As promised, loan arrangers rolled out a big September calendar of M&A deals brimming with new money seeking to take advantage of the late-August lull and a favorable funds flow picture following the busiest month for CLO issuance since March 2015. High-yield, too, kicked back into high gear, driven in part by coordinated cross-border deals for some of the same issuers currently being reviewed by loan accounts, while restructurings drove some of last week’s lively secondary action.

Loan investors are kicking the tires on a trio of large M&A deals that will set the tone for the market in the coming weeks not only for the other transactions already launched but also for those to come later this month. Traders, too, are awaiting clearing levels on these jumbo deals—which are being talked wide of where single-B executions printed earlier in the year—as well as to see how the market absorbs the supply once these deals allocate.

Read More

Topics:

Middle Market,

BDC,

bonds,

market analytics,

Fixed Income,

portfolio,

LevFin Insights,

News

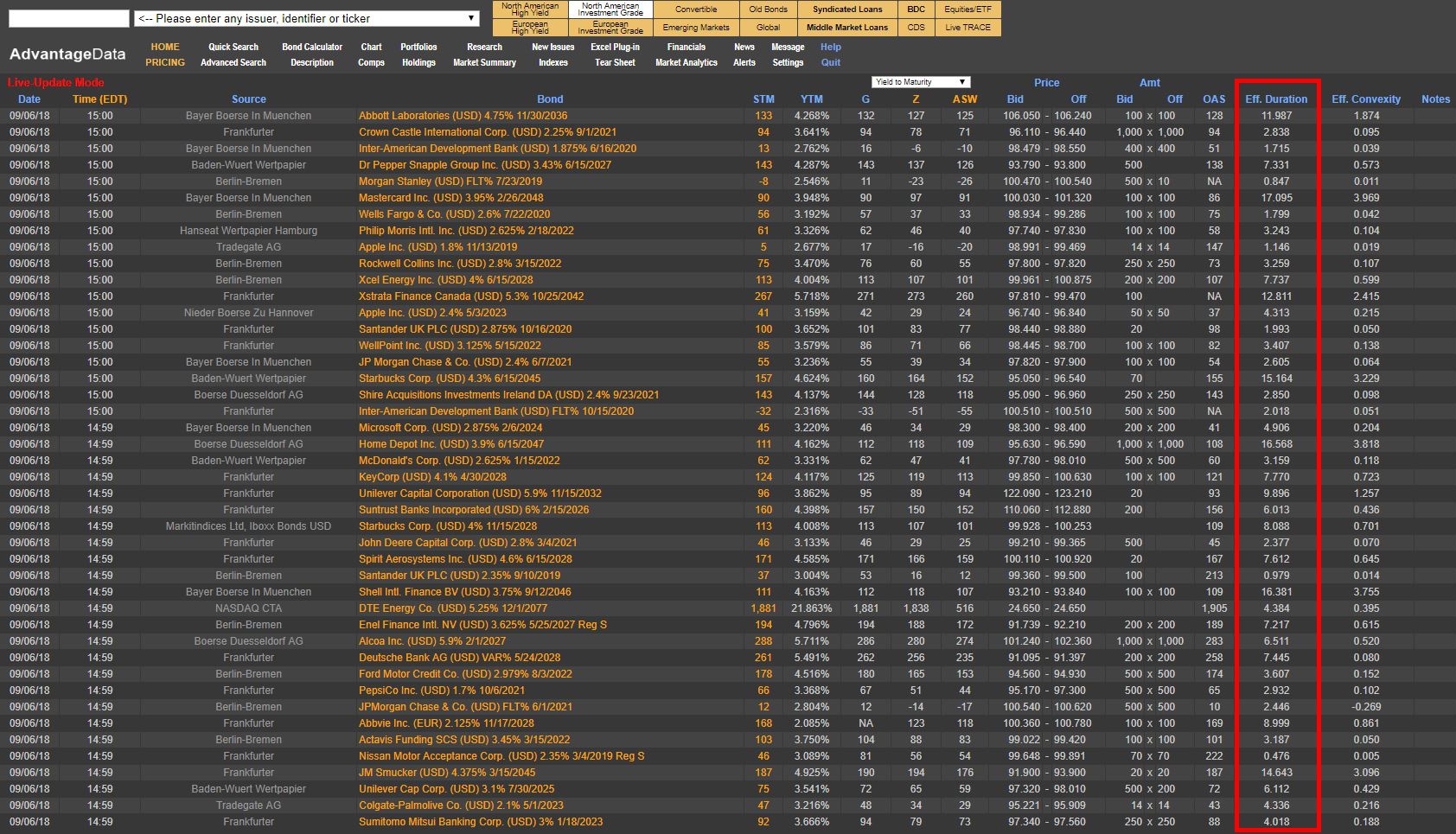

Duration risk has been a popular theme around buy-side firms as they look to incorporate low duration bonds into model portfolios to reduce interest rate sensitivity and increase liquidity. Typical bond indexes have an average duration of 5-7 years; this will create large outflow of assets in the upcoming quarters and increase popularity among individual securities.

