A quarter over quarter coupon spread increase can be an early warning sign for investors and restructuring advisors that the issuer may be facing financial troubles.

What do we mean by “coupon spread increase”? First, the coupon is simply the annual interest payment paid by the issuer relative to the loan or bond's face or par value. Coupon spreads compare the interest rate differential between two loans or bonds. Say the coupon rate is 5% in the first quarter of the year, and then changes to 7% the next quarter. This would cause a coupon spread increase between it and the coupon of a comparable loan or bond. [source]

An increased coupon spread from one quarter to another is an indicator that something happened – it does not mean there is imminent risk of default. If a company does not meet its obligation to its lenders, it may be required to take some sort of action to make good on its promises of repayment or otherwise remain in good faith. One such action could be an increase of the coupon payment.

Read More

Topics:

Loans,

BDC,

Distressed Debt,

Restructuring,

download

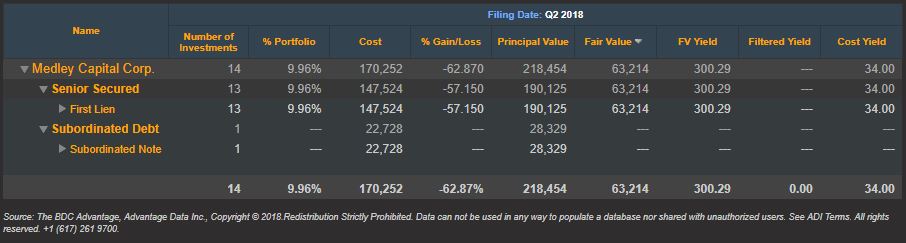

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Read More

Topics:

BDC,

First Lien,

Non-accruals,

Distressed Debt,

Restructuring,

Second Lien,

Loan Default Rate,

BDC Filings,

Default Rate,

Fixed Income,

fair value,

portfolio,

download,

News

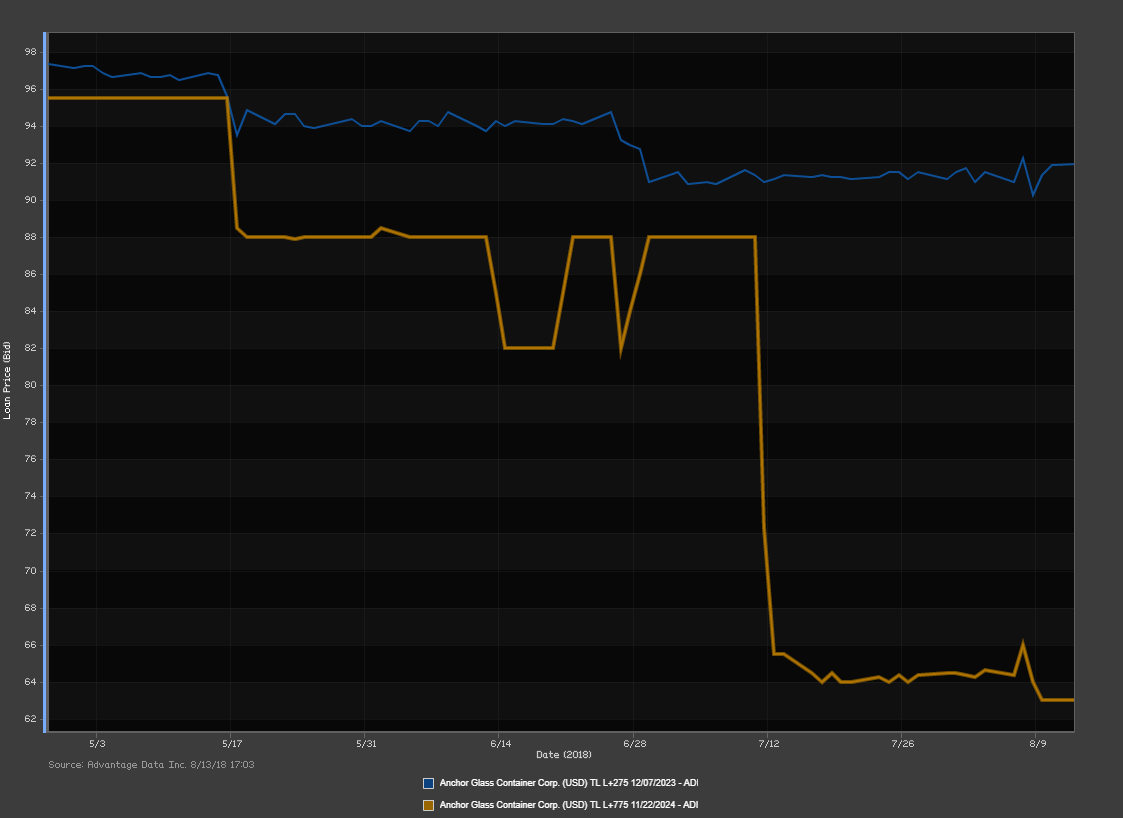

We all know that companies in distress tend to have a harder time meeting their financial obligations, which translates to a higher probability that they will default. A company in this position has pretty straightforward options: either raise enough cash through asset sales, operating improvements, and new financing, or reduce or postpone interest and principal payments on the debt by negotiating with creditors.

For restructuring or turnaround experts, identifying distressed companies is the first hurdle to deal sourcing and business development. Using the AdvantageData workstation, we’ve compiled a list of distressed loans that you might want to be aware of.

