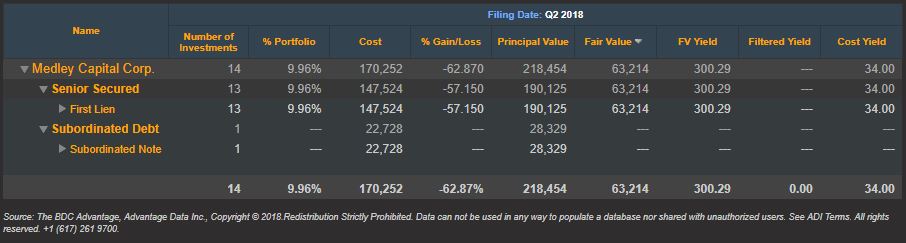

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Q2 2018 BDC Non-Accruals: Medley Capital Corp No Longer Worst Performer

Topics: BDC, First Lien, Non-accruals, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, BDC Filings, Default Rate, Fixed Income, fair value, portfolio, download, News

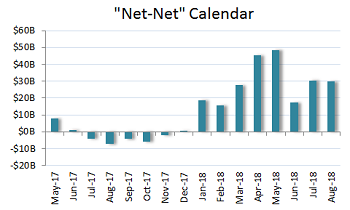

Repricings return, aiming for lower margins at BJ's (ACSF, Hancock Park, CCT), Compass Power (FS Energy) and Travel Leaders (Bain, Triton Pacific)

The first week of the new month was dominated by reactive trading and repositioning in the wake of quarterly reports, even as the new-issue market kept rolling out loans and bonds. In bonds, highlights included $1.25 billion short-term-fix from Intelsat just as the identically sized BMC Software buyout bonds got going on international roadshows for next week’s business following June’s completed loan financing.

After a somewhat sleepy start last week, loan arrangers piled it on. M&A deals peeled off the calendar late in the week included the long-awaited deal for Penn National Gaming, Cetera, Travel Leaders and Del Frisco Restaurant Group as gross launched volume jumped to $15.6 billion in the busiest week since June 15. M&A volume was a healthy $7.9 billion.

Topics: BDC, portfolio, LevFin Insights, News

BDC filings are around the corner. See our Q2 2018 BDC earnings calendar below. Outsourcing your data collection efforts to AdvantageData provides your team with access to standardized #BDC data within 8 hours of filings. BCD Advantage empowers your team with the aggregated data they need. Leveraging filing information has never been easier.

BDC Advantage was developed in partnership with a group of BDCs seeking to outsource BDC data aggregation, direct lending analytics and loan pricing across the thousands of US middle market companies currently held as portfolio companies. AdvantageData provides unmatched insight into the BDC space by leveraging tools perfected through over 20 years of serving the sell-side but using data specific to the BDC and private credit space. See why BDCs, direct lenders, BDC analysts and investors all use AdvantageData.