Read More

Topics:

Investment Grade,

Analytics,

bonds,

Bonds Maturing,

bond market,

market analytics,

Fixed Income,

portfolio,

interest rate,

duration risk

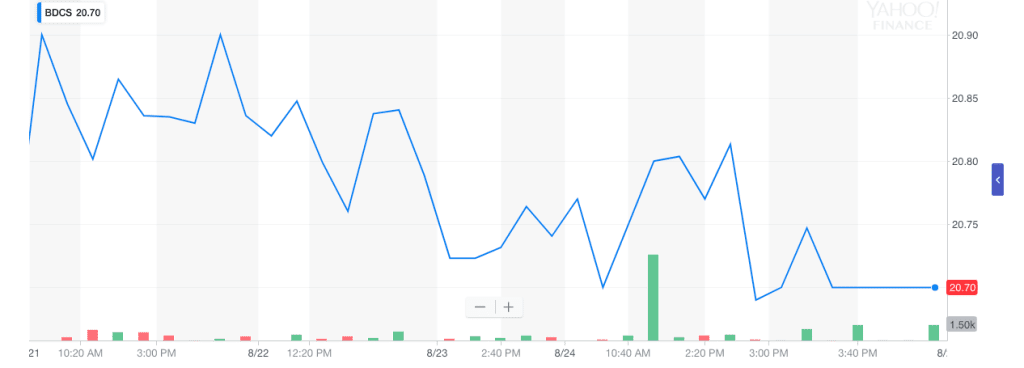

Another quiet week – as you might expect in August – for BDC common stocks.

The headline number – the price of the sector-wide UBS Exchange Traded Note with the ticker BDCS – was down. BDCS closed at $20.69, following a mostly downward sloping week.

Read More

Topics:

Loans,

Middle Market,

BDC,

market analytics,

Fixed Income,

portfolio,

News

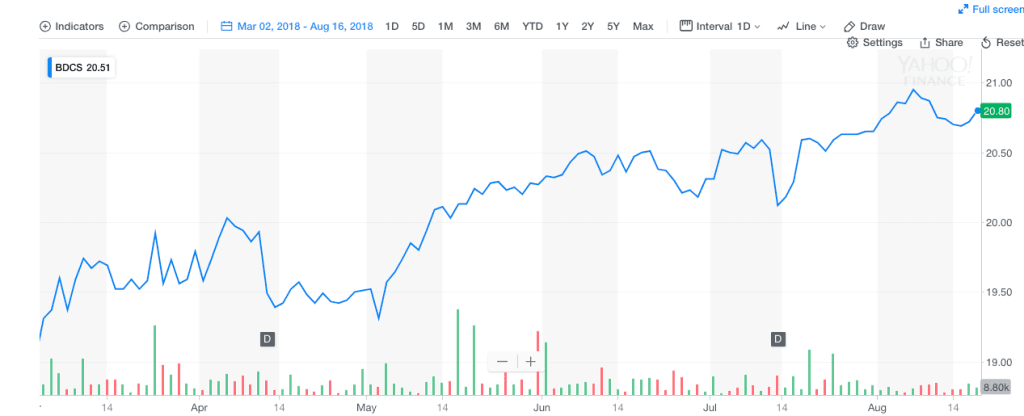

Going Nowhere

Often, after the completion of a BDC earnings season, we are witness to sharp price adjustments. After taking the health of nearly four dozen different funds in a very short period, analysts and investors often reach for the Buy or Sell button.This frequently results in a re-pricing of the entire sector, sometimes favorably and sometimes not. This week was a little different. Looking at the multiple data points that we do every week, we conclude that market participants did not do much in the way of re-thinking.