Read More

Topics:

Loans,

First Lien,

market analytics,

Distress,

Distressed Debt,

Restructuring,

Second Lien,

Loan Default Rate,

Default Rate,

Fixed Income,

download

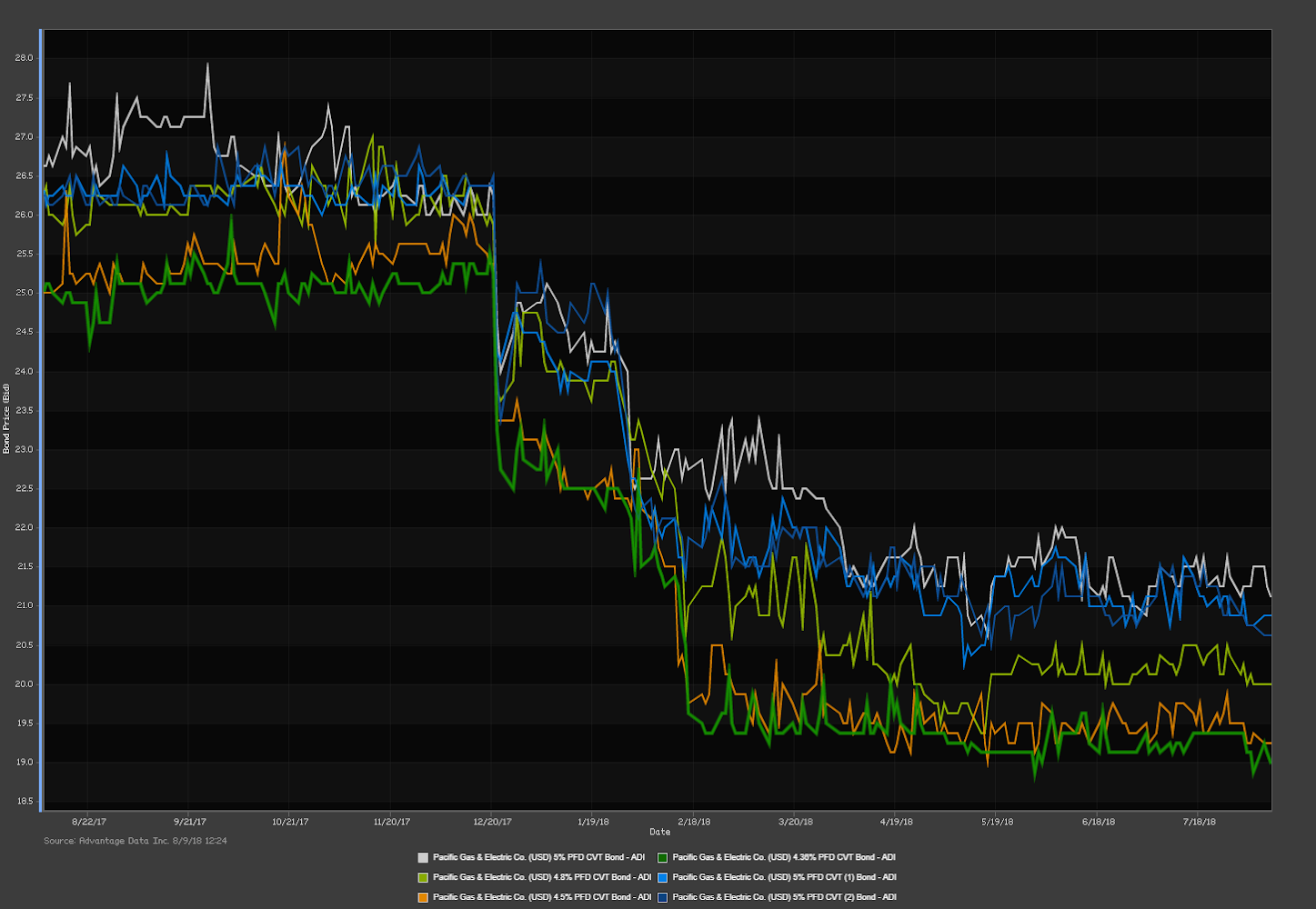

Restructuring is often driven by market rhythms, or quantifiable circumstances like the decline of shopping at brick-and-mortar stores in favor of online shopping. An easy example of the latter is the rise in eCommerce at online stores like Amazon, resulting in the bankruptcy and liquidation of Toys R Us. Another, less common circumstance can be natural (or unnatural) disasters.

It has been reported that Pacific Gas & Electric (PG&E), a California based utility, has brought in law firm Weil Gotshal & Manges LLP to explore restructuring options after California officials found the company responsible for the deadliest wildfires in the state’s history in the fall of 2017. One option the firm is said to be exploring is breaking up PG&E and filing bankruptcy for one of the units. For companies struggling financially, sacrificing one area of a business to protect the rest from liabilities is a popular strategy. [source]

Read More

Topics:

Distressed Investments,

Distressed Debt,

Restructuring,

Fixed Income,

download,

default

What we already know...

We know that investment professionals benefit from reliable, holistic, aggregated data. It doesn't take a rocket scientist to figure out that making data easy to find and understand translates to efficient analysts and more profitable firms.

Over the past two weeks, we have shown you a few ways you can leverage business development company filing data with BDC Advantage. BDC Advantage eliminates the tedious, time-consuming process of manually compiling and standardizing BDC quarterly filings, allowing users to easily analyze data relevant to their firm.

We've shown you how to:

Read More

Topics:

Middle Market,

Analytics,

earnings,

business development company,

BDC Filings,

Fixed Income

.png)