Topics: Loans, BDC, earnings, BDC Filings, Fixed Income

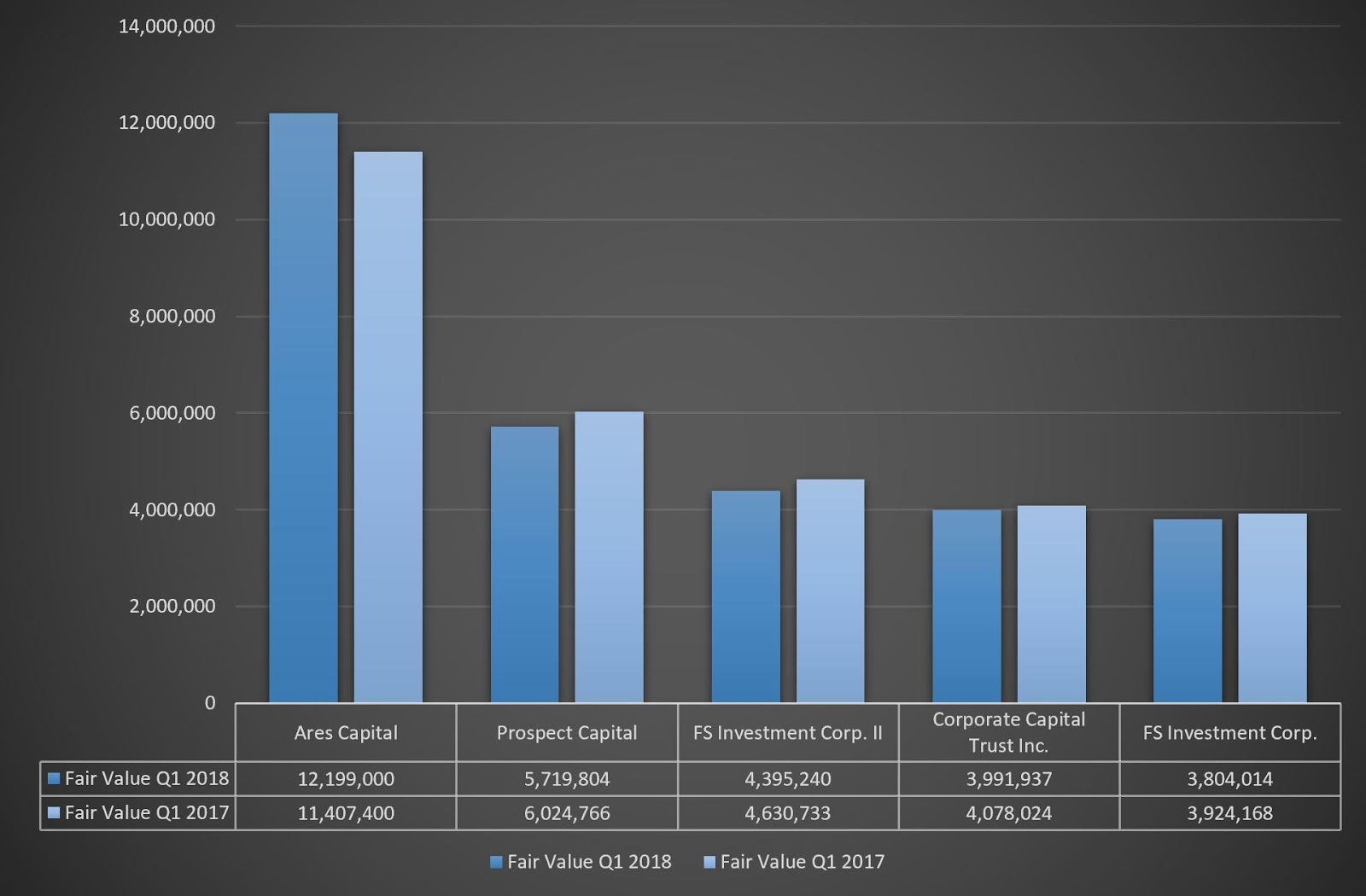

Comparing quarterly filings, fund breakdowns and more...

After the 2008 financial crisis and the subsequent regulatory changes, Business Development Companies (BDCs) skyrocketed in popularity, filling the funding gap in middle market companies. BDCs are closed-end funds that mostly invest in private, growing companies and, increasingly, larger later stage corporations.

BDCs are required to file quarterly reports to the SEC under the Investment Company Act of 1940. Aggregating the data from these reports is tedious, time-consuming, and lacks standardization. AdvantageData’s BDC Product gives investment professionals access to aggregated and standardized data (current and historical), allowing users to easily analyze data relevant to their firm's needs.

Topics: Middle Market, BDC Index, Analytics, BDC, AUM, market analytics, business development company, BDC Filings, Fixed Income

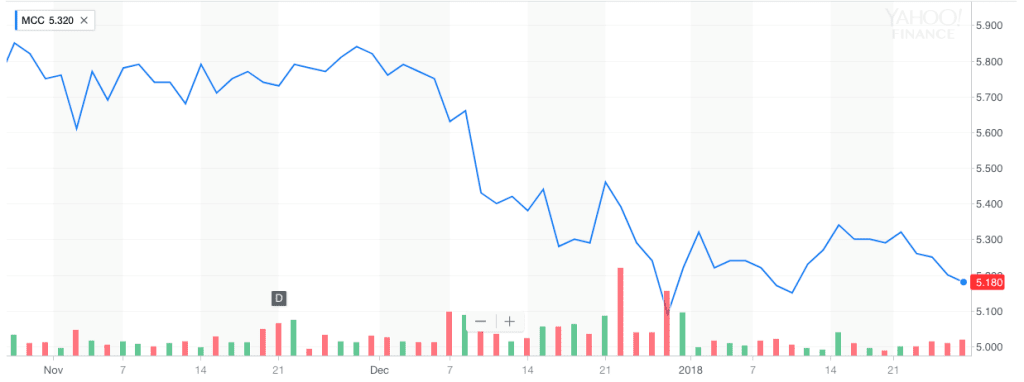

BDC Market Recap: Week Ended January 26, 2018

The Week Of Nothing Much

We’ve been writing these Market Recaps for more weeks than a shark has teeth and we’re hard pressed to remember 5 consecutive days as uneventful as these have been.

As the BDC Reporter has been saying in the preamble of our articles of late, there is very little new to report.

We counted just 4 stories on our Daily News Table and one Stock Watch alert (as OFS hit a new 52 Week Low) during the week. The week before ? 18 different items.

The same applies to BDC common stock prices, which barely shifted over this, admittedly brief, period between January 19 and 26.

Topics: BDC, Fixed Income

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)