing the Middle Market Loan Advantage. The newest edition to AdvantageData’s suite of credit data products. The Middle Market Loan Advantage complements our syndicated loan and BDC Advantage modules. With [~4500**] middle market loans, the Middle Market Loan Advantage shines a bright light on this opaque market.

How do we do it? AdvantageData aggregates information from news sources, trading desks, buy and sell-side filings, and more.

Read More

Topics:

Loans,

Middle Market,

Analytics,

BDC,

business development company,

Valuation,

Restructuring,

Direct Lending,

Investment Banks,

Syndicated Bonds

An effective deal sourcing process is crucial to successful investing. Deal sourcing involves generating leads and managing relationships with intermediaries. Strategies for deal sourcing vary among firms. Some firms prefer to employ specialist teams while others prefer using in-house resources.

Regardless of a firm’s strategy, access to the proper tools and the right data are essential for effective deal sourcing. In March, Mergers & Acquisitions published an article that illustrated this concept with Michael Lewis’ book, Moneyball: The Art of Winning an Unfair Game. The book details how the Oakland Athletics baseball team successfully used statistics and analytics to their advantage. The same can be done in the world of deal sourcing.

Read More

Topics:

Middle Market,

Analytics,

market analytics,

Distressed Debt,

Finance,

Restructuring,

Fixed Income

Middle market growth continues to be strong. The RSM US Middle Market Business Index (MMBI) posted a score of 134.5 for the second quarter of 2018, just a 2.2-point decrease from the first quarter’s record-high of 136.7 which was buoyed by new tax legislation. An MMBI score greater than 100 signifies growth within the middle market.

Based on strong earnings and revenues, executives were expected to expand hiring and increase employee compensation. Market sentiment among middle market businesses barely swayed despite increased tension over international trade and the slight tightening of finance conditions around the in the second quarter of 2018, potentially signifying the middle market's continued insulation from broader market trends. [source]

Read More

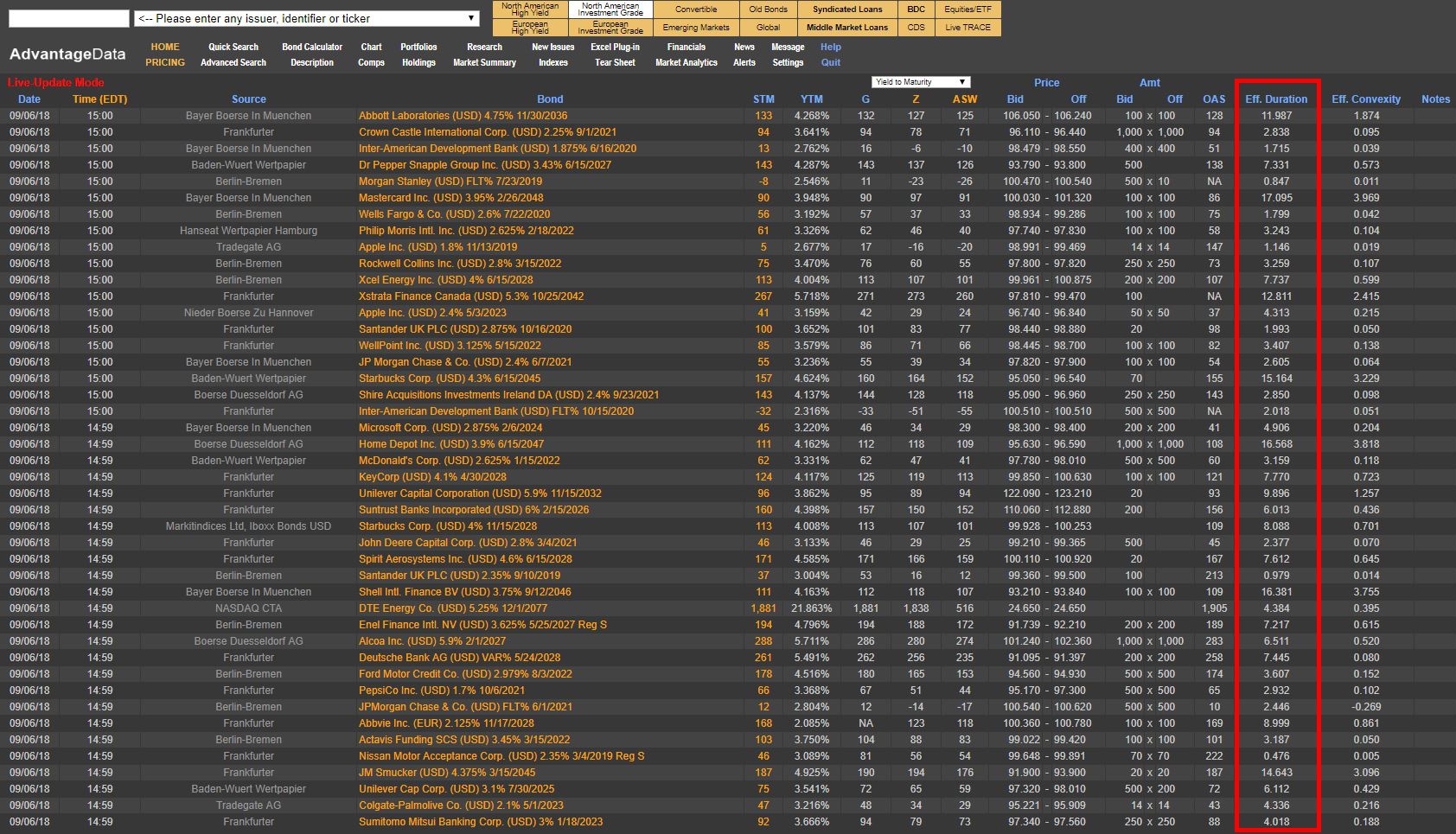

Duration risk has been a popular theme around buy-side firms as they look to incorporate low duration bonds into model portfolios to reduce interest rate sensitivity and increase liquidity. Typical bond indexes have an average duration of 5-7 years; this will create large outflow of assets in the upcoming quarters and increase popularity among individual securities.

Read More

Topics:

Investment Grade,

Analytics,

bonds,

Bonds Maturing,

bond market,

market analytics,

Fixed Income,

portfolio,

interest rate,

duration risk

.png)