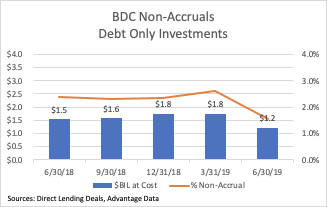

Macro economic factors — tariffs on Chinese goods, political unrest in Hong Kong and Brexit among them — have returned volatility to capital markets, however direct lending has plowed onward with few upsets.

BDC portfolios show little pain in non-accruals for 2Q19, steady ahead

Topics: BDC, debt, business development company, Non-accruals, portfolio, Direct Lending, underperformers, Direct Lending Deals

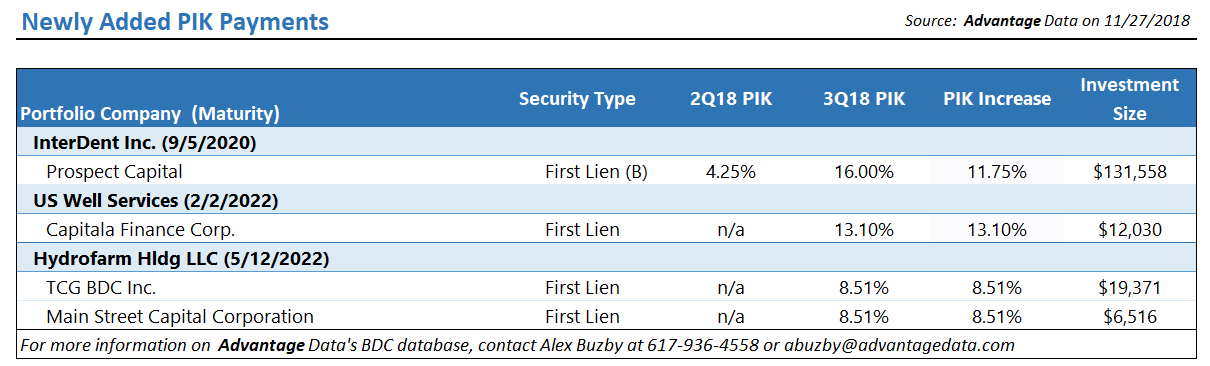

One Step Ahead: Identifying Distress In The Middle Market

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

Topics: Middle Market, BDC, Spreads, First Lien, Distressed Investments, debt, business development company, Distress, Distressed Debt, Finance, Restructuring, Fixed Income, download

BDC Common Stocks Market Recap: Week Ended August 31, 2018

BDC COMMON STOCKS

Ended Well

Like a good beach novel, the BDC sector ended the summer in a satisfying manner.

The UBS Exchange Traded Note with the ticker BDCS – which is based on the Wells Fargo BDC Index – and which we use as a sector proxy, closed at $21.00.

That was 1.50% above the prior week’s end.

Topics: Loans, BDC, debt, business development company, Fixed Income, News

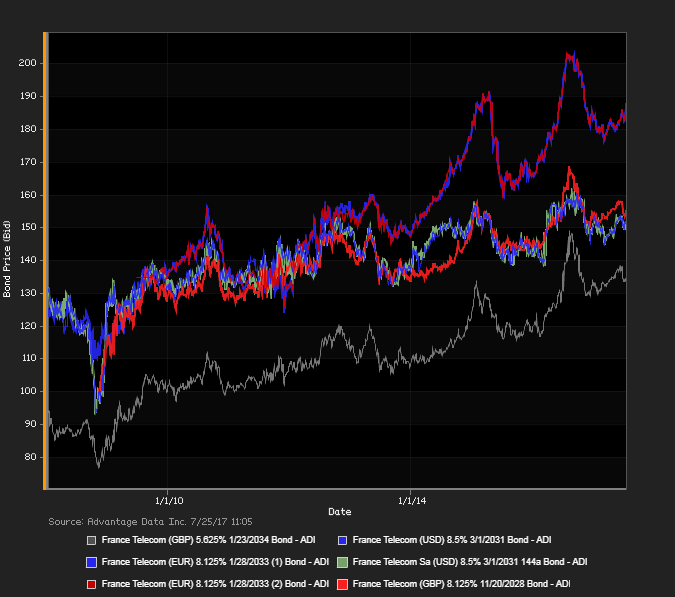

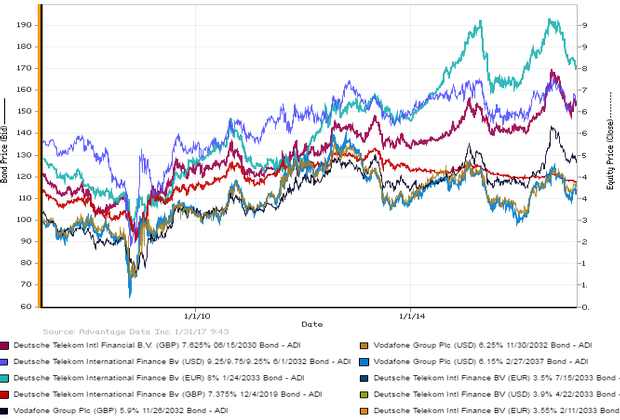

European Bond Research as of February 14, 2017

EUROPEAN HIGH-YIELD BONDS RETAINED FAVOR - although a narrow one, over a range of investment-grade securities. Disappointing GDP numbers for Germany and the overall euro-bloc weighed upon 'risk-on' trades, as did views of increased French political risk ahead of an upcoming presidential election. Nonetheless, a residual bullish tone after yesterday's resurgence in risk-taking in Europe and 'across the pond' in the U.S. was in play, on the heels of fresh record highs in Dow, S&P 500, and Nasdaq.

Topics: High Yield, Investment Grade, debt

'RISK-OFF' SENTIMENT WAS TONED DOWN relative to yesterday's levels, among a spectrum of European corporates. Investment-grade debt edged out junk bonds in net price gains nonetheless, amid continued attention to political risk emanating from 'across the pond' on the U.S. front. Corporate-bond investors took sector cues from gains in Deutsche Bank AG shares, moving up 2.1% before profit-taking set in. Upbeat views on financials were offset a bit by a 3.4% pullback in Italy's UniCredit SpA, as of 4 PM, London time. However, gains in retailer Hennes & Mauritz AB, Ocado Group PLC, and Alfa Laval AB buoyed the pan-European Stoxx 600, limiting its descent into the shallow red.

Topics: High Yield, Investment Grade, debt

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)