Read More

Topics:

Middle Market,

BDC,

market analytics,

Fixed Income,

portfolio,

News

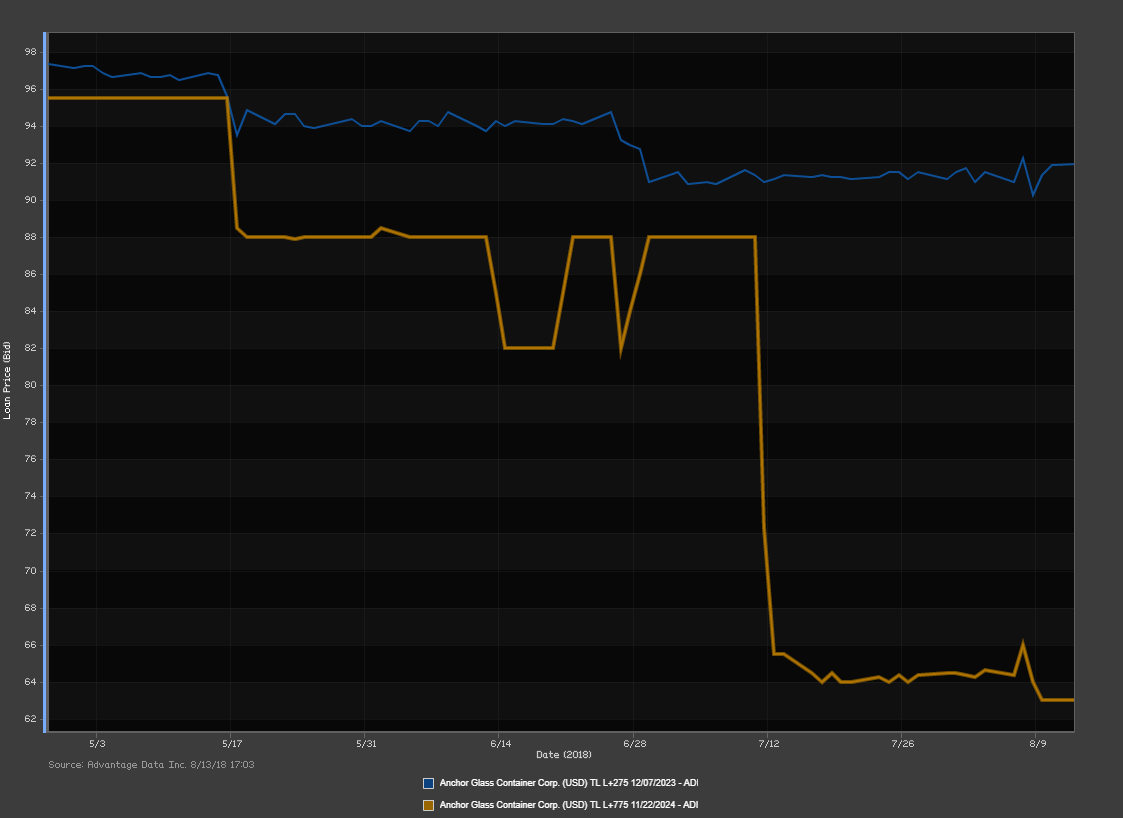

We all know that companies in distress tend to have a harder time meeting their financial obligations, which translates to a higher probability that they will default. A company in this position has pretty straightforward options: either raise enough cash through asset sales, operating improvements, and new financing, or reduce or postpone interest and principal payments on the debt by negotiating with creditors.

For restructuring or turnaround experts, identifying distressed companies is the first hurdle to deal sourcing and business development. Using the AdvantageData workstation, we’ve compiled a list of distressed loans that you might want to be aware of.

Read More

Topics:

Loans,

First Lien,

market analytics,

Distress,

Distressed Debt,

Restructuring,

Second Lien,

Loan Default Rate,

Default Rate,

Fixed Income,

download

.png)